The Revival of Industrial Policy: A New Era of Government Intervention in the Economy

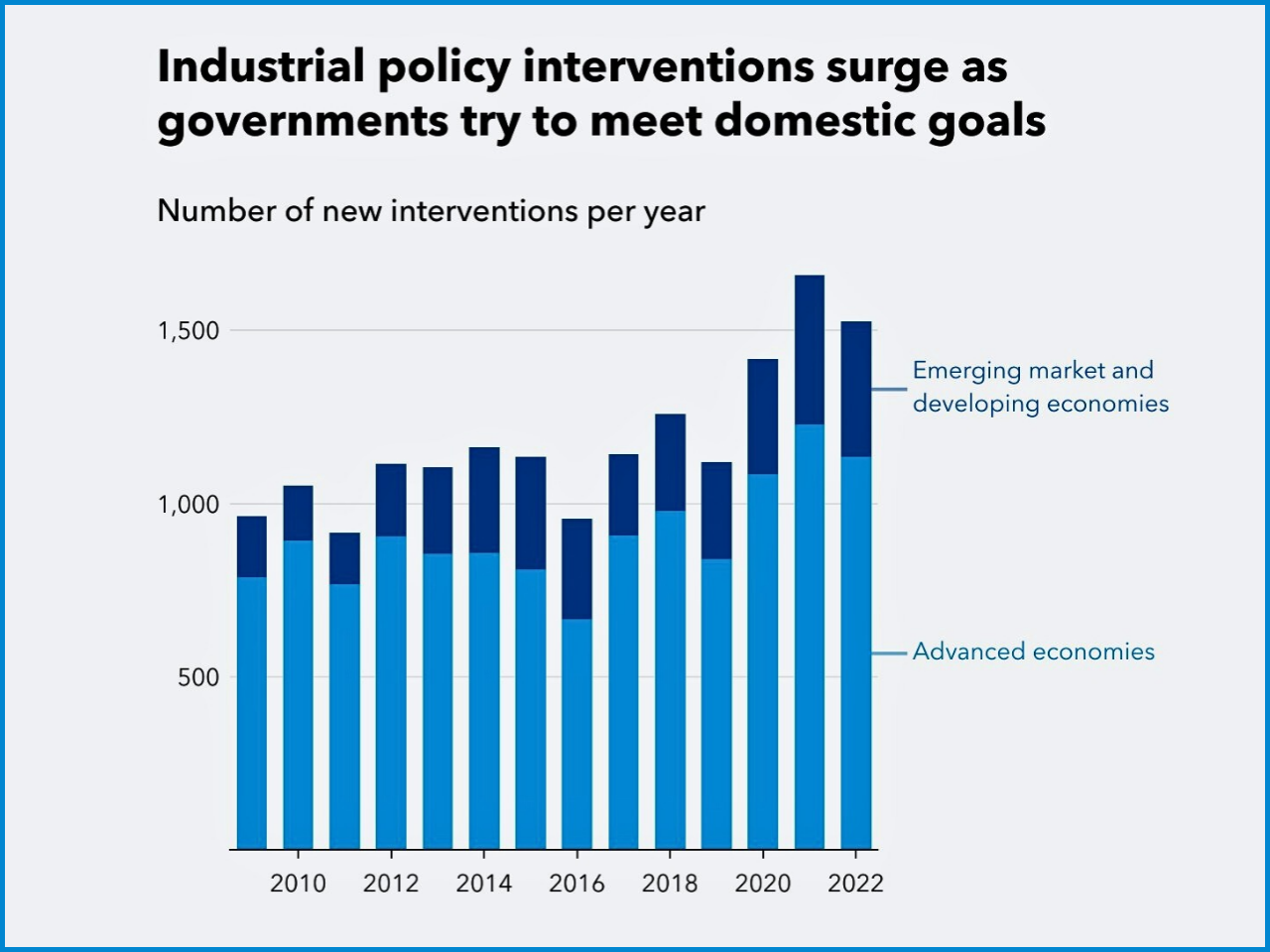

In the last ten and a half years, industrial policy has come back to the fore and center of economic policy in both advanced and emerging market economies. Governments are also becoming increasingly involved in helping certain companies and industries to achieve domestic goals like productivity increase, supply chain sustainability, strategic independence, and job security. According to the statistics of the Global Trade Alert (GTA), summarized in the World Economic Outlook (WEO) of the International Monetary Fund (IMF), there is an increase in new interventions in industrial policies, which starts to grow significantly after 2018 and has reached its apogee around the pandemic. There has been a significant increase in the number of measures of industrial policies in the world. Second, although the main beneficiary of interventions is advanced economies, emerging market and developing economies (EMDEs) have increased their application of targeted industrial assistance. This revival represents a basic change of policy ideas, no longer focusing on horizontal, market-neutral reforms but rather making choices more selective in terms of sector.

