Metals Market at a Crossroads: Clean Energy and Digitalization Drive Structural Shift

The world metals market is also experiencing a structural shift that is prompted by the rapid pace towards clean energy, electrification, and digital infrastructure. Although the traditional sources of metal are especially construction and real estate, have been weakened in many major economies, especially China, newer sources of growth are the emerging ones. This is changing the structure and resilience of metal demand across the world as renewable energy systems, electricity grids, electric cars, and data centers are being invested in. This trend can be best seen through the fact that the outlook on copper and aluminum, two metals that are the core of electrification and decarbonization, is strengthening.

Trends in Metal Prices in the recent past-

Global metal prices have been stable in November after a robust rise in October, and have remained on top of the previous gains. The index of metals and minerals prices by the World Bank increased significantly in the second half of 2025, which can be explained by stable demand and constrained supply. The above developments imply that long-term structural forces have a growing impact on the metal price cycle, not short-term cyclical changes.

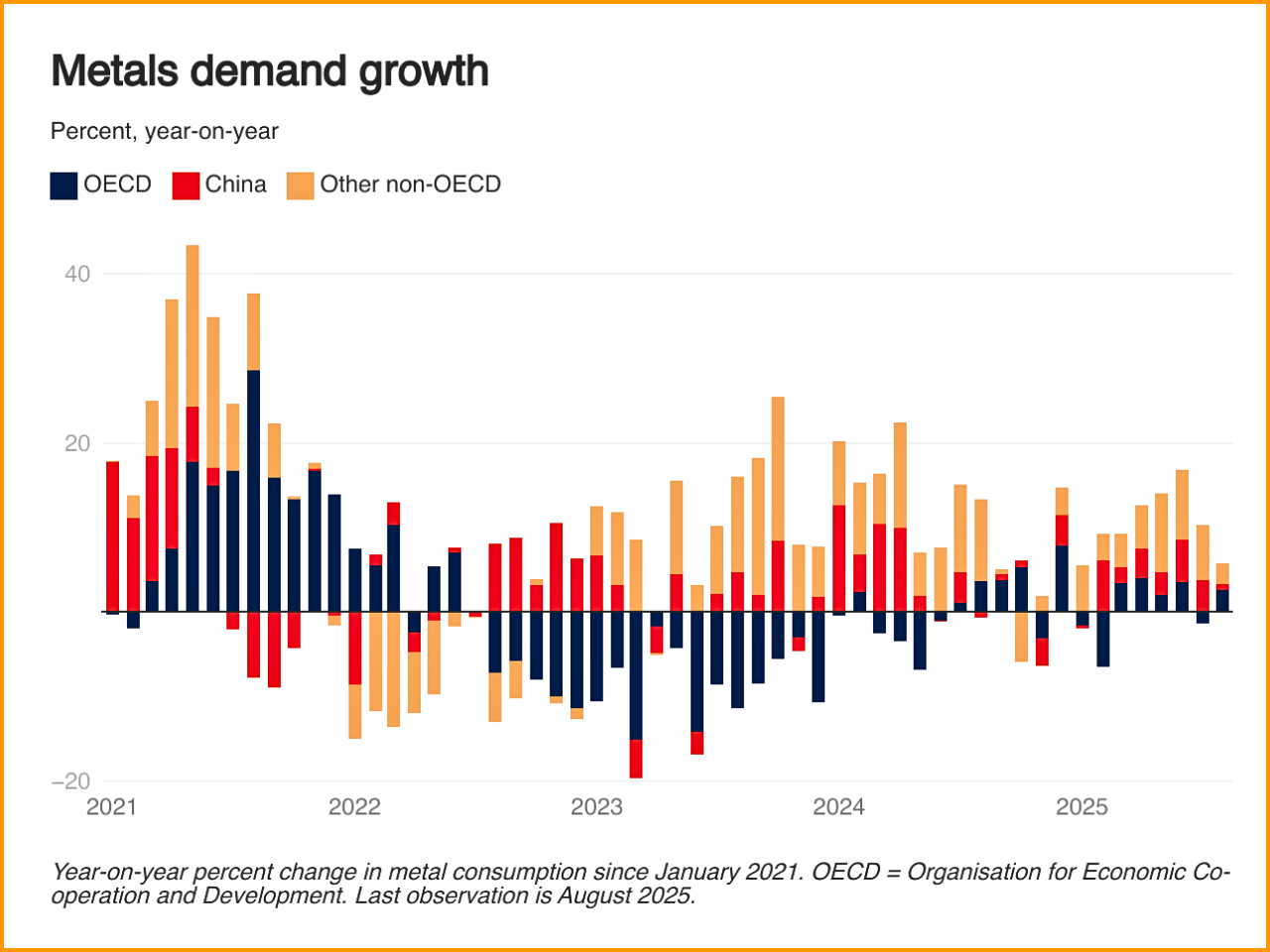

The industrial activity has been stronger than thought to be, even when the world was facing economic uncertainty. The indicators of manufacturing in key economies rebounded following some contracting periods suffered earlier in the year, and this was essential in supporting demand in base metals. Notably, this strength has been witnessed although the traditional construction activity, which had been a significant source of metal consumption, has been diluted, which underscores the increased significance of other sources of demand.

Shifting demand: Building to Electricity-

The world is changing with regard to its need for metals. China, which contributes about 50 percent of the world's base metal consumption, is still grappling with a chronic condition in its property business. This has reduced the demand for metals used in construction, like iron ore and steel. Yet, the macroeconomic policies and excellent export performances have avoided a more pronounced decrease in the aggregate industrial activity. More importantly, the increase in clean energy technologies investment is compensating for construction demand declines. Renewable sources such as solar and wind demand