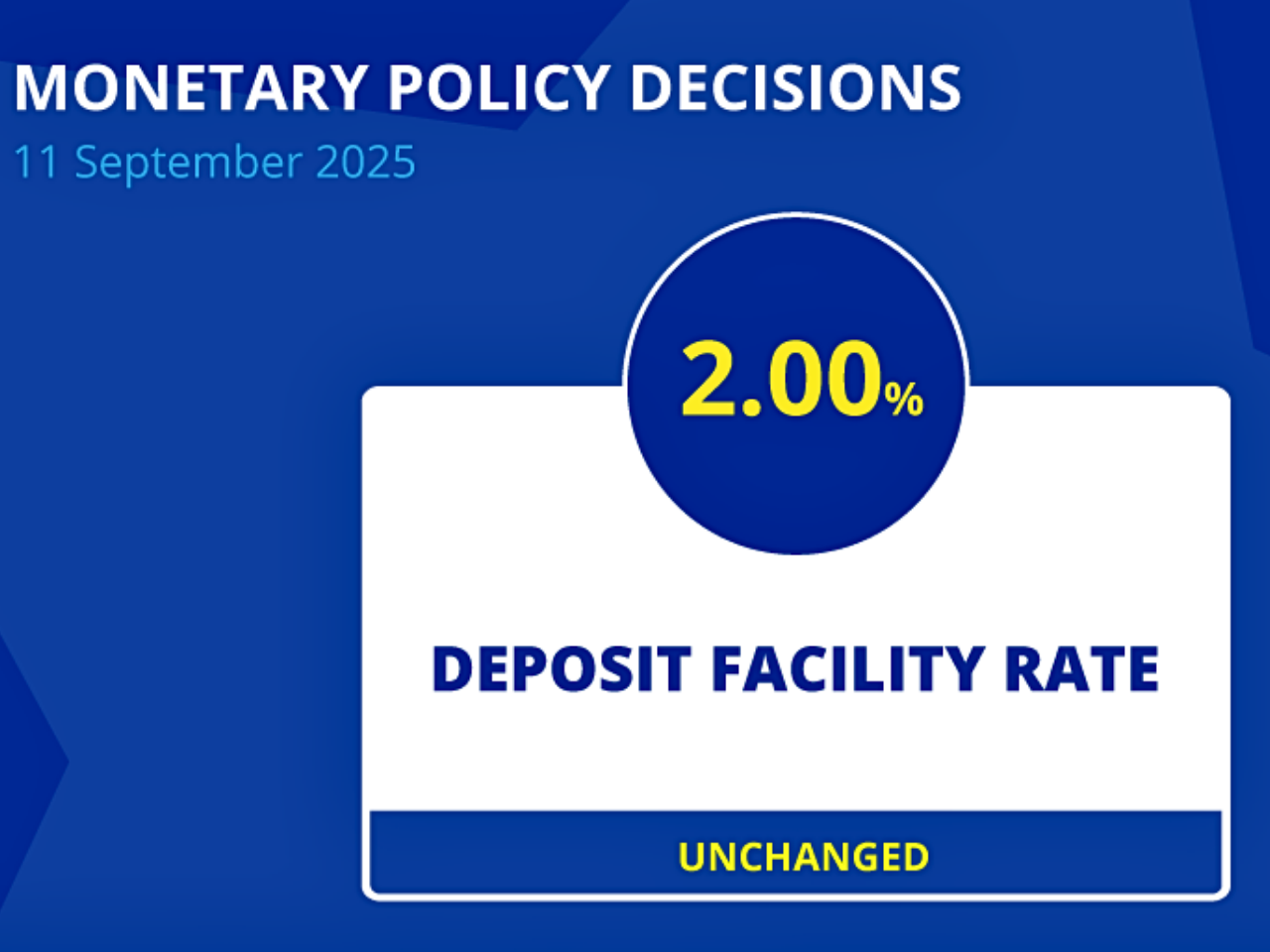

ECB Maintains Interest Rates Amid Stable Inflation and Moderate Growth

The European Central Bank (ECB) once again decided that these three ECB-rated interest rates will remain at 2 percent for the deposit facility, at 2.15 percent for the main refinancing facility, and at 2.40 percent for the marginal lending facility. Inflation currently stands around the 2 percent medium-term target, with forecasts being largely aligned with the previous estimates. In the present year the expected inflation rate is expected to be 2.1%, and in 2026 it will be 1.7%, in 2027 it will slightly rise up to 1.9%. Not including food and energy, the inflation rate expected in 2025 is 2.4%, which will decline to 1.8% in 2027. The growth outlook for this year is at 1.2 percent, somewhat enhanced from the previous estimate, in the next year, growth will stabilize at 1.0 percent before increasing to 1.3 percent in 2027.

