2025 Global Innovation Index: Switzerland Tops Rankings, China Enters Top 10 for First Time

As stated by WIPO’s 2025 Global Innovation Index (GII), Switzerland ranks first and is followed by Sweden, the United States of America, the Republic of Korea, and Singapore. The Netherlands, Denmark, Finland, the United Kingdom, and China (which ranked in the top 10 for the first time) complete the list. The GII uses over 80 factors to assess roughly 140 economies, including high-tech exports, venture capital, R&D levels, and IP registration statistics. Notably, among middle-income economies, many are showing compelling gains. China, India, Turkey, Vietnam, the Philippines, Indonesia, and Morocco are a few examples of economies that are performing better in terms of innovation.Saudi Arabia, Qatar, Brazil, Mauritius, Bahrain, and Jordan are among the countries with highly successful economies.

A noteworthy finding is that investment in innovation is slowing. Global R&D growth is down to 2.9% in 2024 (down from 4.4% the previous year) and the lowest since the 2010 financial crisis and is projected to slow further to 2.3% in 2025. Corporations have also slowed R&D spending. Corporate R&D growth is now 1%, and inflation is a considerable obstacle. Some sectors continue to increase R&D (ICT, software, and pharmaceuticals), while other sectors (manufacturing and consumer goods) have cut back. Venture capital (VC) funding showed some mixed signals: overall deal value increased approximately 7.7% in 2024, largely driven by sizable deals occurring within artificial intelligence (AI) and within the United States, but the number of deals fell approximately 4.4%. Outside the stronger areas of investment focus (information communications technology (ICT) and AI) and regions (the United States), VC investment is retreating.

In terms of additional observations, international patent applications, filed via the World Intellectual Property Organization (WIPO), saw a slight rebound up, approximately 0.5%, led by increases in the Republic of Korea, with declines seen in the United States, Japan, and Germany. Technology continues to make gains with increasingly better battery costs and improvements in supercomputing and genome sequencing, although there are signs of slowing technology adoption; for example, robotics and electrical vehicle adoption, for example, are lagging. Socioeconomic measures are improving, as shown by life expectancy, labor productivity, and poverty.

In looking at the world by regions, we note many economies improved in Southeast/East Asia & Oceania, and India continues to stand out in Central & Southern Asia. Newer signs of innovation momentum are seen in Northern Africa & Western Asia, while we have a number of overperformers in sub-Saharan Africa. Growth is noted in Latin America & the Caribbean; however, we also see imbalances between productivity and consumption (the so-called input-output gap). Northern America and Europe retain many of the highest performers but show some competitiveness challenges.

Latest News

Uniting for a Better Future: UNGA 80 Marks 80 Years of Global Cooperation and Action

High-level government and civil society representatives gather throughout the city every September to work together to address the most pressing problems affecting society worldwide. There is more excitement this year because it is the UN’s 80th session, which is a significant milestone. Thus, there will be opportunities for introspection about the UN, as well as to establish actions for future work

India's Ports and Shipping Industry Set for $82 Billion Investment Boost

India’s ports and shipping industry are changing rapidly, and more than $82 billion in investments are expected in the wake of all the infrastructure projects designed to create greater efficiency and promote economic growth. The economy and processed over 819 million metric tonnes (MMT) of cargo at major Indian ports in FY 2023-24, reflecting the industry’s growing capacity

Global School Meal Programs Soar: 466 Million Children Fed, 80 Million More Than in 2020

The World Food Programme notes that approximately 80 million more children now receive school meals than in 2020, bringing the total to about 466 million, a 20% increase overall. The increase in coverage is strongest at the points of greatest need: low-income countries increased coverage by roughly 60% in two years, and in Africa, there are about 20 million new daily school meals being served

