Digital Divide Widens: Developing Countries Left Behind in FDI Surge

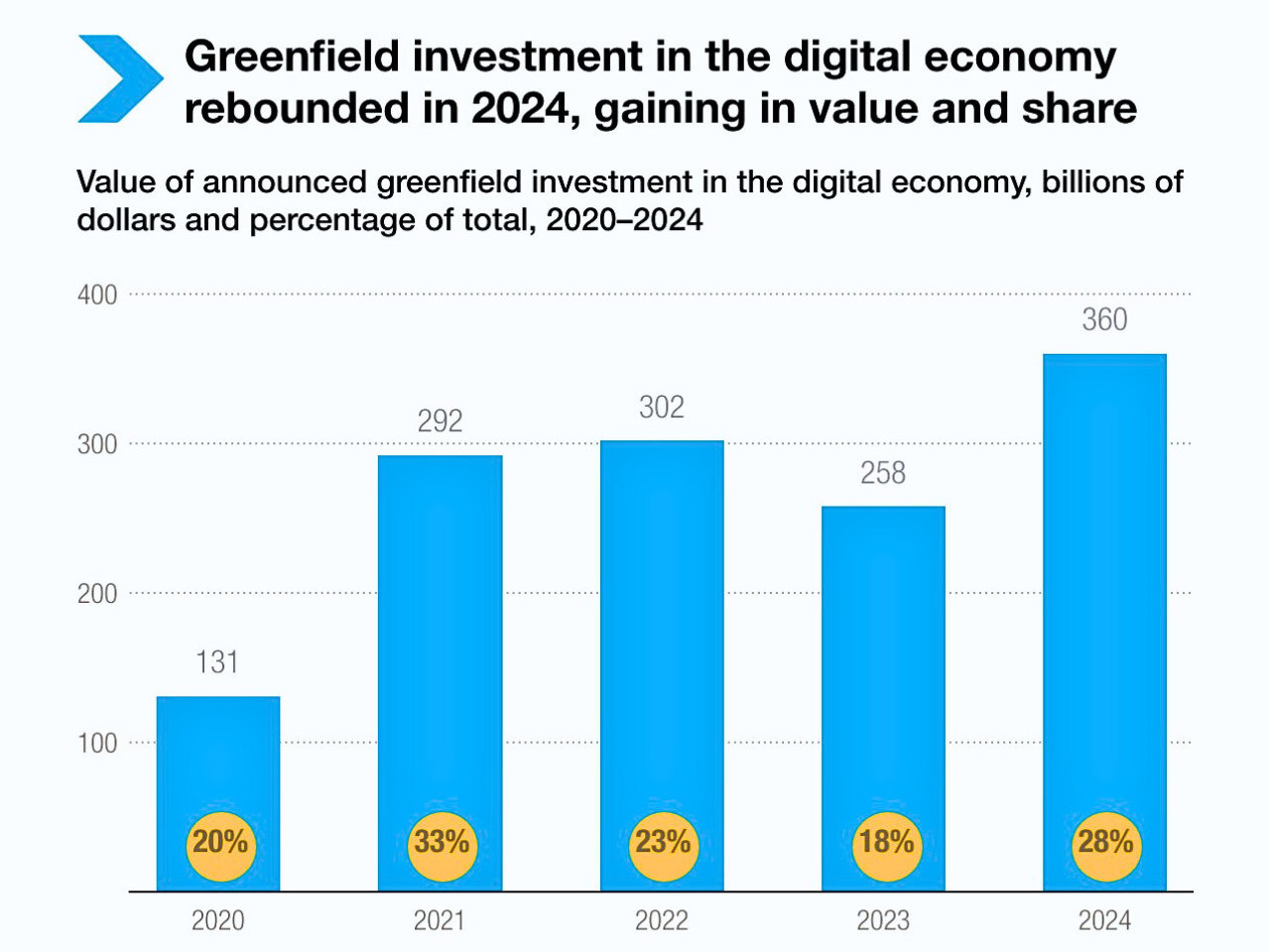

Foreign direct investment (FDI) in the digital economy globally has increased from 5.5% of total FDI to 8.3%. The average annual FDI in the digital economy between 2021 and 2023 was $122 billion. However, FDI has not been distributed equally, with developing countries and least developed countries (LDCs) receiving a negligible share. More than one-third of greenfield projects go to developing countries, even though foreign direct investment in the digital economy has almost doubled. Within the Global South, 80% of all digital projects are concentrated in just 10 economies, mostly in Asia, while poorer countries are largely excluded.

