Global Beverage Prices Ease as Coffee and Cocoa Supplies Recover

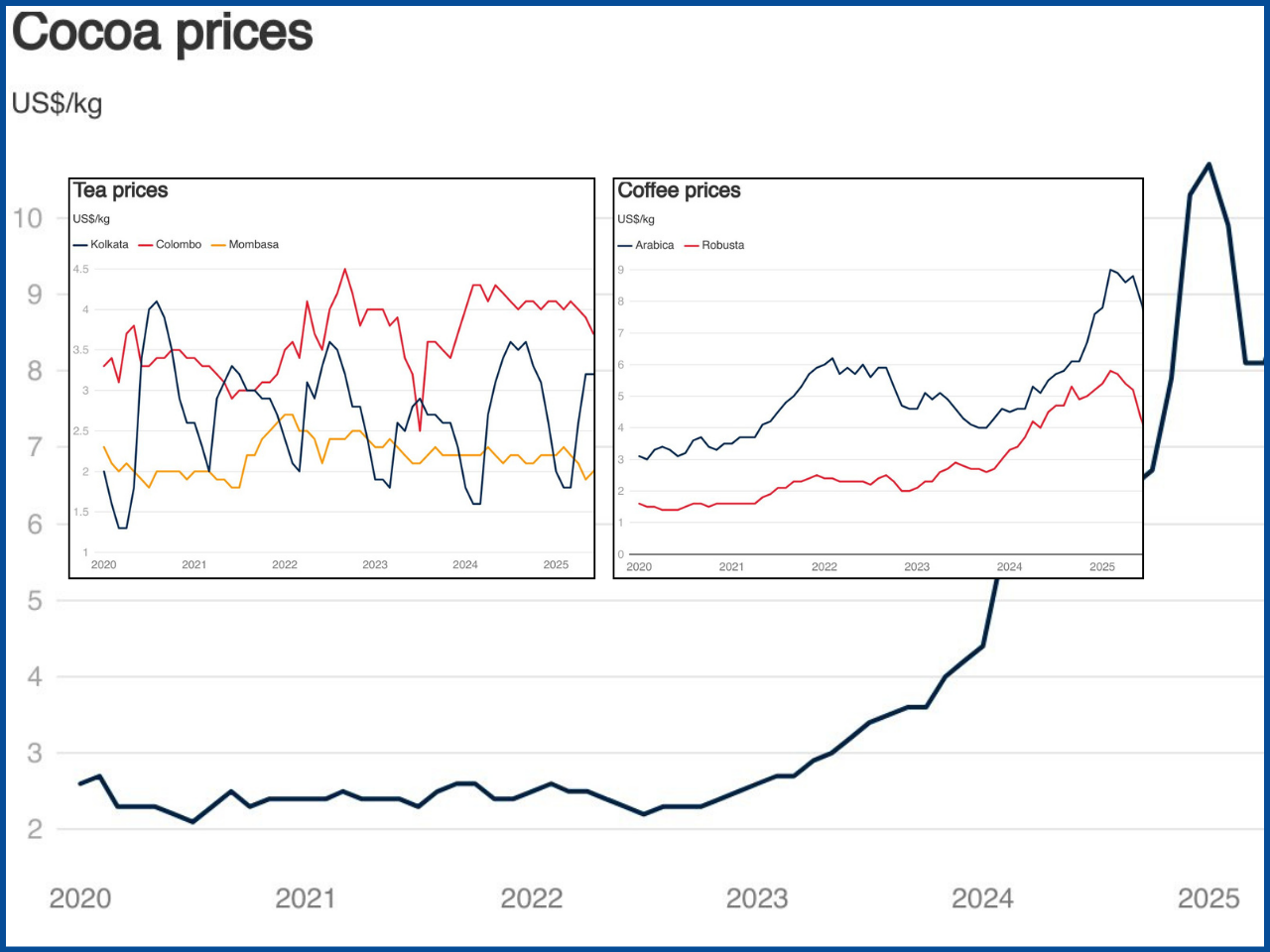

Global beverage markets are showing improvement with the refined harvest of coffee and cocoa, releasing some of the pressure on commodity prices that were tied to the previous harvests. According to a World Bank report titled “Commodity Markets Outlook—October 2025,” today’s prices of these beverages are coming down as global coffee and cocoa supplies have returned as a result of weather conditions that affected both the global market prices for coffee and cocoa. In late 2025, the World Bank’s beverage price index decreased significantly after increasing drastically throughout 2025 (the coffee and cocoa prices have begun to fall) and as the tea prices remain stable for a significant period of time. Following the forecasted rise of the beverage price index by 18% for 2025, it is forecast to decline by 7% for 2026 and by another 5% for 2027 due to anticipated increases in output levels.

