Global Economy Remains Resilient Amid Uncertainty: IMF's 2026 Outlook

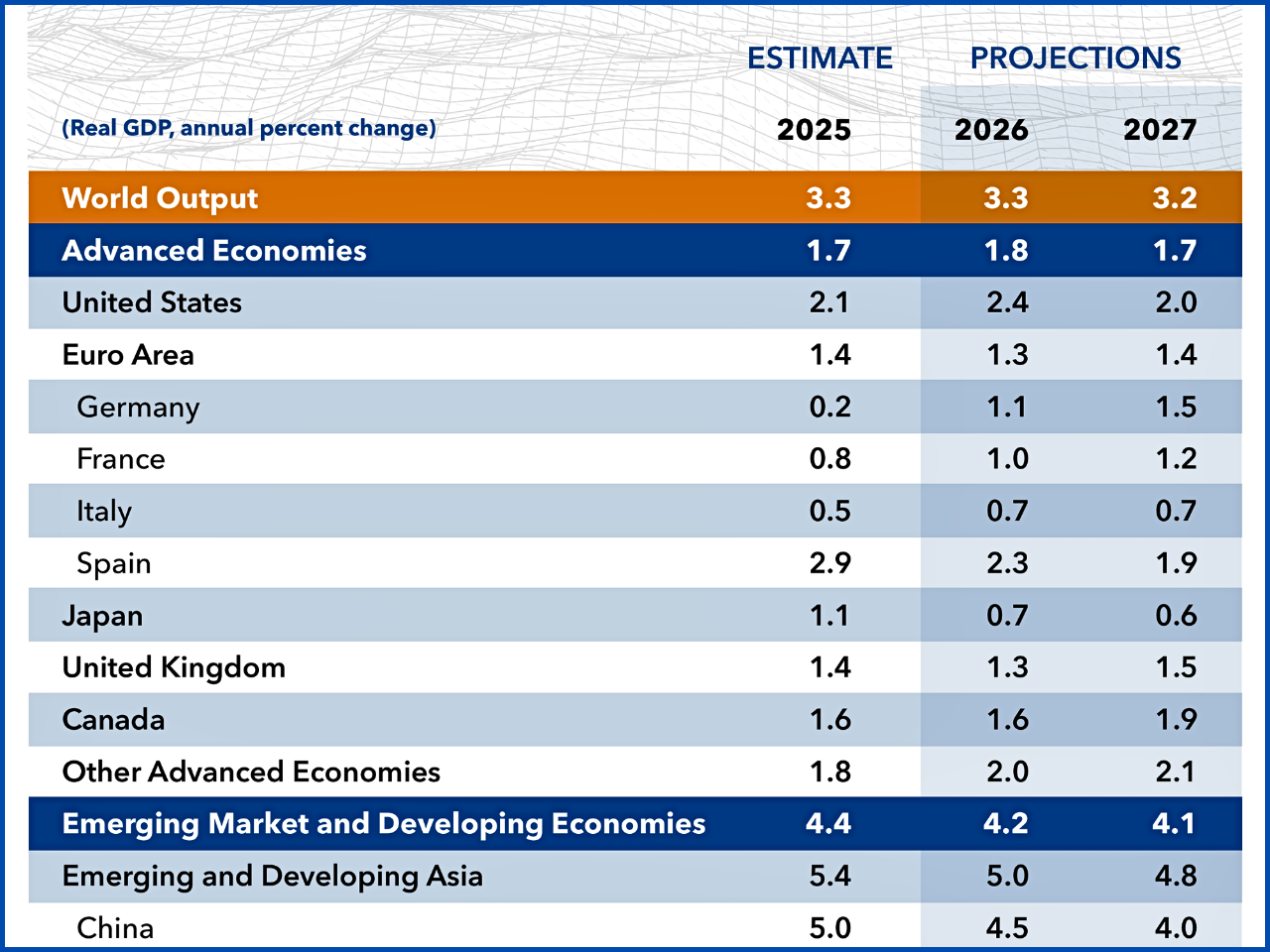

The World Economic Outlook (WEO) Update, January 2026, produced by the International Monetary Fund, offers a very careful projection of the economy. Global growth has been quite resilient despite increased geopolitical uncertainty, changing trade policies, and structural issues in the key economies. Such stability is supported, however, by a small range of drivers, especially the investment related to technology, such that the picture is susceptible to shocks. International Expansion Prospective: Stability with Bolstered Weakness. The IMF predicts that world economic growth will continue to be stable at 3.3 and 3.2 percent in 2026 and 2027, respectively, which is in close relation to the expected global economic growth in 2025. This calmness is a demonstration of a balance of forces. On the one hand, trade policy restrictions, high policy uncertainty, and geopolitical risks are still taking a toll on economic activity. Conversely, the robust investment growth in modern technologies, particularly artificial intelligence (AI), combined with a favorable financial environment and favorable fiscal policies, has provided considerable tailwinds.