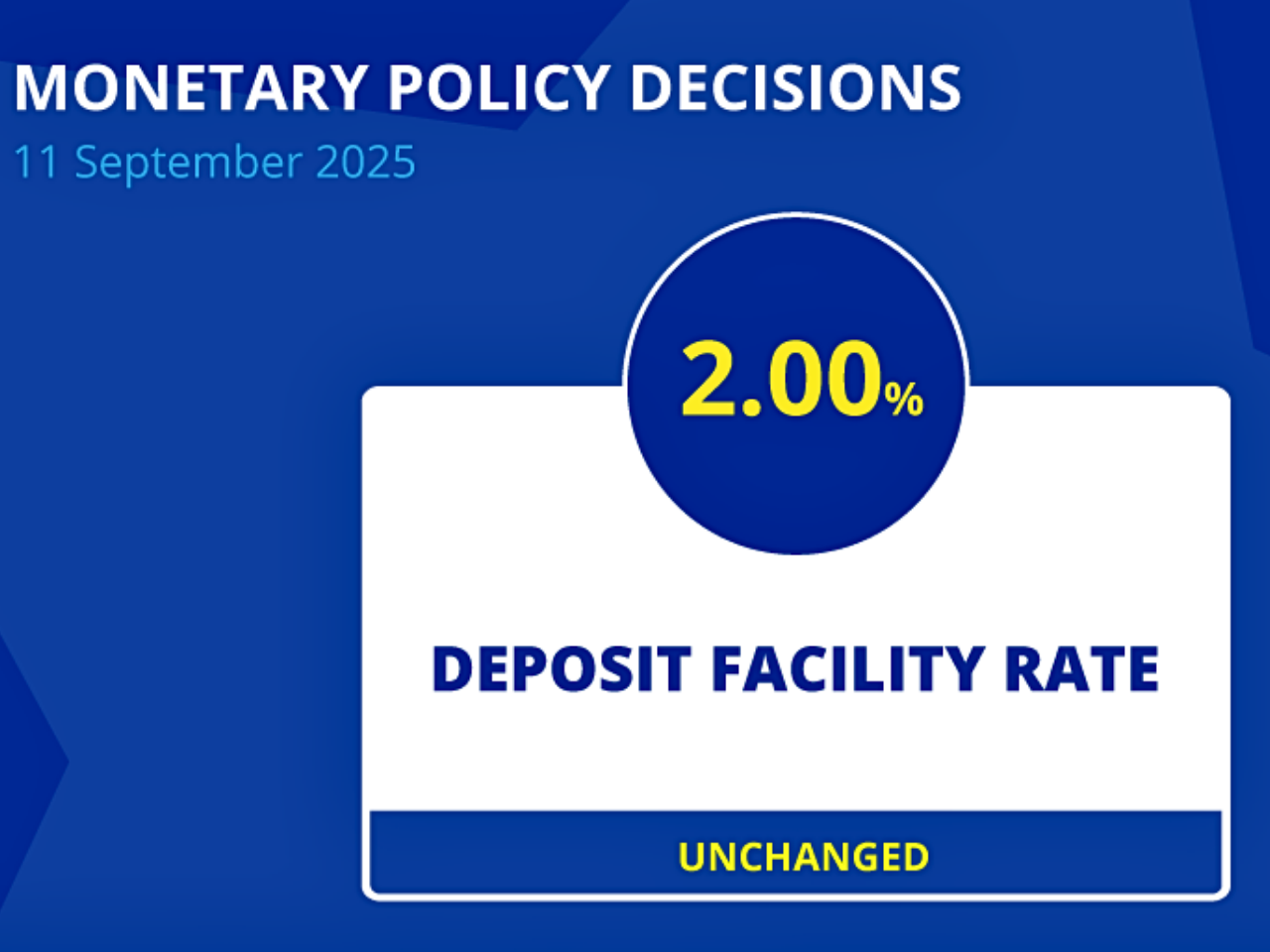

ECB Maintains Interest Rates Amid Stable Inflation and Moderate Growth

The European Central Bank has decided to keep interest rates unchanged, citing stable inflation and moderate economic growth amidst global uncertainty. Financial stability continues to be helpful towards growth. The interest rates by commercial entities are lower, and loans against property are stable, which helps the expansion of credit

India's Economy Shows Resilience and Strong Growth Amid Global Uncertainty

The number of e-bills reached a record level, while the manufacturing PMI reached a 16-month peak, and the services continued to expand, along with the growing trade confidence. The trend of consumption was also healthy; rural demand was buoyed by a favorable monsoon, while urban markets showed strength through high FMCG sales, UPI transactions, and an increase in vehicle purchases

Ireland's Child Poverty Summit Calls for Urgent Action to Address Systemic Barriers

At the Child Poverty and Well-being Summit in Dublin, One Family, an organization that advocates for single-parent families, called on the Irish government to address the structural barriers that keep families trapped in poverty. With Budget 2026 around the corner, the organization stated the government must act quickly in the areas of housing, childcare, and social welfare to tackle reductions in child poverty