The price of coffee is lower now compared to one year ago, but not significantly lower than the previous year. In November, the average price of Arabica was nearly $9 per kilogram, which represents an increase of around 35% from November of the previous year, and was nearly $5 for Robusta coffee. Production of both coffee varieties is expected to increase throughout the 2025–26 season, with the greatest increases occurring in Colombia, which will have a substantial impact on future Arabica coffee pricing. Likewise, cocoa prices are also expected to decrease for a larger West African harvest in the 2025–26 season with increases in exports from the Ivory Coast and Ghana. Tea producers can meet their supply obligations, and tea price stability should return to levels slightly above current values. Weather-related risks associated with climate patterns and potential tariffs or quota restrictions placed on imports of coffee could impact any future price movements in coffee.

Latest News

Social Protection: A Gateway to Stability and Economic Engagement

Social protection has become one of the most effective tools that alleviate extreme poverty and generate opportunities for vulnerable groups. Social protection regimes, including cash transfer schemes, social pensions, food stamps, and labor market initiatives, are not only a temporary soothing measure, but instead the gateway that enables people and families to switch between survival and stability and long-term economic engagement.

IMF Warns of AI-Driven Job Displacement, Urges Governments to Support Workers

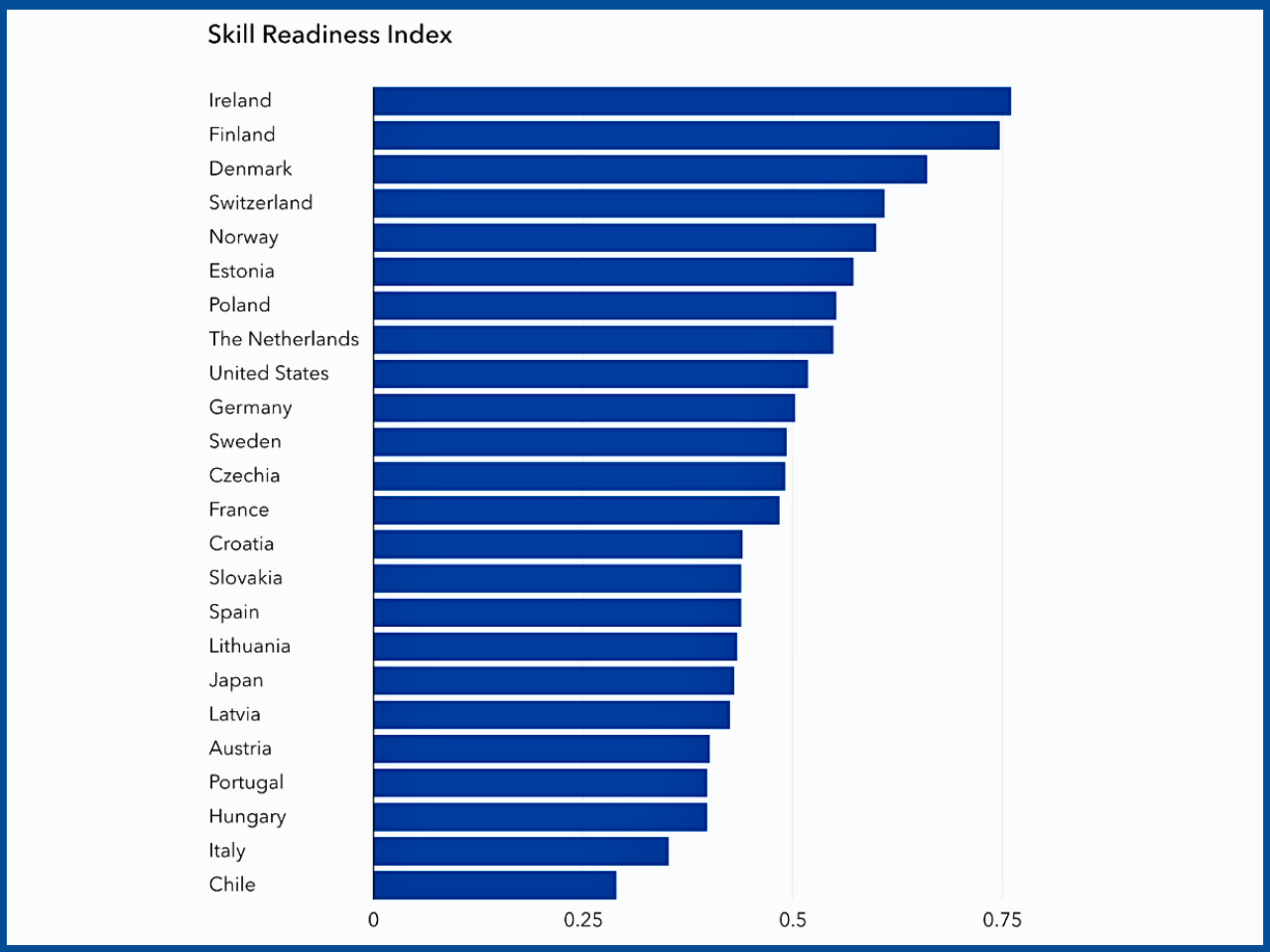

The International Monetary Fund (IMF) has warned that artificial intelligence (AI) is transforming the global labor market, with nearly 40% of workers worldwide vulnerable to job displacement. The study found that approximately 10% of job advertisements in advanced economies require new skills, such as digital literacy and technical skills, while the figure is around 5% in developing countries.