The global inflation is predicted to reduce slowly by slowly as it will drop to 4.1 percent in 2025, to 3.8 percent in 2026 and 2027, and to 3.4 percent. Although inflationary pressures are abating across the globe, countries are experiencing disinflation at different rates, and the inflation in the United States is expected to be slower than in other developed economies. Disparity in Economic Performance by Region- The momentum of the economy is still disproportionate. The US has become the engine of economic expansion in the world, though with solid technology investment and expansionary fiscal policy. The U.S. growth has gathered speed in 2025, and the IMF forecasts 2.4 percent growth in 2026 as a result of fiscal stimulus, reduced interest levels and decreased drag due to previously existing trade barriers. Conversely, the euro area growth is small, with projections of 1.3 percent in 2026 and 1.4 percent in 2027. The region is still limited by structural weaknesses, the residues of the escalated energy prices, and the spillovers of the global technology boom. The economy of Japan is predicted to achieve slower growth, which will drop to 0.7 percent in 2026, and will be supported to some extent by the government

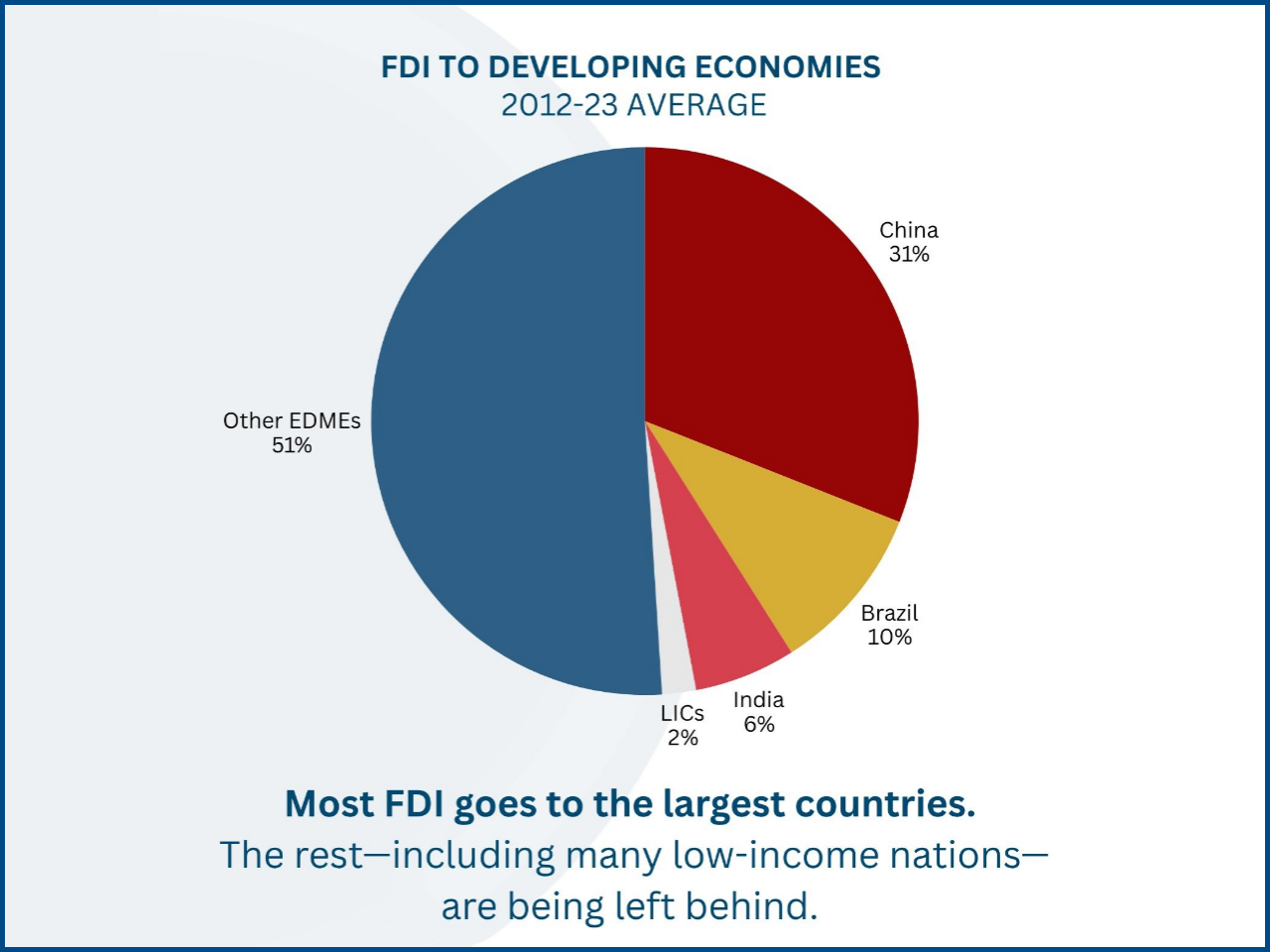

In the emerging markets and developing economies, growth is expected to remain slightly above 4 percent in the years 2026 and 2027. Following policy stimulus and reduced trade tension with the United States, the growth prognosis of China has been revised to 4.5 percent by 2026. Nevertheless, structural challenges, especially the low domestic demand and the pressure in the housing sector, will decelerate growth to 4.0 percent in 2027. India is also among the fastest-expanding major economies, with growth set to continue at 6.4 per cent in 2026 and 2027, though this is a slowdown of recent highs as the cyclical issues recede. Trade, Technology, and Financial Conditions It is assumed that the growth of global trade will slow down in 2025 to 4.1 percent, and to 2.6 percent in 2026, before surging slightly in 2027. Front-loading behavior, policy