a lot of metal compared to conventional sources of power. Copper is essential to electrical wiring, transmission of power, and electric vehicle motors, whereas Aluminum is an essential component of grid infrastructure, renewable installations, and lightweight transportation components. With the expansion of electrification facilities by governments and private investors, the demand for these metals has been stabilized and is not highly reliant on the housing cycles. Moreover, the quick growth in digital infrastructure, especially data centers to support cloud computing and artificial intelligence, has also become a new metal-consuming demand driver. These facilities need large quantities of copper in power distribution and cooling systems, and aluminum in structural and thermal applications. With the enhanced digitalization across the world, this source of demand will continue to increase.

Constraints in Supply and Structural Tightness-

Although demand has been more resilient, the increase in supply of a number of base metals has been significantly muted. The rise in production in the first three quarters of the year was curtailed, and it is predicted that the increase will not see any rise in output in the next few years. This is an extreme of demand and supply with copper and aluminum.

The global metal supply chains have been highlighted as being vulnerable to operational disruptions. The risks of concentration in mineral production have been brought to focus due to the disruption in one of the largest mines in the world as a result of the incident at the mining plant. Most of the important metals are manufactured at a few points; the world supply is affected by technical breakdowns, rule alterations, labor strikes, and natural disasters.

Supply is also being influenced by policy-related constraints. In the scenario of aluminum, the self-imposed production limit set by China is about to hit its maximum limit, limiting any possibility of increasing its production. With China controlling much of the world's production of aluminum, such a policy is a good move to limit the supply in the world, thereby enhancing the tight market.

However, the case of iron ore is different. Supply is likely to increase as more production will be done in leading exporting nations and new low-cost mining projects will be developed. This will further cause the iron ore prices to go down; an example of how the divergent demand and supply basics are causing varied price movements of different metals.