Youth Pulse 2026: The Next Generation of Leaders Reveals Their Priorities for a Changing World

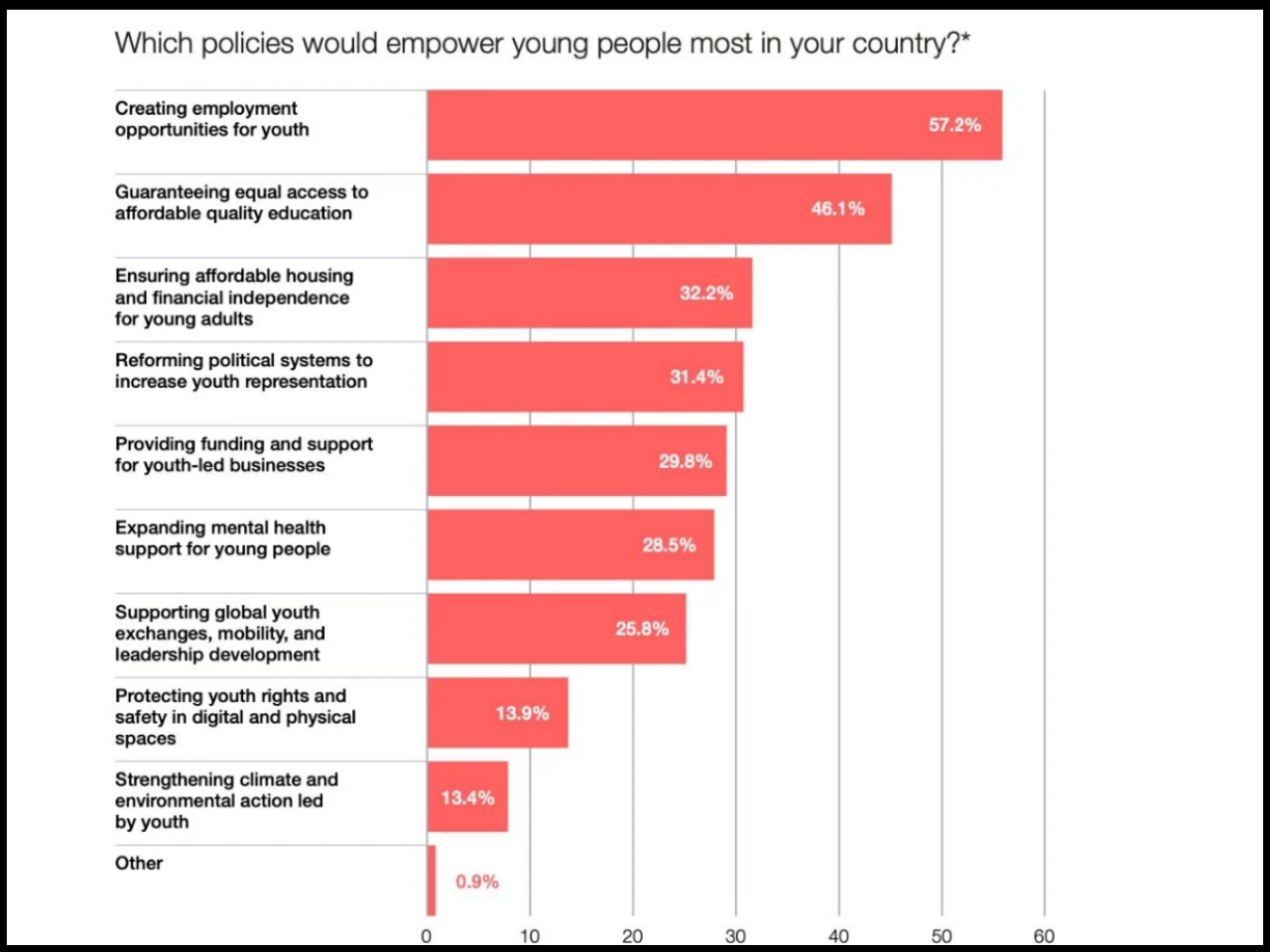

The report is politically against the stereotype of youth apathy. Almost 60% of them claim they use AI regularly, although two-thirds of them express concerns that automation will lead to a shortage of entry-level jobs. Youths require the regulation of ethical AI, more security of data, and access to formal digital skills education.

EU-Mercosur Trade Deal: A Game-Changer or a Threat to European Farmers?

The European Council completed its negotiations with Mercosur (Argentina, Brazil, Paraguay, and Uruguay) for a trade agreement, one of the largest bilateral trading relationships in the world, allowing both geographical areas access to the respective markets of over 700 million consumers, with a current total value of trade in goods being more than €111 billion annually throughout the globe.

Free To Activate Membership