The ECB reiterated its dedication to keeping inflation on its medium-term path at 2% and opted for data and risk dependence rather than an explicit rate path. The asset purchase programs (APP and PEPP) are continuing to decline as reinvestment was discontinued. The performance of the economy in the first half of 2025 was moderate, with growth underpinned by domestic demand and supply and sustained consumer welfare (with unemployment at 6.2%).Although the economy faces tariff imposition to stave off internal deflation as global economic concerns, international competitions, and increasing euro value alllead to unwinding activity to decline.

Macroeconomic and structural adjustments are important to retain and enhance competitiveness, the demand for the supply of services comes up on infrastructure expenditure, defense, and growing digitalization. The general risk level stays steady and equitable but is affected by other worldwide trade disputes and geopolitical conflicts towards climate change conditions; this could affect the growth and inflation trends. Financial stability continues to be helpful towards growth. The interest rates by commercial entities are lower, and loans against property are stable, which helps the expansion of credit. In that regard, the ECB confirmed its commitment to the proactive approach of using its tools to maintain stability and ground monetary policy within its borders to ensure proper transmission.

Latest News

India's Economy Shows Resilience and Strong Growth Amid Global Uncertainty

The number of e-bills reached a record level, while the manufacturing PMI reached a 16-month peak, and the services continued to expand, along with the growing trade confidence. The trend of consumption was also healthy; rural demand was buoyed by a favorable monsoon, while urban markets showed strength through high FMCG sales, UPI transactions, and an increase in vehicle purchases

Ireland's Child Poverty Summit Calls for Urgent Action to Address Systemic Barriers

At the Child Poverty and Well-being Summit in Dublin, One Family, an organization that advocates for single-parent families, called on the Irish government to address the structural barriers that keep families trapped in poverty. With Budget 2026 around the corner, the organization stated the government must act quickly in the areas of housing, childcare, and social welfare to tackle reductions in child poverty

