Foreign Direct Investment in Emerging Markets: Trends, Challenges, and Opportunities

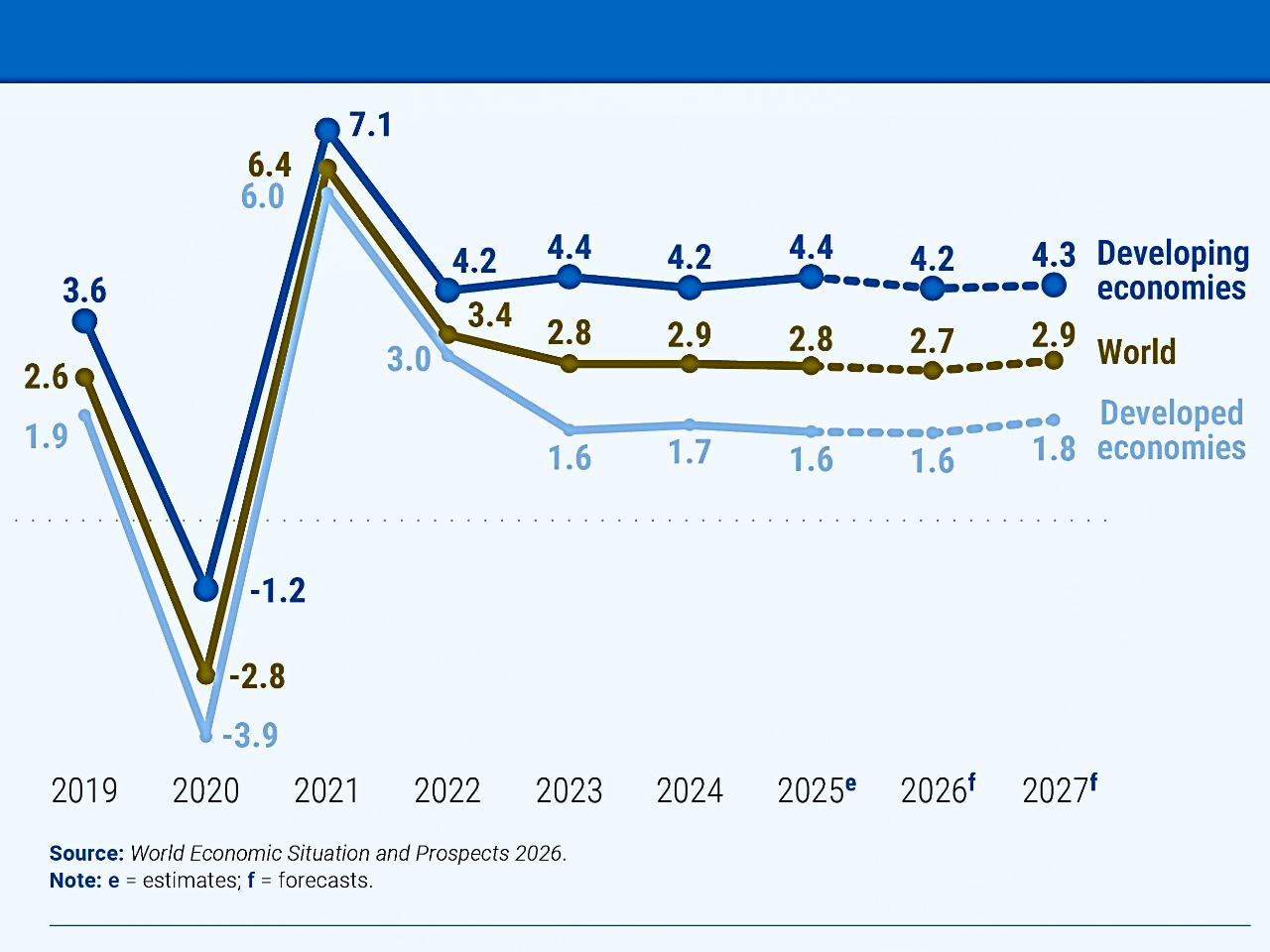

Since the year 2008, foreign direct investment into EMDEs has decreased steadily. Historically, EMDEs experienced an increase in foreign direct investment after the Financial Crisis of 2008; however, as a result of the Financial Crisis and the ensuing global economic recession, foreign direct investment continued to fall in both absolute and relative terms. In absolute terms, the amount of foreign direct investment into EMDEs declined by $435 billion to approximately $435 billion in 2023. In relative terms, the share of foreign direct investment of EMDE of total gross domestic product declined by approximately 2%. This decreasing trend appears to be affecting the majority (approximately 60%) of EMDEs, including the four largest EMDE regions (Central and Eastern Europe, Africa, and the Middle East), and is expected to continue to decline when comparing the period of 2012 to 2023 with that of the period of 2000 to 2011 based on recent project announcement data collected over the past year.