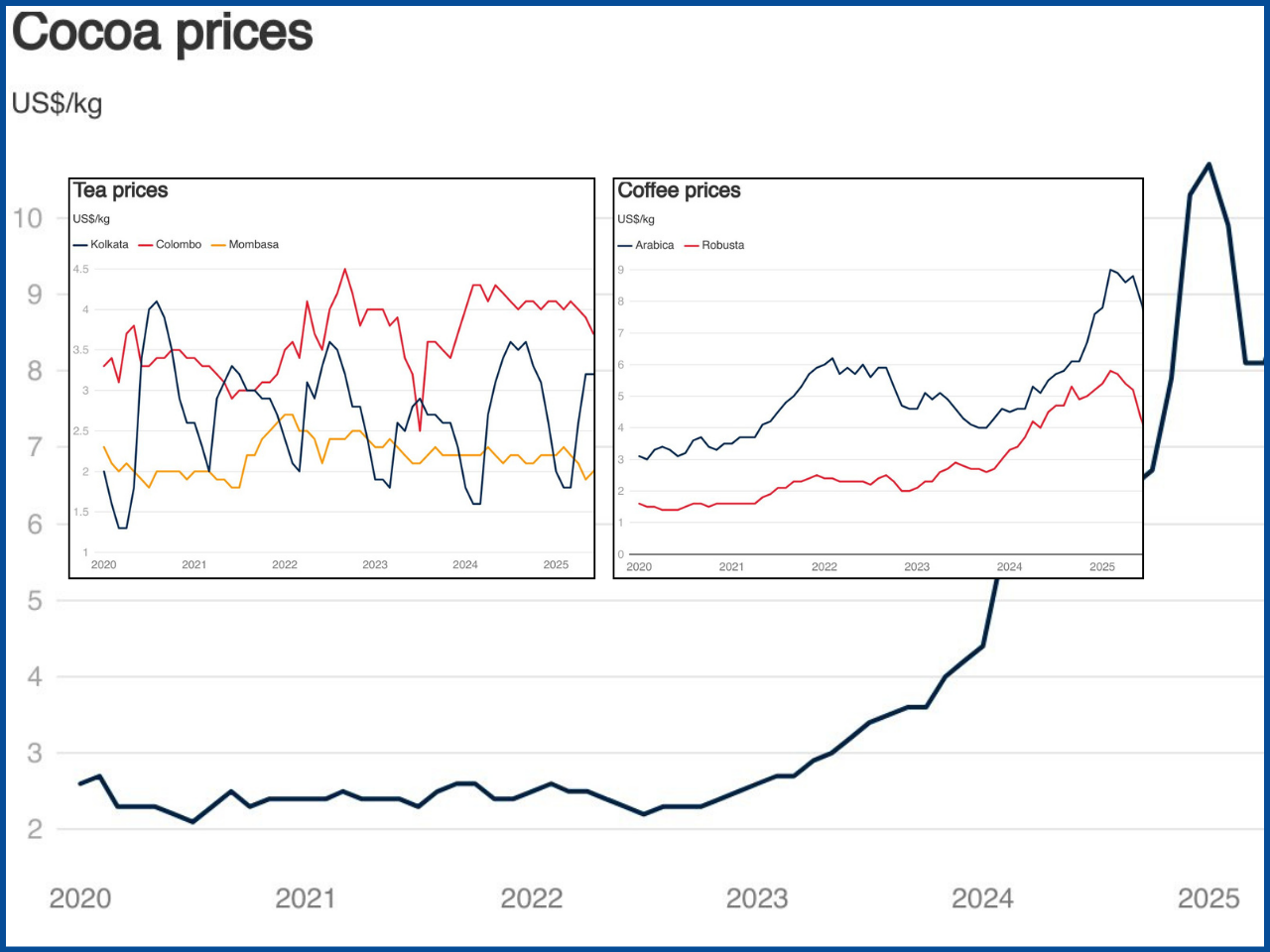

What Is Driving the Revival of Industrial Policy? Generally, industrial policy refers to a willful government intervention to change the nature of the domestic economy by encouraging certain sectors or activities. Based on the textbook-based system of IMF classification, these interventions can be divided into such categories as subsidies, tax breaks, state aid, trade protection, and regulatory favors directed to the chosen sectors. There are a number of structural forces that can be used to explain the renaissance of industrial policy. The slow pace of growth in productivity in a large number of developed economies has led to governments trying to find new sources of growth. Simultaneously, the impact of geopolitical tensions, trade disruptions, and the perception of being vulnerable to supply chain risks during the COVID-19 pandemic highlighted the dangers of overreliance on global markets. Moreover, the worldwide energy shift has enhanced the application of the industrial policy in favor of clean technologies and in minimizing the dependence on imported fossil fuels.