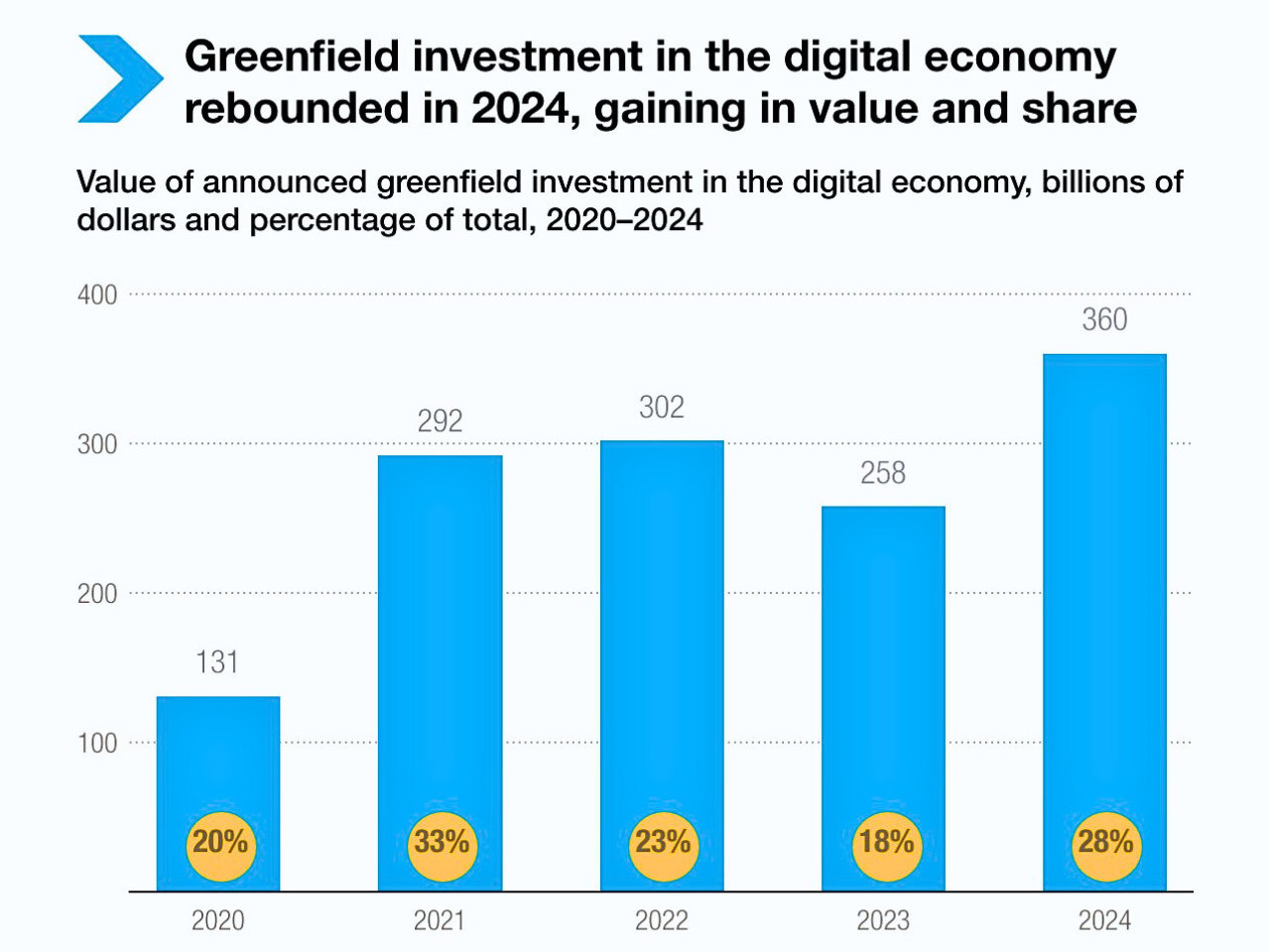

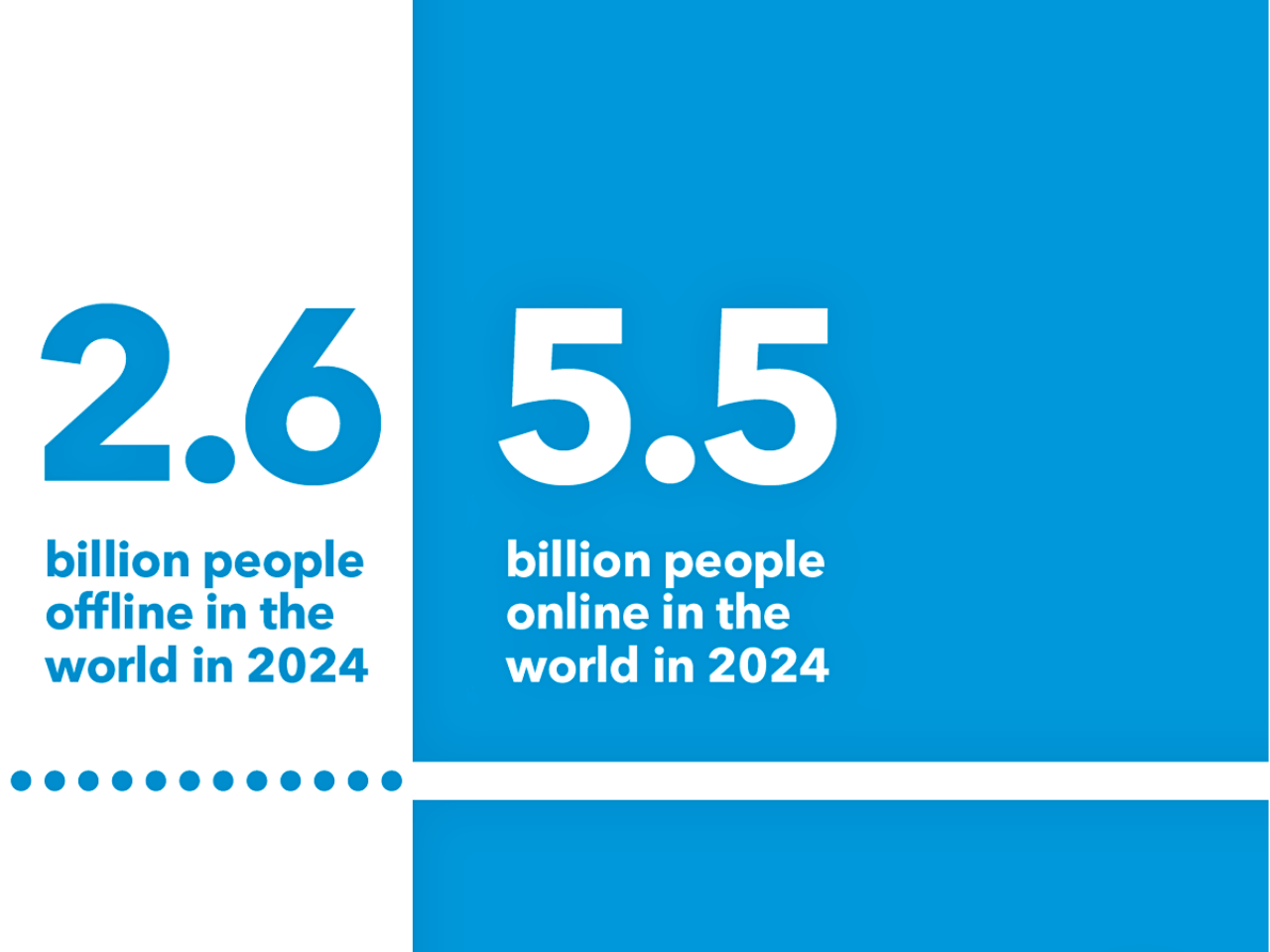

Digital Divide Widens: Developing Countries Left Behind in FDI Surge

The global digital divide will probably be exacerbated by the uneven increase of investment throughout digital development, which will leave many nations missing out on the economic and technological advantages enjoyed by a small number of nations

Global Military Spending Hits Record $2.7 Trillion: A Threat to Peace and Sustainable Development

A $2.7 trillion record for worldwide military expenditure in 2024, pursuant to a ten-year increasing trend, while SDGs strive to gain progress. It was assumed 20% of the Sustainable Development Goals are concentrated in the year 2030, and the yearly financial insecurity will rise up to $6.4 trillion

Bridging the Youth Job Gap: A Call to Action for Governments and Private Sector

Over 1.2 billion youth from emerging economies, or at-risk countries, will be entering the labor market. The situation is a bit dire since estimates say only about 420 million new jobs will be created in that time span. The gap is plainly an opportunity for looking for new solutions that hopefully will create jobs at scale and provide youth with the skills to work in an environment that is rapidly changing

Bridging the Digital Divide: $2.6-2.8 Trillion Needed to Connect 1/3 of Global Population

Saudi Arabia has calculated that it would require between 2.6 and 2.8 trillion dollars to provide internet access to everyone worldwide by 2030, as outlined in the Connecting Humanity Action Blueprint. The report emphasizes the required investment in infrastructure, skills, affordability, and regulatory frameworks if we want to connect the 1/3 of the global population not yet connected to the Internet

£8 Million Boost for Welsh Arts: 40 Organizations Receive Funding for Cultural Growth

Investment in theaters, galleries, cinemas, and art-based community centers by the government will ensure institutional development and generate interest among future generations by enjoying Welsh culture, heritage, literature, and language. This would be their part of economic growth from art sectors, will generate employment, and will generate income for local businesses

IFC Makes Historic $20 Million Investment in Bhutan's Power Sector for Enhanced Electricity Reliability

This financing, with the support of the Private Sector Window of the International Development Association, will bring Bhutan its first Bhutanese Ngultrum (BTN)-linked loan, create IFC’s first infrastructure investment in Bhutan, and be the first investment in the power distribution sector in Asia by a state-owned enterprise

1 Billion People Suffering: Global Mental Health Crisis Demands Urgent Action

In high-resource countries, spending on mental health can be as high as US$65 per person and can be an extremely low US$0.04 in low-resource settings. Globally, the number of 33 mental health workers per 1,00,000 of population shows that they are from developing areas. In regard to service delivery, there still remains a very low percentage of countries (fewer than 10%) that have completely transitioned to care based on communities