Price Outlook for 2026-2027-

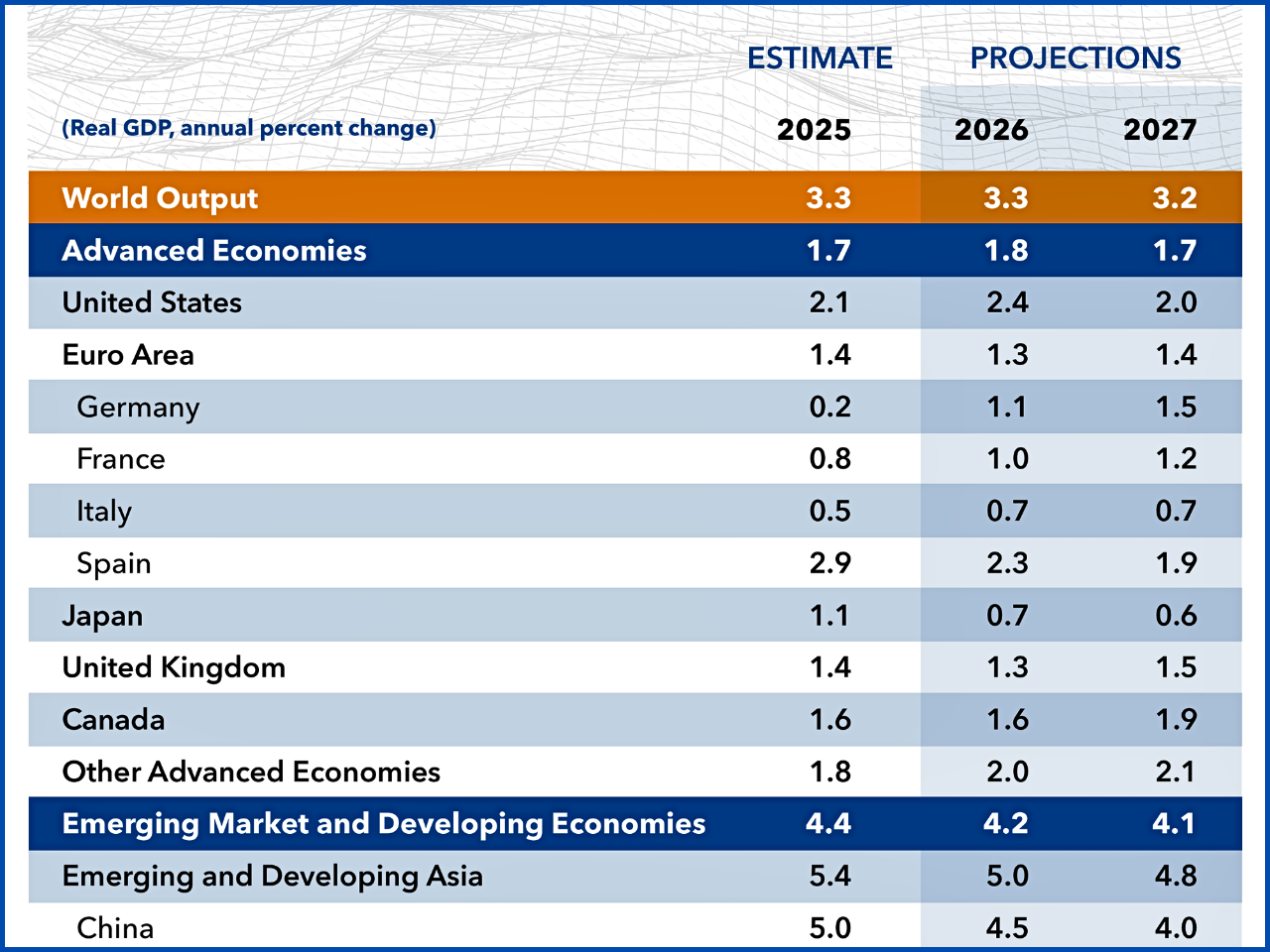

In the future, the metal prices should become even stronger within the following two years. The World Bank metal price index is expected to increase by a small margin, with the largest increase in the price of aluminum, copper, nickel, and tin. Copper and tin, which are key supplies to clean energy technologies, will experience new nominal price peaks.

These forecasts are based on the presumption that the supply restraints will remain, with the demand expanding at a moderate rate. The phase of clean energy transition, transport electrification, and growth of digital infrastructure are long-term processes that need continuous metal input. These industries give demand a structural floor even in a situation where the overall growth of the world is low.

Threats to the Prognosis: Positive and negative-

The outlook of the metal price has significant uncertainty with the risks on both sides. On the positive side, the supply-side disruptions are also a significant issue. Weather imbalances, energy crises, water scarcity, and government controls can easily minimize production, especially where the markets are already constrained. There are additional weaknesses in labor disputes and operational issues.