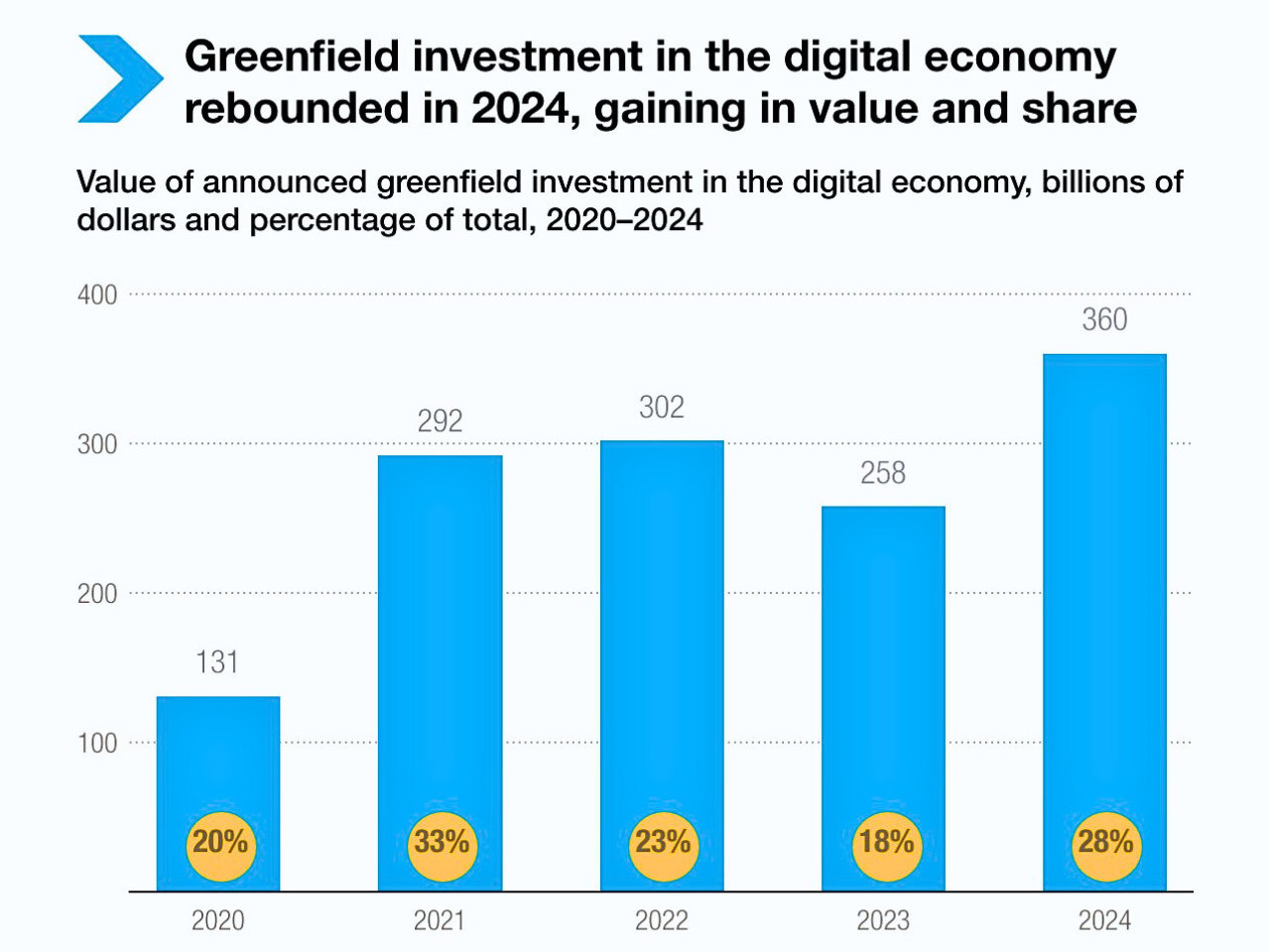

Digital Divide Widens: Developing Countries Left Behind in FDI Surge

The global digital divide will probably be exacerbated by the uneven increase of investment throughout digital development, which will leave many nations missing out on the economic and technological advantages enjoyed by a small number of nations

Global Military Spending Hits Record $2.7 Trillion: A Threat to Peace and Sustainable Development

A $2.7 trillion record for worldwide military expenditure in 2024, pursuant to a ten-year increasing trend, while SDGs strive to gain progress. It was assumed 20% of the Sustainable Development Goals are concentrated in the year 2030, and the yearly financial insecurity will rise up to $6.4 trillion

Bridging the Youth Job Gap: A Call to Action for Governments and Private Sector

Over 1.2 billion youth from emerging economies, or at-risk countries, will be entering the labor market. The situation is a bit dire since estimates say only about 420 million new jobs will be created in that time span. The gap is plainly an opportunity for looking for new solutions that hopefully will create jobs at scale and provide youth with the skills to work in an environment that is rapidly changing