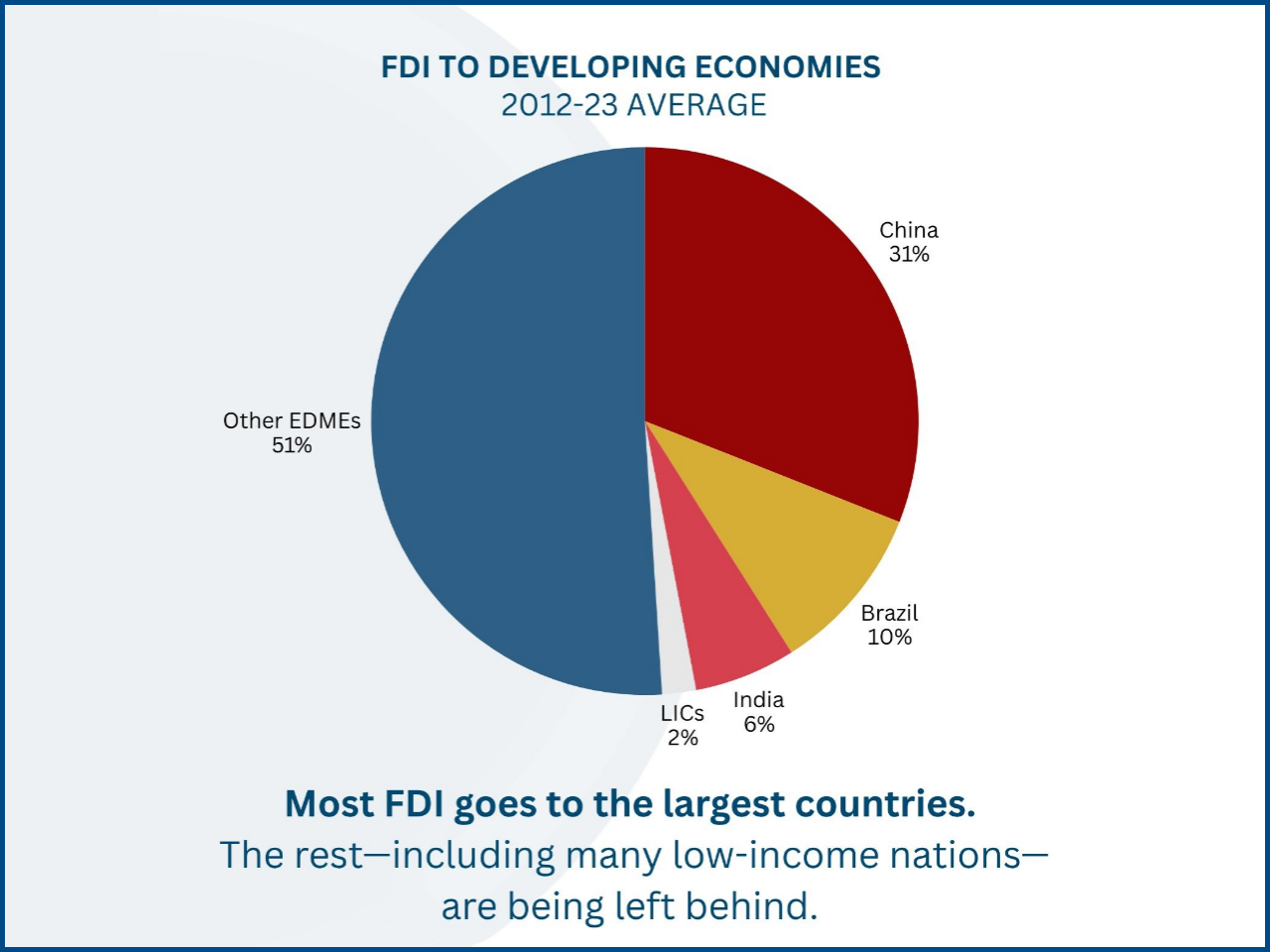

In the case of emerging and developing economies, industrial policy is frequently perceived as the means of diversification, modernization of the manufacturing sector, and developing infrastructure industries that otherwise would not be able to compete with the developed world producers without state aid. Potential Improvement of Specific Sectors According to the IMF analytic framework, the industrial policy may, given some conditions, increase productivity in some sectors. In cases where firms accumulate experience, enhance their production processes, or enjoy technological spill-overs, early government subsidies can assist industries to achieve some degree of competitiveness that they would otherwise have been unable to achieve. The WEO model simulation indicates that subsidies and trade protection can increase employment, output, and productivity of supported sectors, especially when productivity increase is proportional to production volumes. This conclusion is supported by empirical evidence that the IMF has analyzed, and the results show that direct subsidies have no significant impact on improving sectoral performance. Particular industries show a rise in value added of 0.5 percent and total factor productivity of 0.3 percent over a period of three years of policy implementation. These are gains that are mainly motivated by an increase in the accumulation of capital and employment. Nevertheless, they are not significant in comparison with average annual growth rates of industry value added (some 6.5 percent) and productivity (some 4 percent). This observation highlights one crucial detail, which is that industrial policy can assist, but not replace, more general economic growth drivers.