More than $6 billion has been invested in digital services and solutions between 2020 and 2024, but essential digital infrastructure remains underfunded. Developing countries only received $9 billion in 2024, less than $1 billion worth of investments per month, against the $62 billion needed annually just to catch up with infrastructure growth.

Fintech and data centers dominate the sectoral investment. Projects are concentrated in Asia and Latin America. For example, in 2024, there were 206 fintech ventures in developing economies in Asia, compared to just 18 in Africa. Additionally, only 3% of all reported data center investments went to Asia.

National digital strategies have been produced in the great majority of developing (86%) and least developed (80%) countries, but only 20% of them connect with investment promotion agencies (IPAs). Additionally, legal frameworks (such as those pertaining to data governance, intellectual property, and competition) are inadequate, particularly in LDCs, which further restricts their ability to draw in and hold on to investment. The global digital divide will probably be exacerbated by the uneven increase of investment throughout digital development, which will leave many nations missing out on the economic and technological advantages enjoyed by a small number of nations.

Latest News

Global Military Spending Hits Record $2.7 Trillion: A Threat to Peace and Sustainable Development

A $2.7 trillion record for worldwide military expenditure in 2024, pursuant to a ten-year increasing trend, while SDGs strive to gain progress. It was assumed 20% of the Sustainable Development Goals are concentrated in the year 2030, and the yearly financial insecurity will rise up to $6.4 trillion

Bridging the Youth Job Gap: A Call to Action for Governments and Private Sector

over 1.2 billion youth from emerging economies, or at-risk countries, will be entering the labor market. The situation is a bit dire since estimates say only about 420 million new jobs will be created in that time span. The gap is plainly an opportunity for looking for new solutions that hopefully will create jobs at scale and provide youth with the skills to work in an environment that is rapidly changing