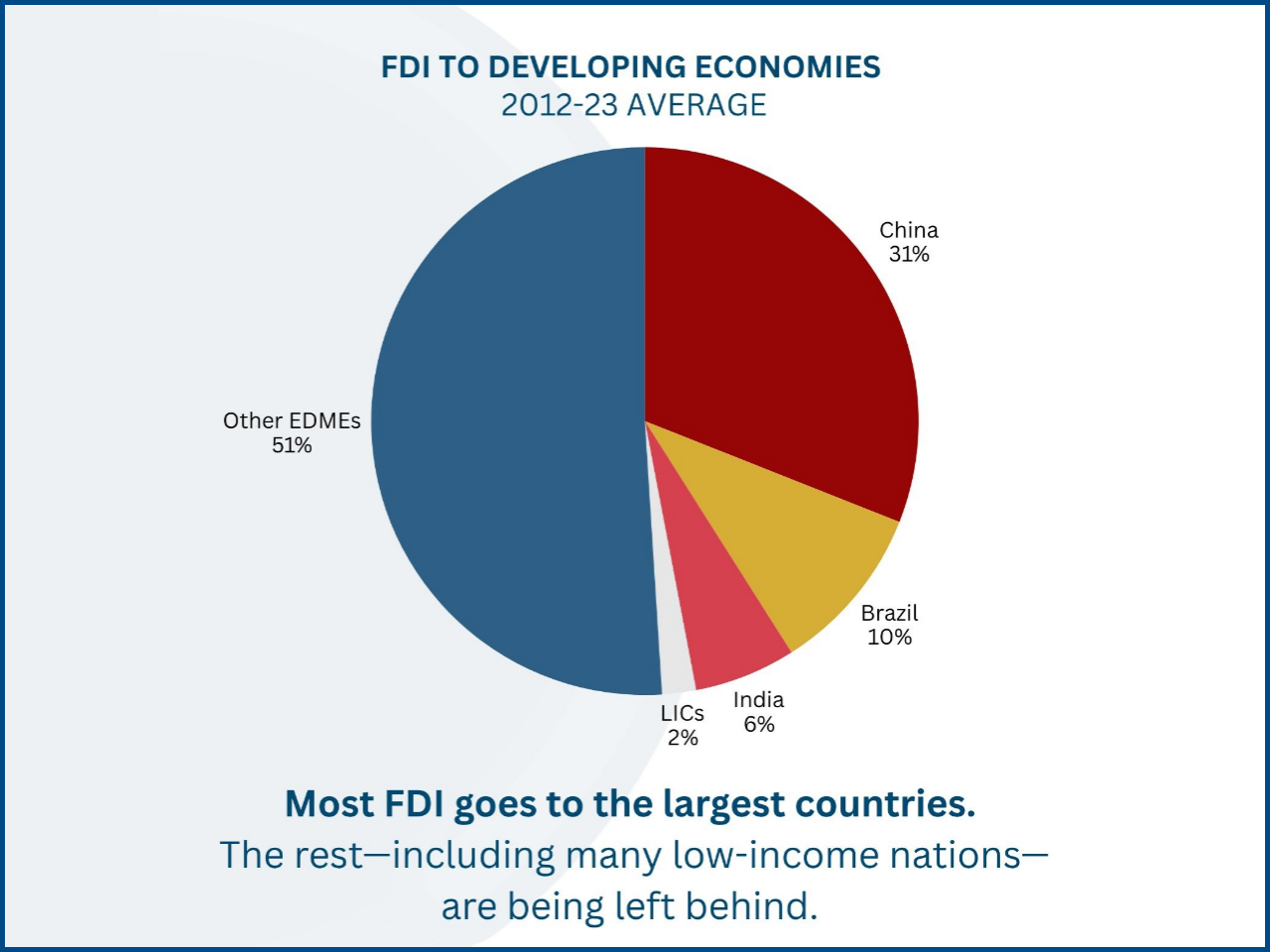

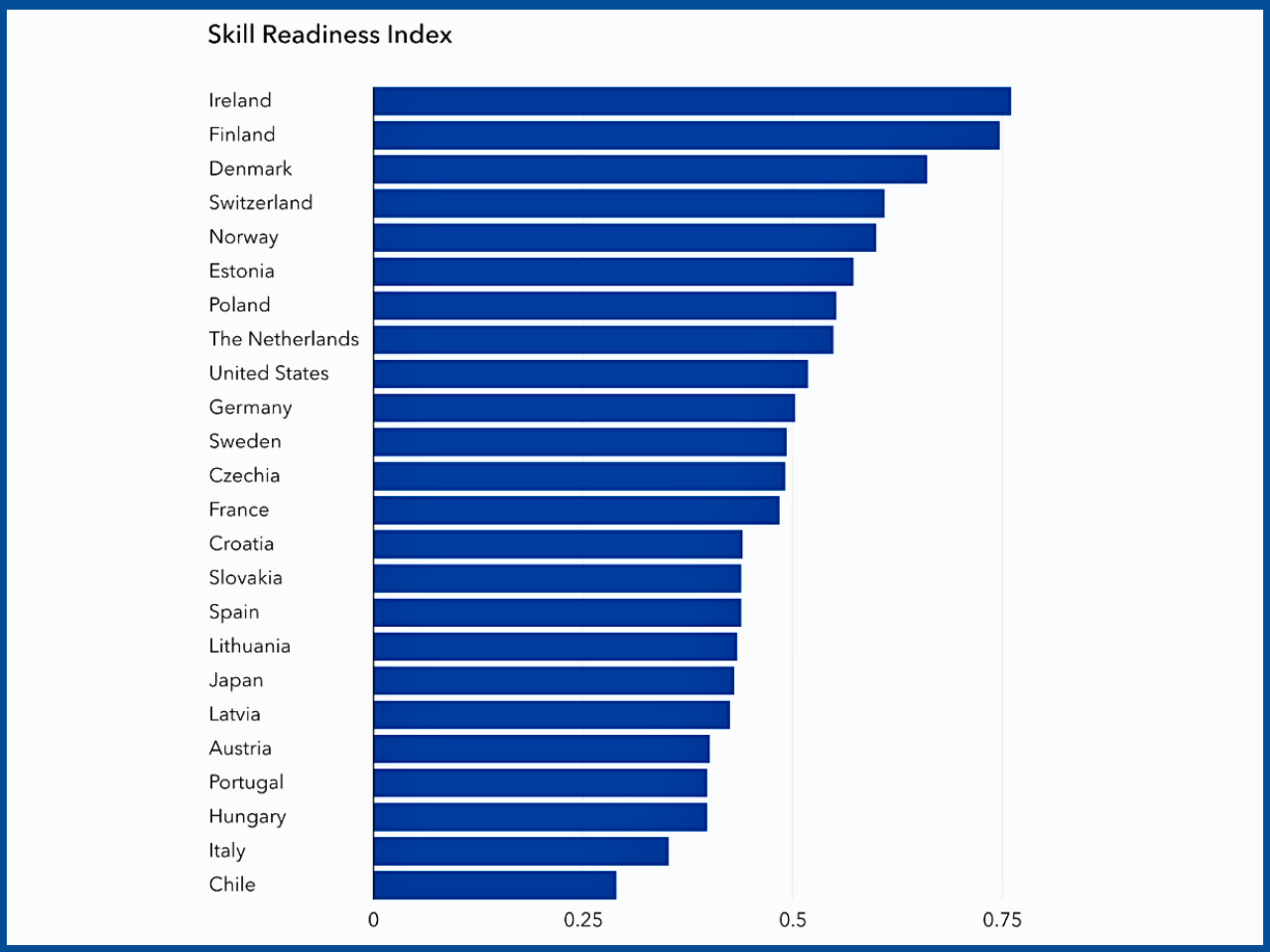

Between the beginning of the 21st century and the present day, the composition of Foreign Direct Investment (FDI) flows into Emerging Markets and Developing Economies (EMDE) has changed significantly. The trend has been a shift from manufacturing to services. From 2019 to 2023, approximately two-thirds (65%) of all FDI inflows to EMDE went into the services sector, a number that is now comparable to that of the FDI sector in developed countries and up 20% from exactly 20 years prior. The remaining third went into manufacturing and has been declining steadily, from approximately 45% to less than 30%. The other major trend that has changed over this time will show an increased geographical concentration of FDI; during the 2012-2023 period, just under half of total EMDE FDI inflows went into the three largest EMDEs, China, India, and Brazil—this is an increase of approximately 10% from the previous decade. Of that total, just under one-third came from China alone for the period of 2012-2023. FDI inflows have a positive effect on EMDE’s GDP; however, the effect is dependent upon structural conditions in the country. On average, an increase of 10% in FDI inflows corresponds to an increase of 0.3% in GDP after three years. Foreign direct investment (FDI) has the greatest impact on economic growth (through the FDI gain) in those countries that are the most ‘open’ to international trade and investment, with the most supportive institutions for business and industry, with the highest levels of skilled labor (human capital), and with the least amount of informal economy activity. Many of the lower-income countries of the world tend to lag behind the more developed nations in all of these criteria, thus limiting their ability to effectively convert (use) FDI inflows into sustainable economic growth (within their borders) over the long term. Therefore, lower-income countries must create a suitable domestic business environment in which they will benefit from the domestically supported growth (and increased investment) that is generated by their FDI inflows.

