Global Economy in 2026: Navigating Uncertainty and Inequality Amidst Shocks and Challenges

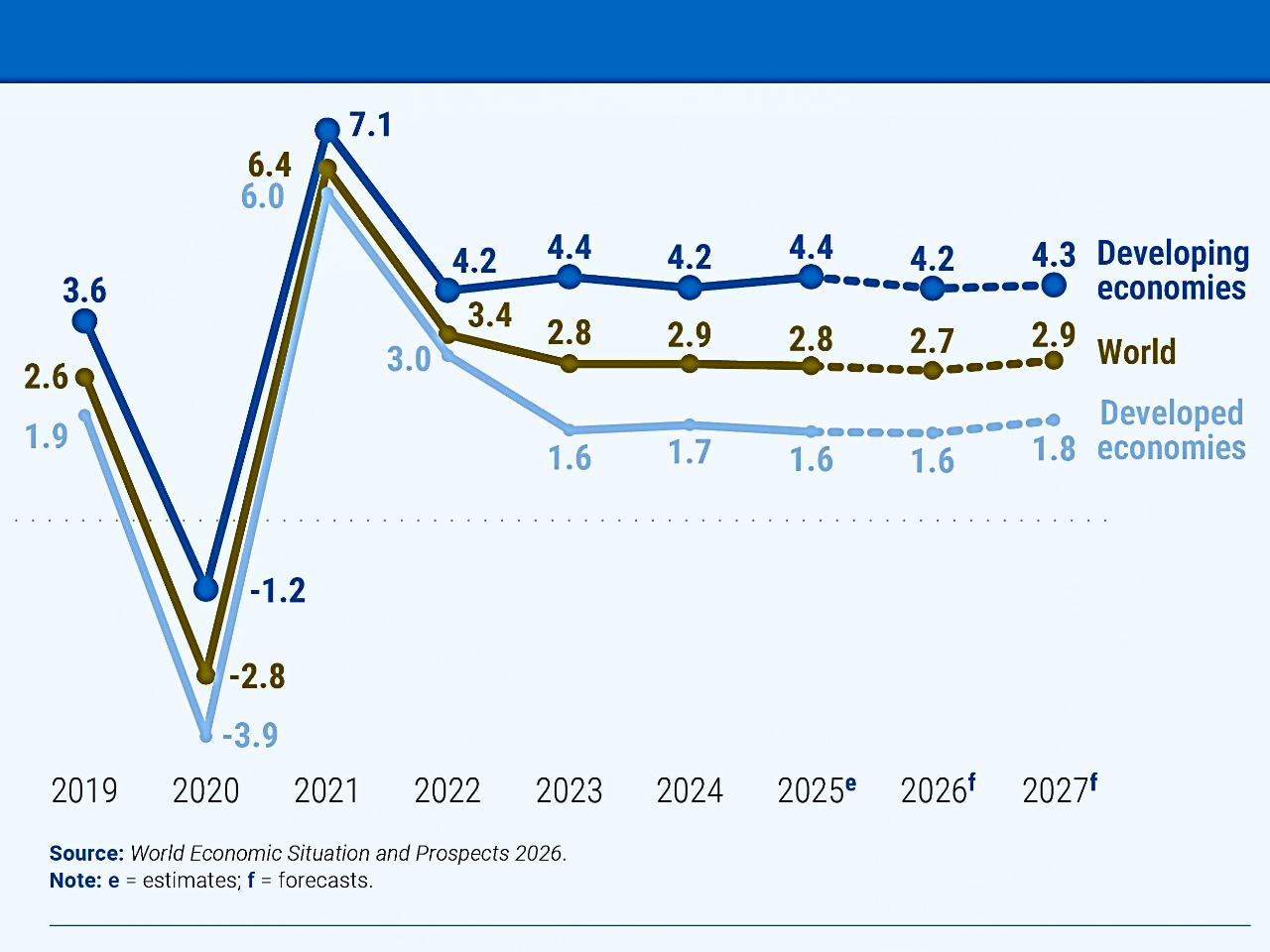

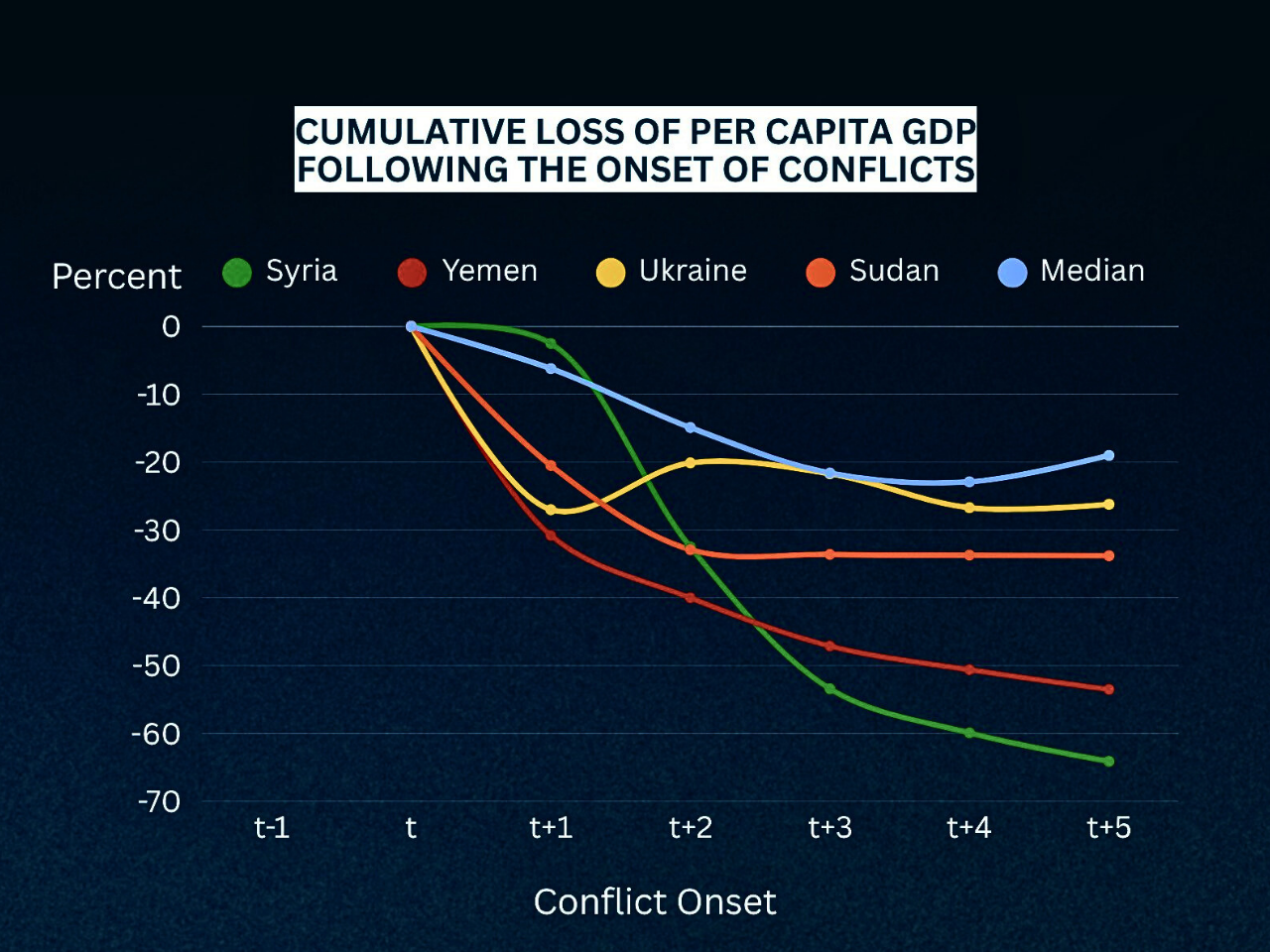

In 2026, the world is facing some of the most important moments in the economic world. Although recent times have been marked by unprecedented shocks (including the COVID-19 crisis, increasing energy costs, wars, and natural disasters), economies continue to show weakness with both low growth and uneven performance around the world. In a report released by the United Nations titled “World Economic Situation and Prospects 2026,” the global economy is continuing to improve; however, improvements will take time to develop. In emerging and vulnerable areas, improvements are likely to take years to arrive because of the numerous obstacles in the way.