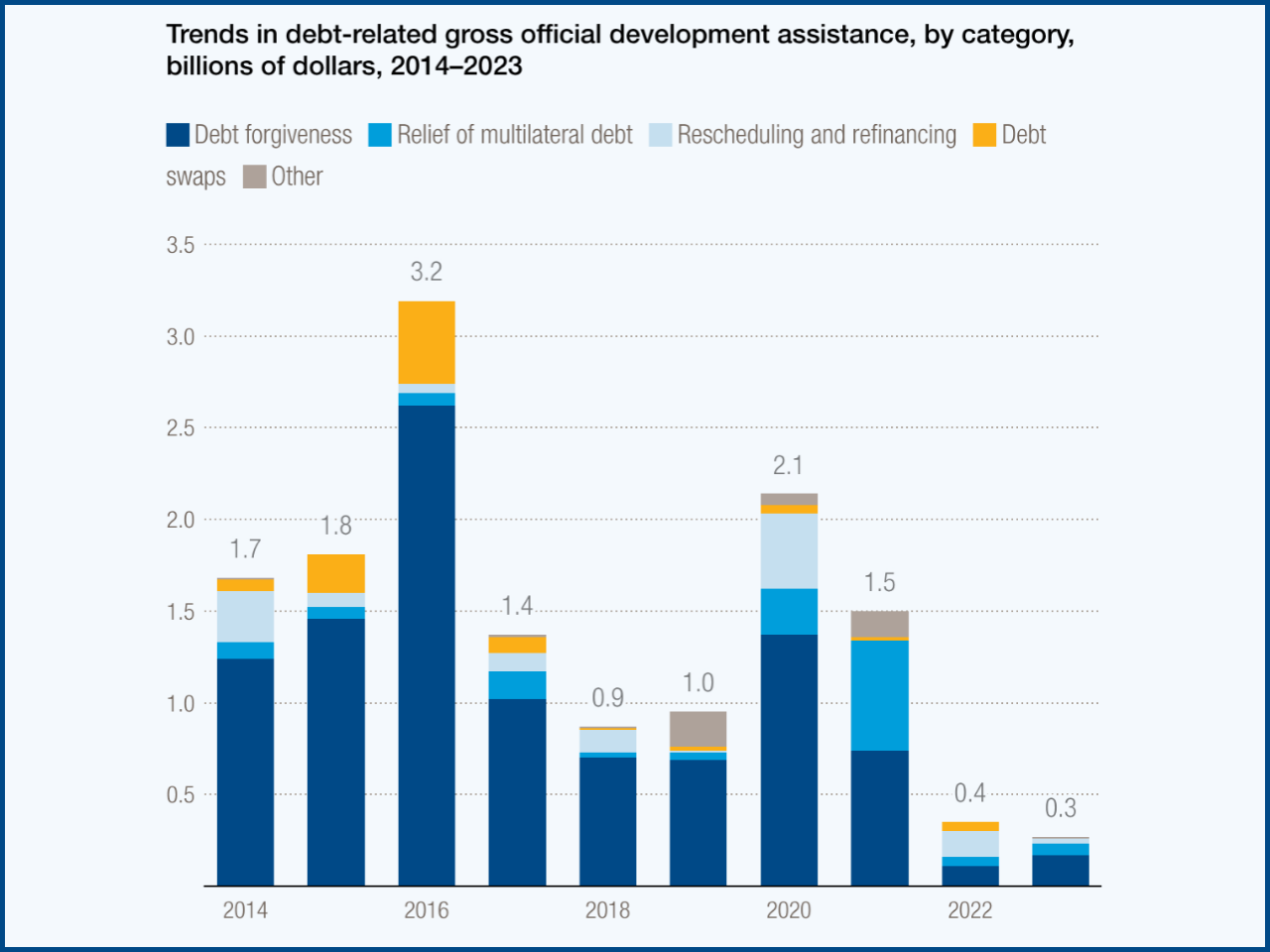

Although industrial policy can be used to provide benefits with local effects, the cost and trade-offs associated with it are also high economically. The first of these is an increase in consumer prices. Trade protection and subsidies lower the intensity of the competition, and the domestic producers are able to continue working at a higher cost level for a length of time. The consumers and taxpayers pay these costs effectively. Another big issue is fiscal expenses. The industrial subsidies on a large scale can put pressure on the national budget, especially in nations with a small fiscal space or high levels of state debt. The IMF warns that poorly structured industrial policies would be transformed into transfers that are irreversible to politically favored firms, and not as a means of boosting productivity. More to the point, industrial policy may create inefficiencies in the whole economy by misallocating resources. This multi-sector, multi-country quantitative model proposed by the IMF reveals that industries that are targeted grow, but untargeted industries tend to shrink due to reallocation of the labor force and capital. These shrinking sectors may reduce productivity, and this could counterbalance gains in other areas. Consequently, the aggregate productivity may either level off or even decline, resulting in the economy being worse off as a whole. The latter risk is particularly high when the governments fail to accurately identify the areas with real potential growth or when the learning effects are low. The industrial policy can fail to bring the projected dynamic benefits when domestic firms are too distant from the technological frontier, when they do not have access to export markets, or when they are not subject to strong competition.

A key finding from the IMF's empirical analysis is that institutional quality is a crucial factor in determining the effectiveness of industrial policy. Nations that have good administrative structures, open governmental financial systems, and good regulations to check their financial systems have a good result of the interventions. Subsidies in such settings have an increased likelihood of being given on a performance basis than on political grounds, and those programs that are inefficient are likely to be disclosed. On the other hand, industrial policy may contribute to the development of rent-seeking behaviour, the survival of inefficient firms, and competition in the weak institutional economies. This is the institutional aspect that makes it possible to consider that similar policies can lead to extremely different results in different countries. Industrial Policy and Structural Reforms The results of the IMF maintain