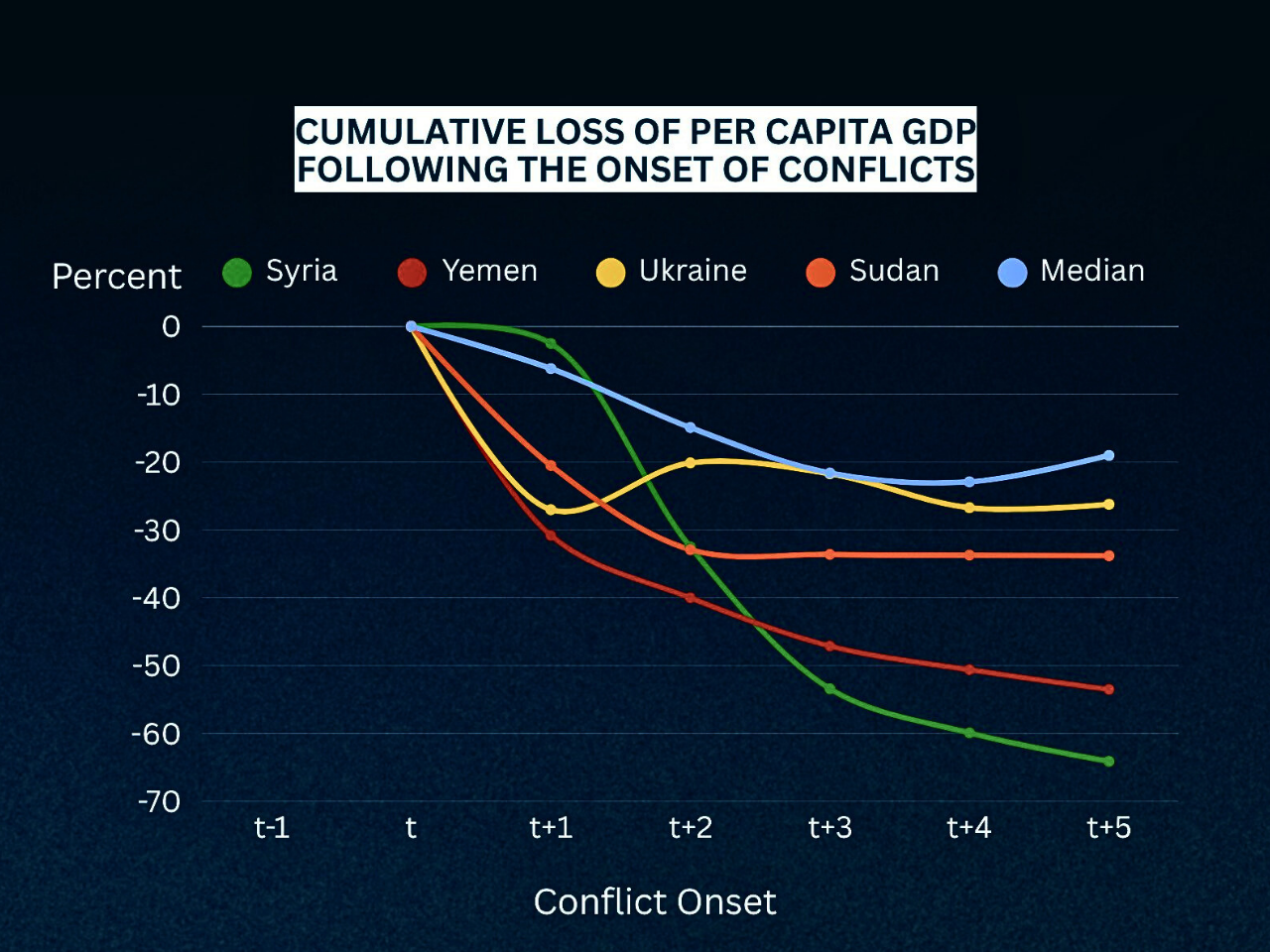

A country’s ability to attract foreign direct investment (FDI) correlates positively with its macroeconomic strength, degree of trade integration, and quality of institutional environment. For example, the global economic recessions that occurred in 2009 and 2020 had a substantial impact on FDI flows from many different countries and resulted in very large declines in both years. Countries that have high trade integration tend to have higher levels of FDI. A one-percentage-point increase in the trade-to-GDP ratio results in approximately a 0.60 percent increase in FDI inflows, and a similar increase in the share of global value chain (GVC) participation results in an approximate 0.30 percent increase in FDI inflows. Executing global investment agreements is another significant factor because when two or more countries have a bilateral investment agreement (BIA), the amount of FDI between those countries will typically increase by more than 40 percent. Currently, the international economic environment, along with political instability worldwide, limits the possibility of increased foreign direct investments in emerging markets and emerging and developing economies. There is now a record level of uncertainty in global economic policies and a high level of political risk around the world. The average time it takes for countries to establish new international agreements on investment and trade has dropped considerably. In the last four years, about 380 treaties have been implemented, compared to around 870 treaties in the previous decade. Domestically, the policy environment for EMDEs has shifted toward more restrictive policies in recent years after a long period of liberalization in the 1990s-2000s. Furthermore, many countries are implementing a growing number of trade distortions