The World Bank forecasts that global economic growth will decrease to 2.7% in 2026, which is lower than the growth rates seen before the COVID-19 pandemic. Rising consumer prices force consumers to tighten their belts and impose on themselves. Additionally, trade disruptions created by rising tariffs and geopolitical tensions are causing less trade volume globally and increasing the overall instability of economies. These factors have also generated significant barriers to the implementation of productive multilateral cooperation. The inability of many countries to provide adequate funding for public services due to high national debt levels and a lack of fiscal capacity will also add to a reduced ability to provide a boost for future growth and development.

Growth for advanced economies is projected to be stable at a moderate level. The US will have economic growth propelled by consumer expenditure and technological investment, especially in artificial intelligence and favorable macroeconomic policy decisions. However, risks from continued high-level fiscal deficits are further exacerbated by uncertainty around fiscal policies, and the financial markets remain exposed to volatility.

Due to a continuing reliance on robust labor markets, rising real wages, and consumption levels, the European Union is in a favorable position. On the other hand, due to low consumer confidence and the concomitant decline in external demand for products, Japan is struggling because it is an aging society. Developed countries face low productivity growth due to high energy prices and relatively low rates of innovation. Rising developing countries such as China and India continue to sustain their growth, while many developing nations will be affected by high levels of debt and climate change instability. Because the prices of goods have gone down and central banks around the world are applying tighter financial rules, inflation is predicted to drop back to about 3.4% by 2025. However, it is expected that the ongoing increase in prices will still affect the poorest people the most.

Presently, consumer prices for food, energy, and housing continue to place significant financial burdens on developing countries, whereby they are spending higher percentages of their total income purchasing basic needs. Governments are also feeling the stress of continued inflationary pressure on their budgets as a result of increased cost of public service delivery and social protection, while limiting the space available for productive investment. Global trade continues to demonstrate resilience in 2025 through a period of increased uncertainty in global trade policy and implementation of additional tariffs; a growth in service trades, such as tourism and digital services, helped counterbalance weaknesses in merchandise trade. However, if and when short-term factors dissipate, continued implementation of protectionist policies will likely result in a slowdown in trade growth throughout 2026. As noted, there remains weak investment activity globally, with increased investment occurring in the Global North in artificial intelligence, clean energy, and digital infrastructure, but with the developing world behind; low levels of Foreign Direct Investment (FDI) reflect fragile business confidence and an escalation of geopolitical risk that continue to further limit industrialization and technology transfer to the poorest areas of the Earth.