the same theme, every time stating that the benefits of industrial policy are insignificant relative to those of structural reforms that are broad-based. The general business environment was also improved in areas like regulatory barriers, protection of property, increased access to finance, and investment in human capital, which created bigger and sustainable productivity increases in the whole economy. Previous studies in the IMF affirm that horizontal reforms can improve the allocation of resources and lead to innovation even without governments having to pick winners. In this light, industrial policy is to be regarded more as a supplementary and not as a central growth policy.

Planning Improved Industrial Policies Considering the risks at stake, the IMF emphasizes the need to design and implement the policy carefully. Industrial policy should be explicitly weighed against alternative uses of government resources by governments that consider it. In cases where fiscal space is limited, the chances of wasteful expenditure are really high. Clear objectives, support over a time horizon, and an effective system of monitoring and evaluation must be part of the effective industrial policy frameworks. Frequent review enables policymakers to tune or abandon the programs that do not achieve the outcomes. It is also necessary to keep the competitive pressures, both locally and globally, to ensure that there is no complacency amongst the supported firms. Lastly, policymakers should be aware of international spillovers. The large-scale industrial policies may dwarf the world trade patterns and create a retaliatory response by the trade partners, which can lead to trade conflicts that destroy world development. The modern international re-emancipation of the industrial policy is an indication of justified worries regarding productivity stagnation, economic sustainability, and strategic independence. The IMF experience in its World Economic Outlook indicates that a special intervention may provide productivity in selected sectors, especially in a favorable institutional and technological environment. Nonetheless, such benefits are often small and have great fiscal, efficiency, and distributional trade-offs. Industrial policy is no panacea. It may harm the proper resource allocation and undermine aggregate economic performance without effective institutions, close calibration, and continuous assessment. Finally, the analysis by the IMF supports a balanced policy message that industrial policy can support, but a consistent growth and productivity gain is better attained under the banner of overall structural reforms of the economy that enhance market competition and institutions.

Free To Activate Membership

ADVERTISEMENT