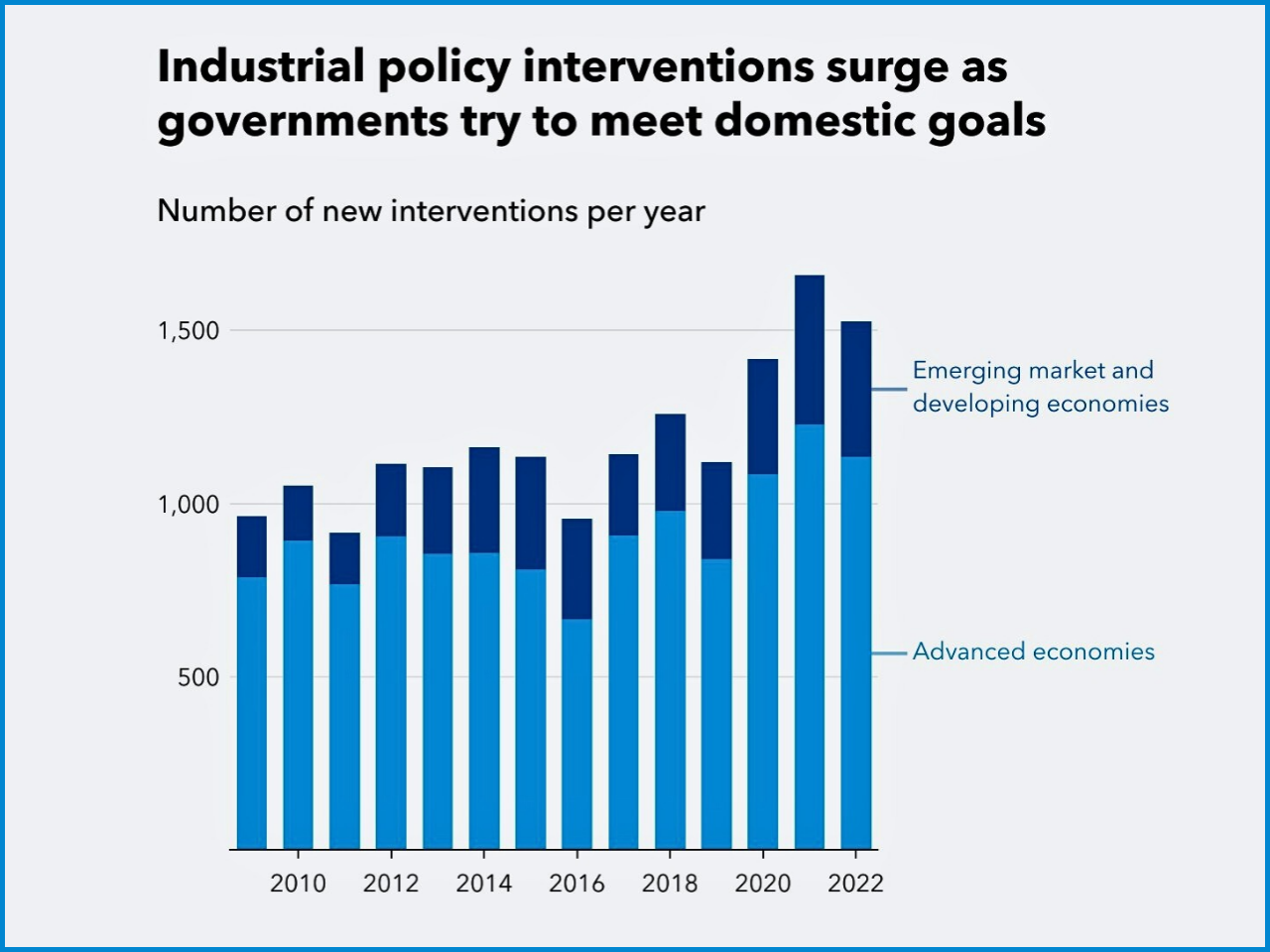

Upside risks are also contributed to by the trade policies. New tariffs on semi-finished metal products, as well as the threat of further limitations against refined metals, may disrupt the global supply chains and increase prices. These measures can raise the cost to the downstream users, besides escalating the price volatility in international markets.

There is another major upside risk, which is the accelerated development of AI-related infrastructure. Should there be a faster construction of data centres than is being projected, there would be increased demand for copper and aluminum more rapidly, again increasing the tightening of markets. The prospects of these upsides notwithstanding, the perspective is dominated by the downside’s risks. The greatest risk is the underperformance of the global economic growth, especially in China. The demand for metals is linked with investment and production of durable goods, which are vulnerable to uncertainty and geopolitical tensions, as well as trade frictions. A decrease in these regions may put pressure on the consumption and prices of metals downwards. The metal market is facing a crossroads in the world market. The demand trends are being transformed by clean energy, electrification, and digitalization, as they create less cyclical reliance on the traditional construction-driven demand and encourage long-term demand for key metals like copper and aluminum. Simultaneously, some of the markets are tight due to supply constraints based on operational, policy, and structural factors. The prognosis of metal prices in 2026-2027 is relatively optimistic, but it is slightly spoiled by the high risk of downsides connected to the uncertainty of global growth. On the whole, the balance of forces indicates that the future world will be characterized by a situation in which metal markets will be more influenced by the long-term structural changes than by the short-term economic changes. The policymakers, investors, and other industry stakeholders who are dealing with the changing global energy commodity environment must understand this shift.

Free To Activate Membership