and have become reluctant to take steps to improve their investment environment through institutional reform. Therefore, FDI inflow prospects are likely to decrease as well. To confront these difficulties, EMDEs should design a three-fold strategy for attracting FDI, maximizing FDI’s benefits, and supporting international collaboration. Comprehensive domestic reforms to foster a stable and supportive investment climate are necessary for attracting foreign direct investment (FDI).

Comprehensive reforms include sound macroeconomic policies, enhanced human capital, enhanced financial markets to give ease of access to trade/investment, and lowered barriers to trade/investment. To fully exploit the opportunity for growth inherent in FDI, developing countries must create the appropriate institutions to strengthen their informal sectors and provide an enabling environment where investment can be translated into sustainable development.

Global cooperation is crucial to safeguarding the rules-based international system of investment and addressing the increasing pollution and fragmentation that is occurring globally. International organizations assist developing countries (e.g., “emerging economies”) with technical and financial support, an example of which is the World Bank Group’s role in mobilizing private capital, mitigating investor risk, enhancing economic conditions, and fortifying ties between the private sector and emerging markets/developing economies (EMDEs). As the global economy becomes more fragmented and uncertain, coordinated policy actions are becoming increasingly important for emerging market and developing economies. These countries are working to reverse the drop in their foreign direct investment and use this investment to promote sustainable development.

Free To Activate Membership

ADVERTISEMENT