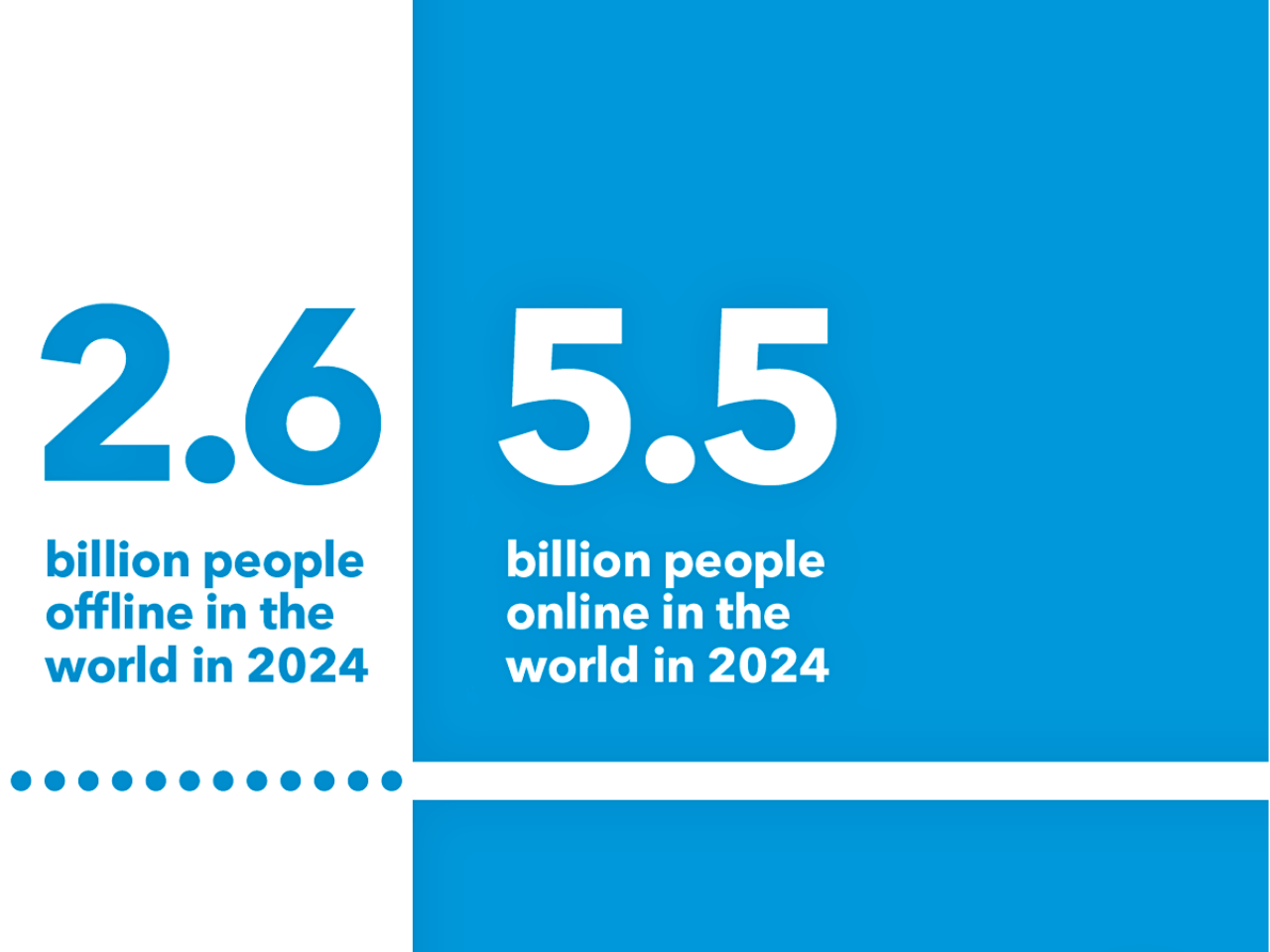

Bridging the Digital Divide: $2.6-2.8 Trillion Needed to Connect 1/3 of Global Population

Saudi Arabia has calculated that it would require between 2.6 and 2.8 trillion dollars to provide internet access to everyone worldwide by 2030, as outlined in the Connecting Humanity Action Blueprint. The report emphasizes the required investment in infrastructure, skills, affordability, and regulatory frameworks if we want to connect the 1/3 of the global population not yet connected to the Internet

£8 Million Boost for Welsh Arts: 40 Organizations Receive Funding for Cultural Growth

Investment in theaters, galleries, cinemas, and art-based community centers by the government will ensure institutional development and generate interest among future generations by enjoying Welsh culture, heritage, literature, and language. This would be their part of economic growth from art sectors, will generate employment, and will generate income for local businesses

IFC Makes Historic $20 Million Investment in Bhutan's Power Sector for Enhanced Electricity Reliability

This financing, with the support of the Private Sector Window of the International Development Association, will bring Bhutan its first Bhutanese Ngultrum (BTN)-linked loan, create IFC’s first infrastructure investment in Bhutan, and be the first investment in the power distribution sector in Asia by a state-owned enterprise

1 Billion People Suffering: Global Mental Health Crisis Demands Urgent Action

In high-resource countries, spending on mental health can be as high as US$65 per person and can be an extremely low US$0.04 in low-resource settings. Globally, the number of 33 mental health workers per 1,00,000 of population shows that they are from developing areas. In regard to service delivery, there still remains a very low percentage of countries (fewer than 10%) that have completely transitioned to care based on communities

Ireland's Well-being Report Highlights Progress and Persistent Challenges

The 2025 report analyzes 35 indicators in 11 dimensions. The indicators show significant advancements and difficulties but do not fully capture Irish life. Ireland has experienced advancements in a variety of areas over the past five years. Stronger government finances improved access to increased income and wealth, as well as less loneliness and increased social ties and participation

Poland’s Defense-Led Growth Strategy: Highest NATO Defense Share and Its Economic Trade-offs

The national security establishment in the amount dedicated to defense spending (4.8 percent of GDP). At about 200 billion zloty (about US$55 billion) in defense spending, it will be the highest level of spending associated with NATO's event, less than their goal of two percent of GDP