changes, and changes towards technology-intensive exports are transforming trade dynamics. The Asian economies, especially, have had the advantage of high demand for semiconductors and digital equipment, which has compensated for low results in other export items. Financing terms are generally comfortable, even though they are a bit fluctuating. The equity markets have been more concentrated, such that a few large technology companies have a disproportionate market capitalization and investment. Although this has facilitated expansion, it has also made it more susceptible to market rectification in case the anticipations regarding AI-led productivity do not come true.

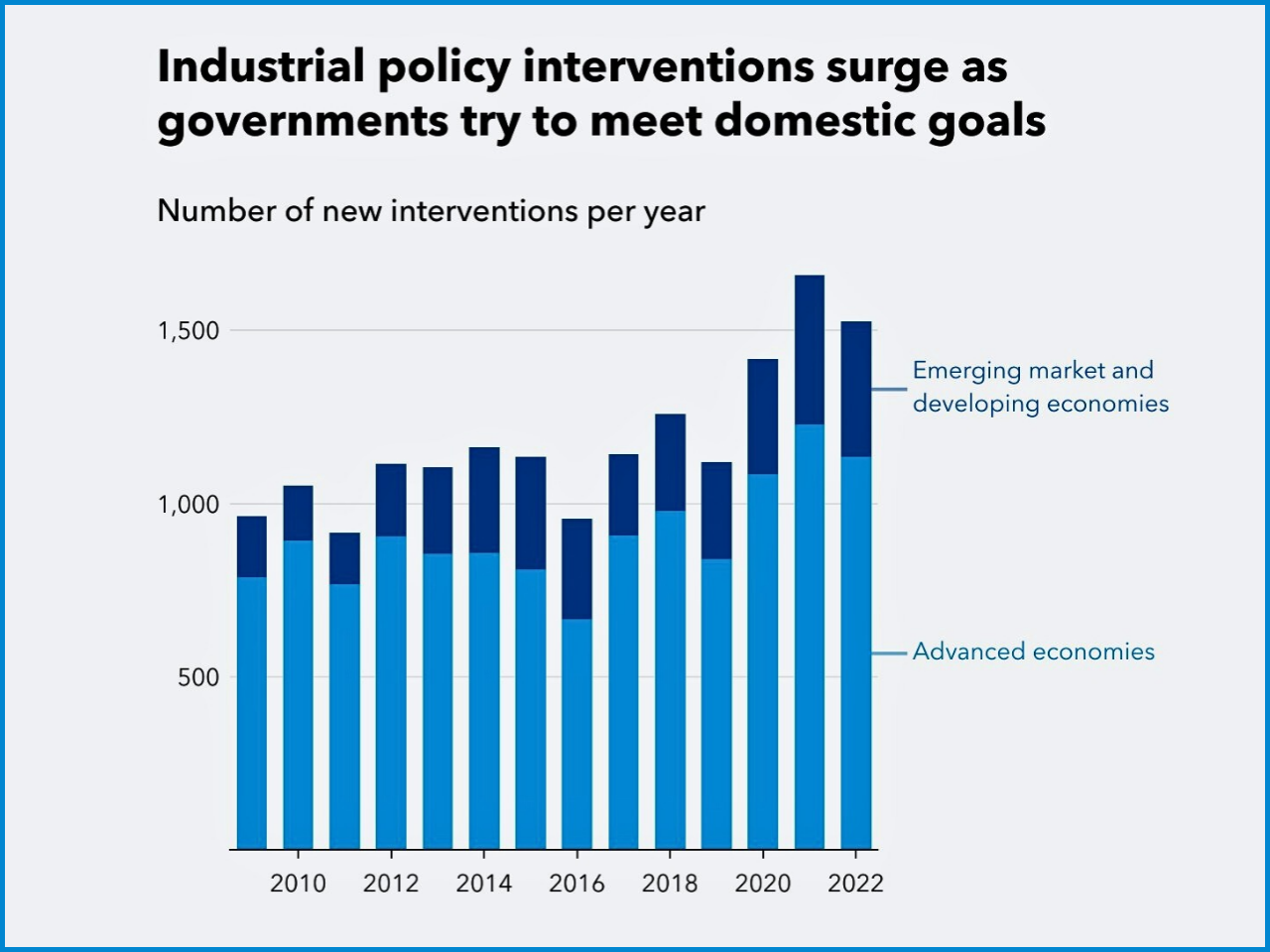

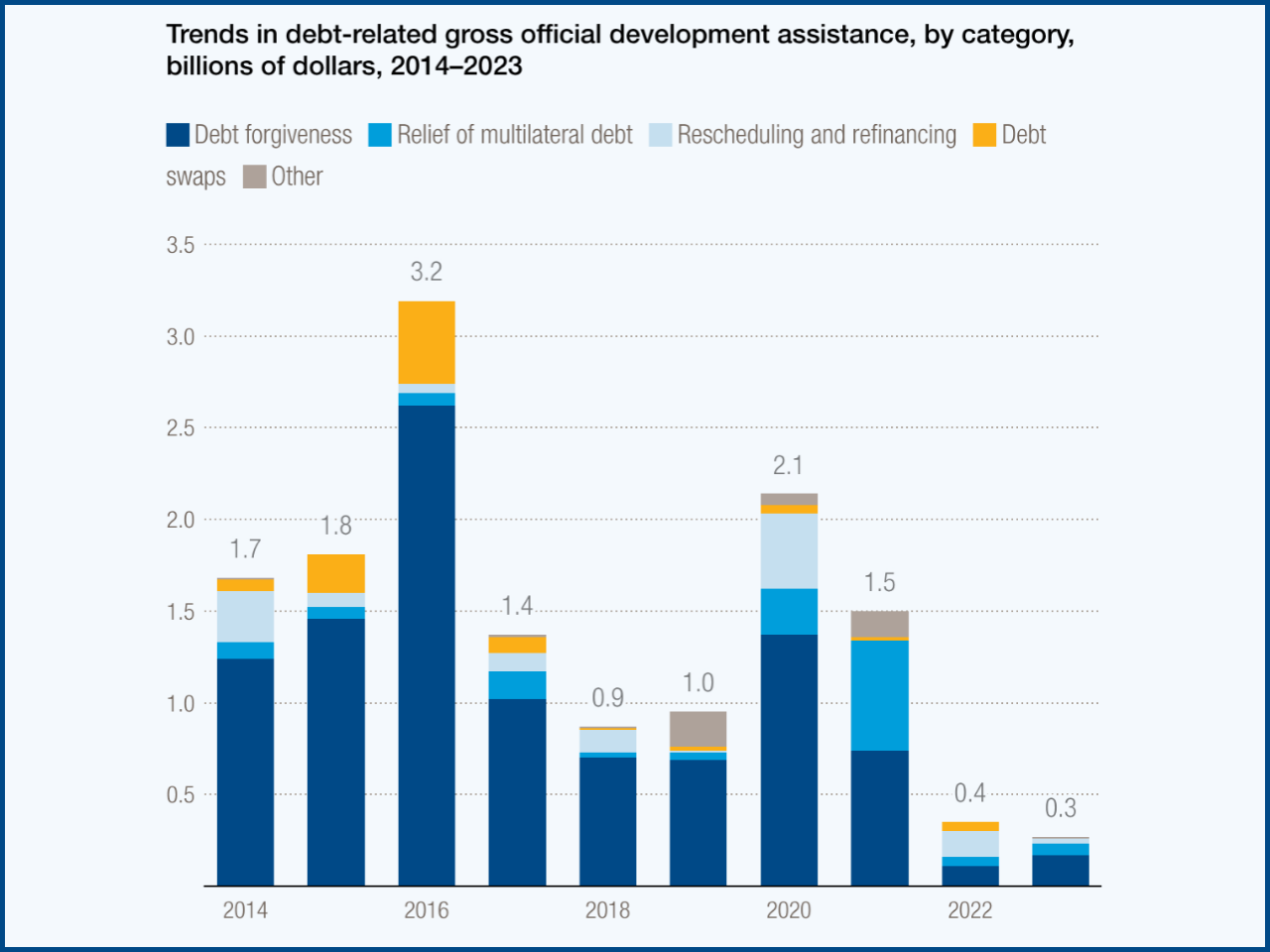

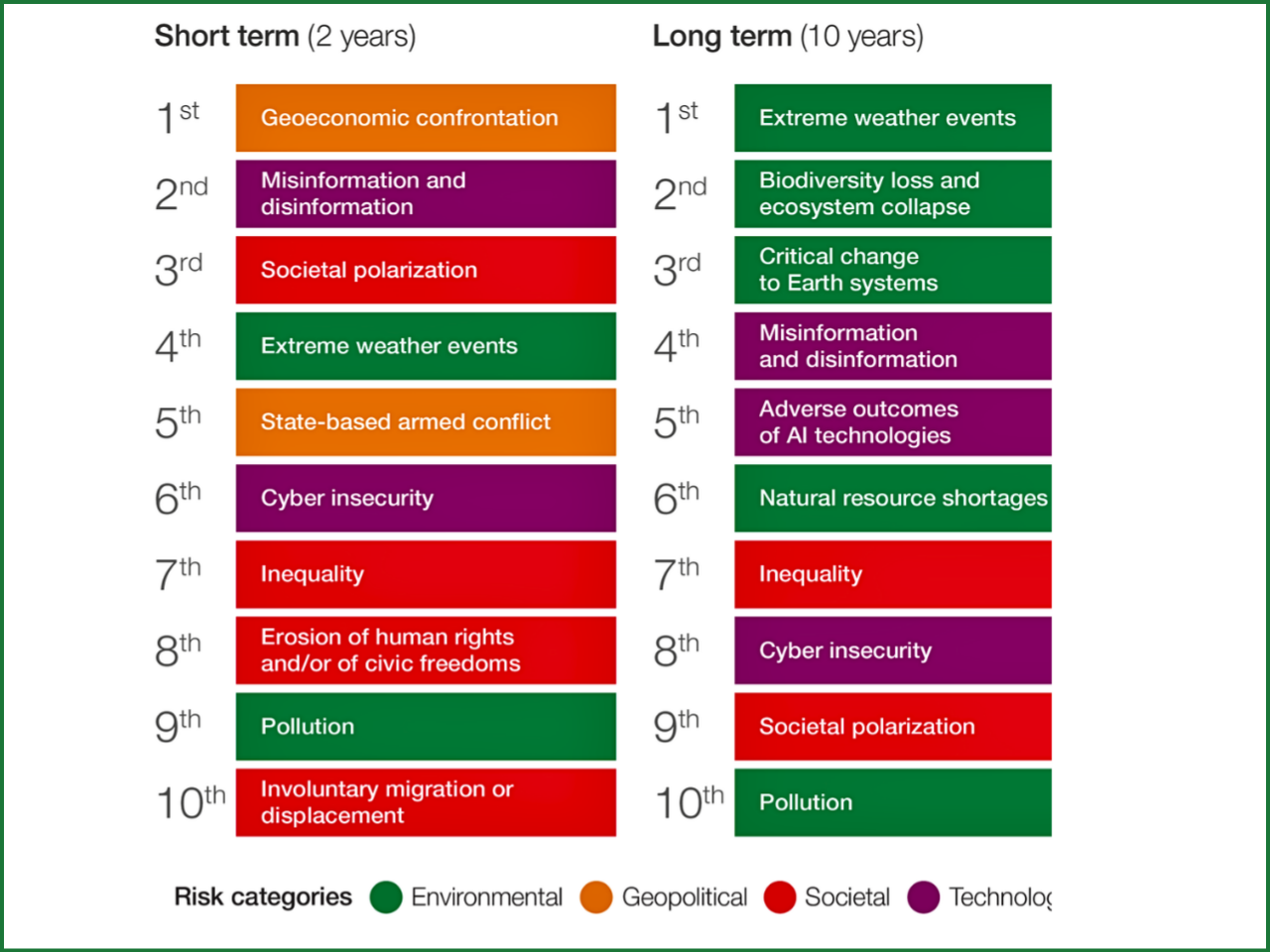

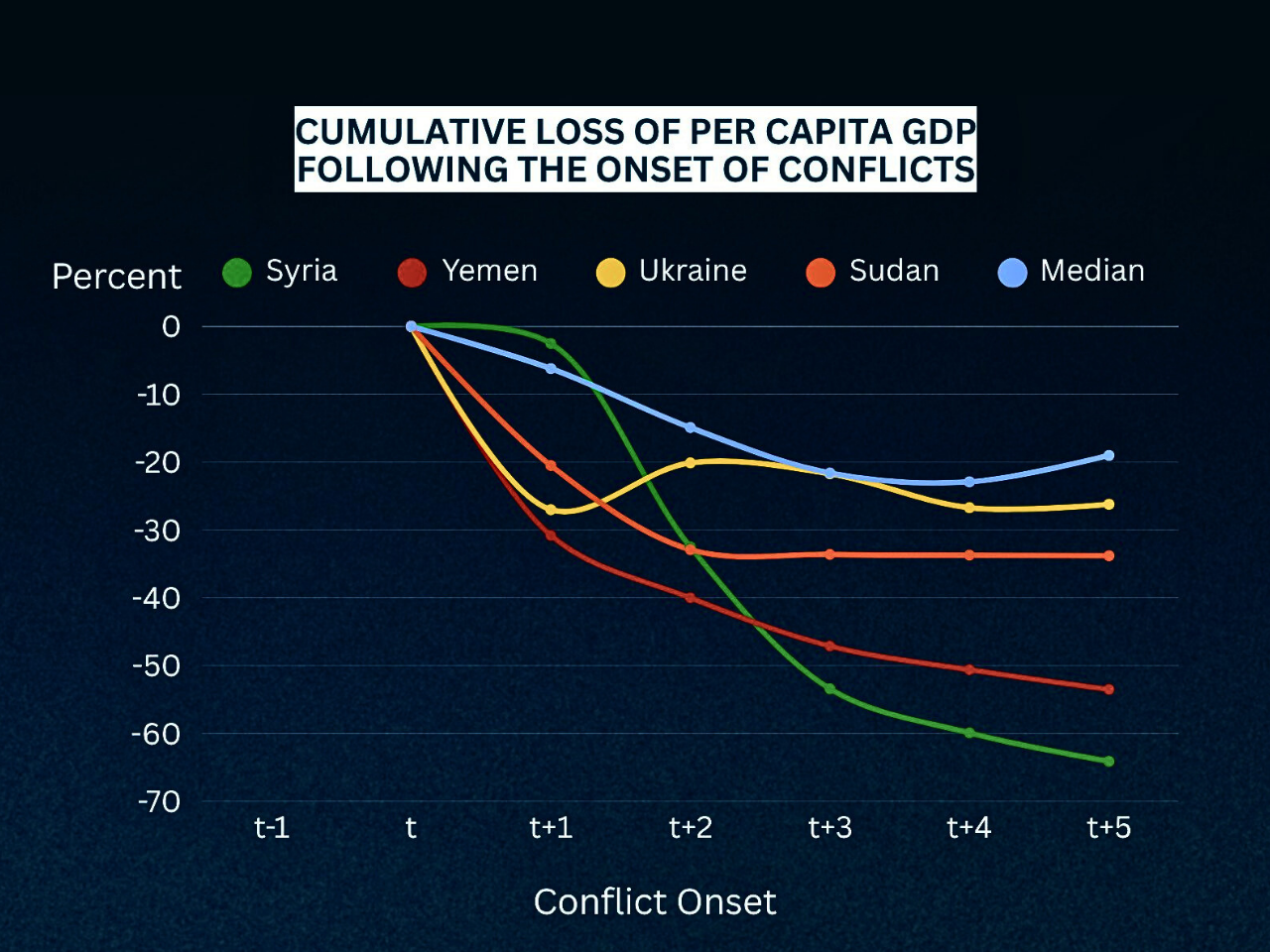

Risks to the Outlook- The IMF stresses that a threat to the global perspective is still skewed towards the negative. The narrow range of growth drivers is one of the significant issues. Unrealistic anticipations regarding