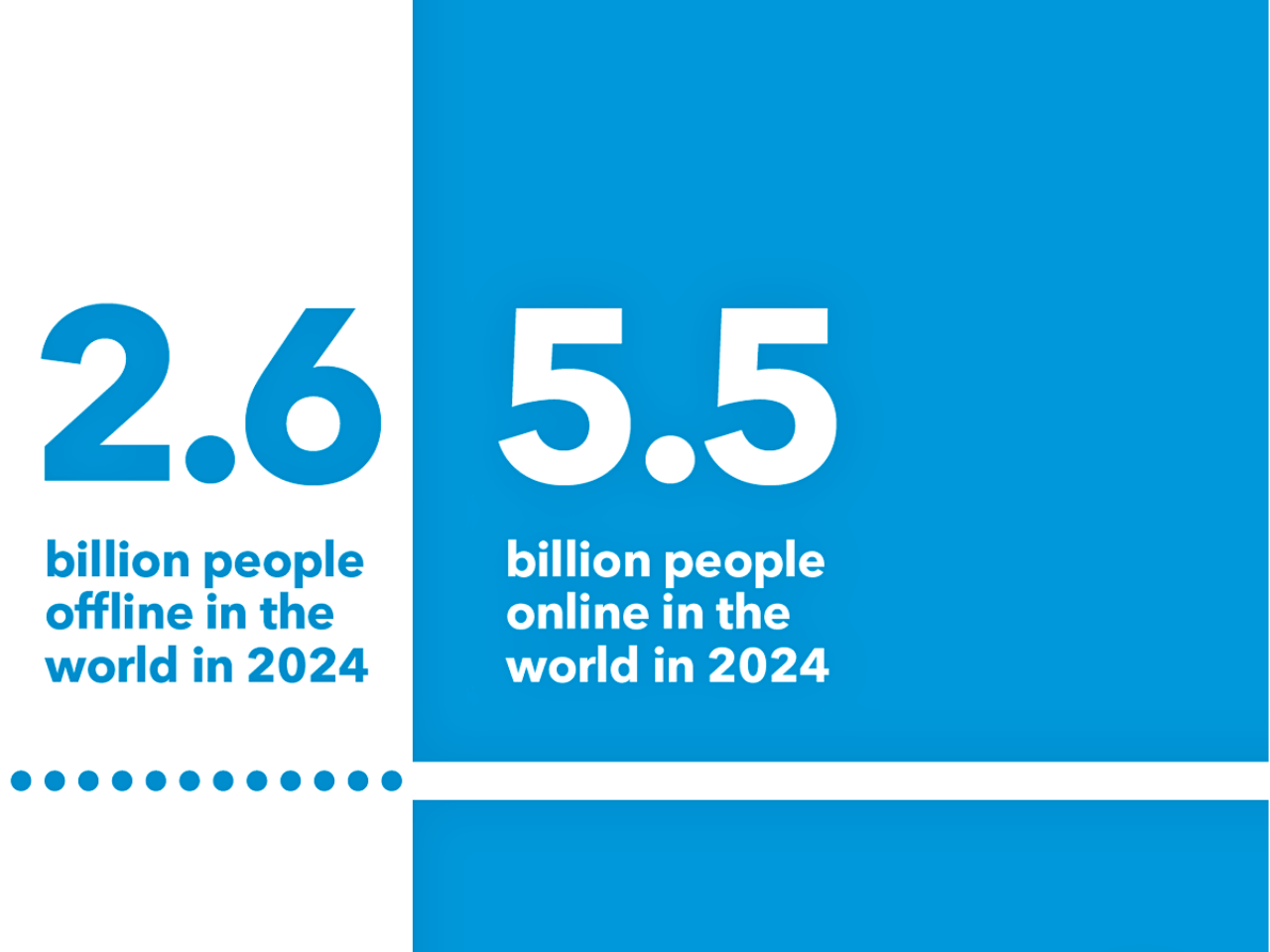

Bridging the Digital Divide: $2.6-2.8 Trillion Needed to Connect 1/3 of Global Population

Saudi Arabia has calculated that it would require between 2.6 and 2.8 trillion dollars to provide internet access to everyone worldwide by 2030, as outlined in the Connecting Humanity Action Blueprint. The report emphasizes the required investment in infrastructure, skills, affordability, and regulatory frameworks if we want to connect the 1/3 of the global population not yet connected to the Internet