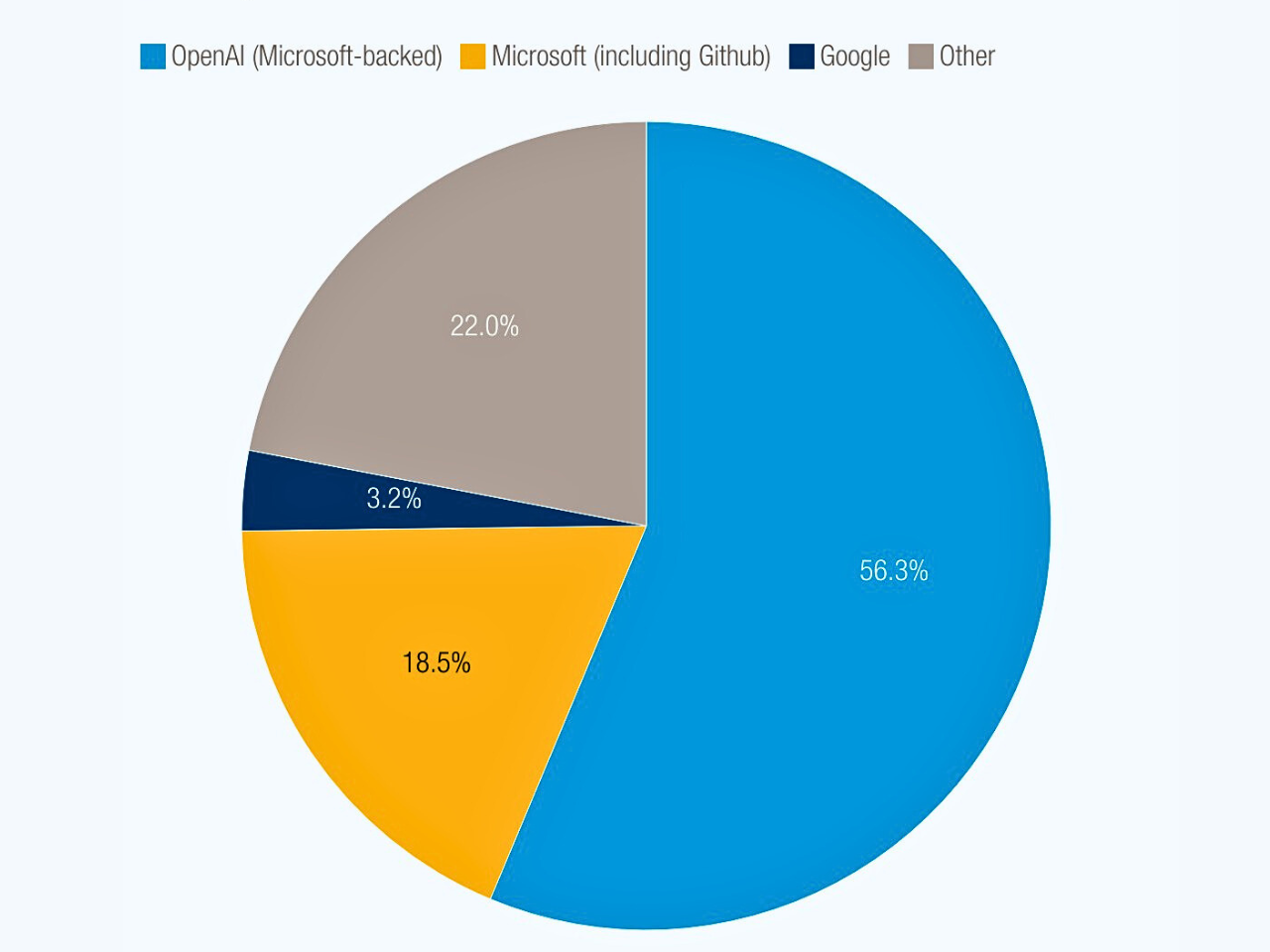

Digital Giants Dominate Global Markets: 7 Companies Control Nearly 50% of Digital Space

The UN Trade and Development (UNCTAD) Global Trade Update, released 8 July 2025, emphasizes today that seven global companies out of ten have now become digital giants across sectors (cloud, e-commerce, AI, and digital advertising). In 2017 their combined share was 21%, and by 2025 it had increased to 48%