Economics Perspective - Global Economic News & In-depth Analysis

Breaking News

WEBSTORIES

Monthly Edition

Our Latest Blog

Global Job Creation Slows Down: ILO Revises Expectations Amidst Declining Investment and Economic Uncertainty

2025's Hottest Sectors: AI, Renewable Energy, Cybersecurity, and More

Latest Podcast

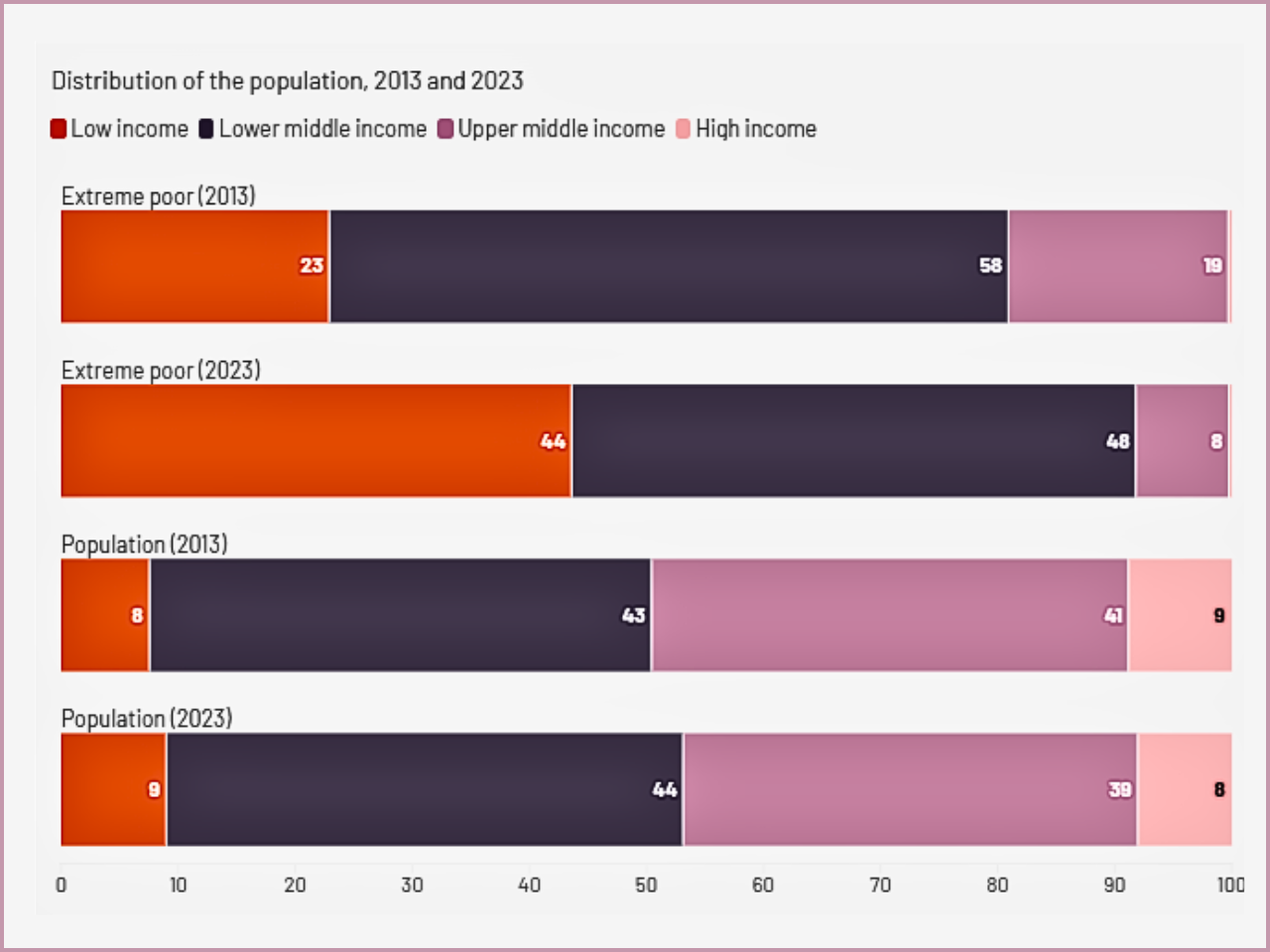

Global Labor Market in Crisis: 2.1 Billion Workers in Informal Employment, 284 Million in Extreme Poverty

EP-Prime Membership