the productivity of AI may result in a drastic reduction of investments and stock market asset prices, where the adverse effects will spread to consumption, trade, and the financial state. Equity prices in the global market can be lowered by the average correction in AI-related prices, and this will lower global growth by up to 0.4 percentage points in 2026. Relationship threats in terms of trade policy are also a major issue. Though the recent truce agreements have lowered some of the tariffs, there are possibilities of re-escalation of the sector-specific tariffs or non-tariff barriers, especially on major inputs like rare earth minerals, which might disrupt supply chains and increase the cost of production in the world. Also, a geopolitical fratricide within the nation, like the Middle East or Eastern Europe, might create a supply shock and raise commodity prices and undermine investor confidence. Another area of vulnerability is fiscal vulnerability. Most of the leading economies have high levels of public debt, and an increasing level of sovereign borrowing may put upward pressure on the long-term interest rates. The two factors, paired with weak financial markets, may further increase volatility and endanger macrofinancial stability, especially in poor and heavily indebted nations. Stability and Sustainable Growth Policy Priorities In order to overcome these difficulties, the IMF highlights the need to have credible fiscal consolidation, price stability, and structural reforms. The governments are advised to restore fiscal buffers by using growth-friendly adjustment policies, enhance efficiency in their expenditure, and reinforce revenue collection. There should be targeted fiscal interventions, which should be temporary and consistent with the medium-term sustainability goal of debt. Central banks have to be on the watch and set monetary policy depending on the inflation and the state of the economy. It is also vital to preserve the independence of the central bank, as well as be able to communicate effectively, to anchor the inflation expectations and financial stability. High prudential surveillance and contingency planning are necessary in a condition of increased doubtfulness. In addition to short-term stabilization, it is important to increase the medium-term growth potential. Flexibility of the labor market, skills, competition, and speeding up digital transformation can be structural reforms to diversify and enhance resilience by fostering growth drivers. With the right policies in place, AI can be adopted very quickly to increase productivity to a great extent and propel the growth of the world in the coming years.

In a nutshell, the world economy in 2026 is resilient amid divergent and usually contradicting forces. Although the growth is still stable, it is becoming more and more reliant on a few sectors and favorable policies. Addressing the underlying issue of weaknesses will be relevant through the implementation of sound macroeconomic policies, predictability of the policies, as well as structural reforms that are not only aimed at ensuring short-term stability but also long-term growth.

Free To Activate Membership