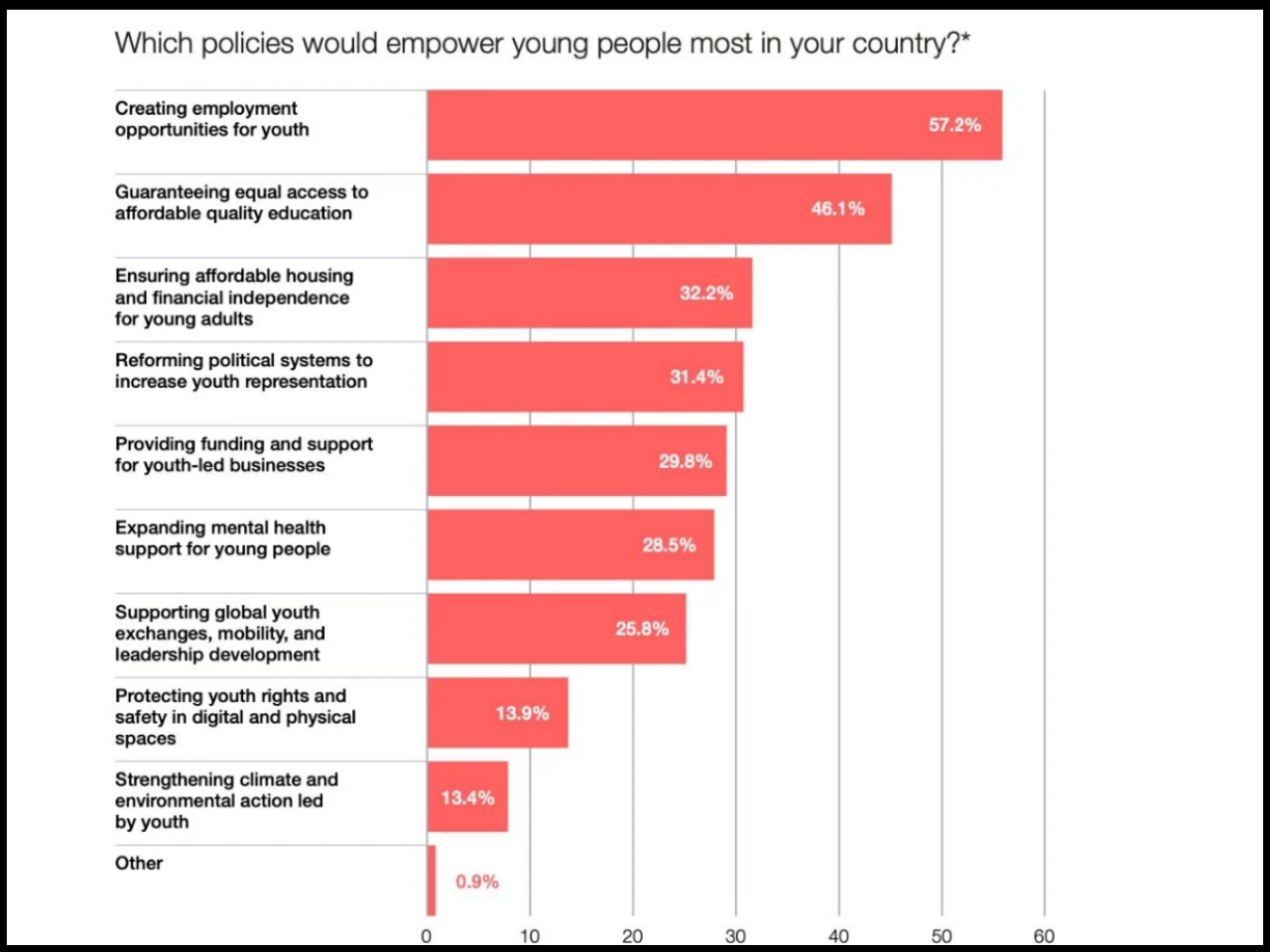

Globally, job markets have remained relatively stable and unchanged with regard to the percentage of unemployed persons; however, there remain underlying structural issues facing the job market. The number of unemployed youths remains significantly high, as millions of young adults are neither working nor enrolled in educational or vocational training programs. In addition, there continues to be a disparity between men and women when comparing the number of men and women employed in the workforce; this disparity is further enhanced for those individuals who are disabled; these individuals may experience many obstacles that would hinder them from obtaining good-paying jobs. Currently, artificial intelligence has been recognized as a changing force that will increase productivity in many areas and profoundly alter job markets. While some early indicators may indicate improvements in productivity within certain business sectors, there are still many unknown aspects of how artificial intelligence will affect the job market as a whole. If strong government policies are not implemented to support the introduction of this technology, countries and workers who have been ill-equipped to use this new technology may suffer from an increase in the disparity between themselves and other countries and workers. Monetary policies have begun to be eased by many central banks, which is supporting economic activity, but because interest rates remain elevated compared to pre-pandemic levels in most economies around the world, policymakers have to find the right balance between maintaining financial stability and controlling inflation. Fiscal conditions are severe due to the rising cost of debt service, increasing demand for expenditures, and decreasing levels of official development aid to countries, all of which create significant restraints on public finances within developing nations. The increase in military spending in many countries has diverted financial resources from health, education, and social assistance programs. This report indicates that weakening multilateralism and fragmentation of the global system of governance are making it impossible for the world to address global challenges with a unified approach. Although recent initiatives emerging from various international bodies indicate that the commitment to provide funding for development assistance, global cooperation on climate change, and global reform of financial institutions will provide some hope for future economic growth.

In order to achieve long-term sustainable growth for all nations, coordinated actions on debt relief, climate funding, trade reform, and technological collaboration will be necessary. For the world’s least developed countries, funding and technology must support the Sustainable Development Goals (SDGs). Addressing all angles of economic sensitivity, inequality, and climate danger will be necessary for integration and international cooperation.

ADVERTISEMENT

Free To Activate Membership