The Gathering Storm: How Trump's Tariffs Forged BRICS Unity

In a world long dominated by the financial tides of the US dollar, a new story is unfolding, driven not by a grand, planned design but by an unexpected external force: the tariff policies of Donald Trump. His administration, in a bid to reassert American primacy and punish what it calls "anti-American policies," unleashed a wave of tariffs that has had a dramatic, and perhaps unintended, consequence—uniting the BRICS nations in a way they never were before.

The narrative begins with a series of blows. Trump's renewed presidency saw him sign an executive order in early 2025, first imposing tariffs on imports from China, then escalating to a "universal" tariff on nearly all imports. But the most pointed attacks were reserved for the BRICS bloc and their partners. India, a nation once seen as a close US ally, was suddenly hit with a steep 50% tariff on its goods, a move justified by New Delhi’s continued import of Russian oil. Brazil faced a similar 50% levy, while China, the initial target, saw its tariffs soar to a staggering 145% at their peak. Even the smaller members of BRICS+ alliance did not go unharmed as South Africa was subjected to 30 percent tariffs and Indonesia, Iran, Egypt, Ethiopia, and the UAE were all levied with 10-19 percent duties.

This was not a mere trade quarrel, but a wakeup call. The previously divided members of the BRICS bloc, a group that is frequently criticized because of its lack of unity, have managed to have a common complaint. The images of these tariffs, with their stark numbers, became a shared symbol of a perceived US financial weaponization. According to the Chinese Ambassador Xu Feihong, who was keen to add, give the bully an inch, he will take a mile, which resonated throughout the bloc.

It is upon this common difficulty that a fresh plot now started to develop, that of strategic consolidation and support. The first act was a quiet but powerful rebellion against the US dollar's dominance. Across the bloc, from the Russian-Chinese border to the bustling ports of Brazil and India, there was a concerted push to conduct bilateral trade in national currencies. Russia and China, which are already becoming more economically interdependent, had over 90 percent of their bilateral trade settled in yuan and rubles, which is an epic achievement not to use the dollar. This de-dollarization initiative was further supported by a rapidly increasing purchase of gold by BRICS central banks, a time-honored technique of diversifying and insuring against financial instability as well as US sanctions.

The second act saw a remarkable strengthening of diplomatic and economic bonds. For Brazil, the US tariffs became an unexpected opportunity. As Chinese importers shifted from American soybeans to Brazilian ones, Brazil's economy benefited directly. President Lula da Silva, refusing to "humiliate" himself by negotiating with Trump, instead turned to his BRICS partners. The result was a new agreement with India to boost their bilateral trade to $20 billion over the next five years, with a specific focus on defence, AI, and the adoption of India’s UPI payment system in Brazil. Another important subplot was the way that Russia assumed a new role of a diplomatic catalyst. Upon realizing that there were smouldering tensions between China and India, the Kremlin advocated the three-way dialogue aimed at reinforcing the backbone of the alliance. This attempt at suppression of historical antagonism was the direct reply to the mutual pressure of the US that demonstrated how common danger could suppress antipathies of the past.

The climax of the storyline is yet to be penned but the course is evident. Instead of isolating them, Trump has provided the BRICS countries with a strong reason to form a unification through his tariffs. What they have ended up with is a stronger, more integrated and self contained bloc that is actively defining the new world order. They are not merely responding to a bully but instead they are creating a new order, an order founded on mutual economic interests, on closer diplomatic relations and on a common drive toward more multipolar world, where the US dollar no longer has the last word.

Avichal Sharma, Assistant Professor – Economics, Christ University Pune-Lavasa

Latest Explained

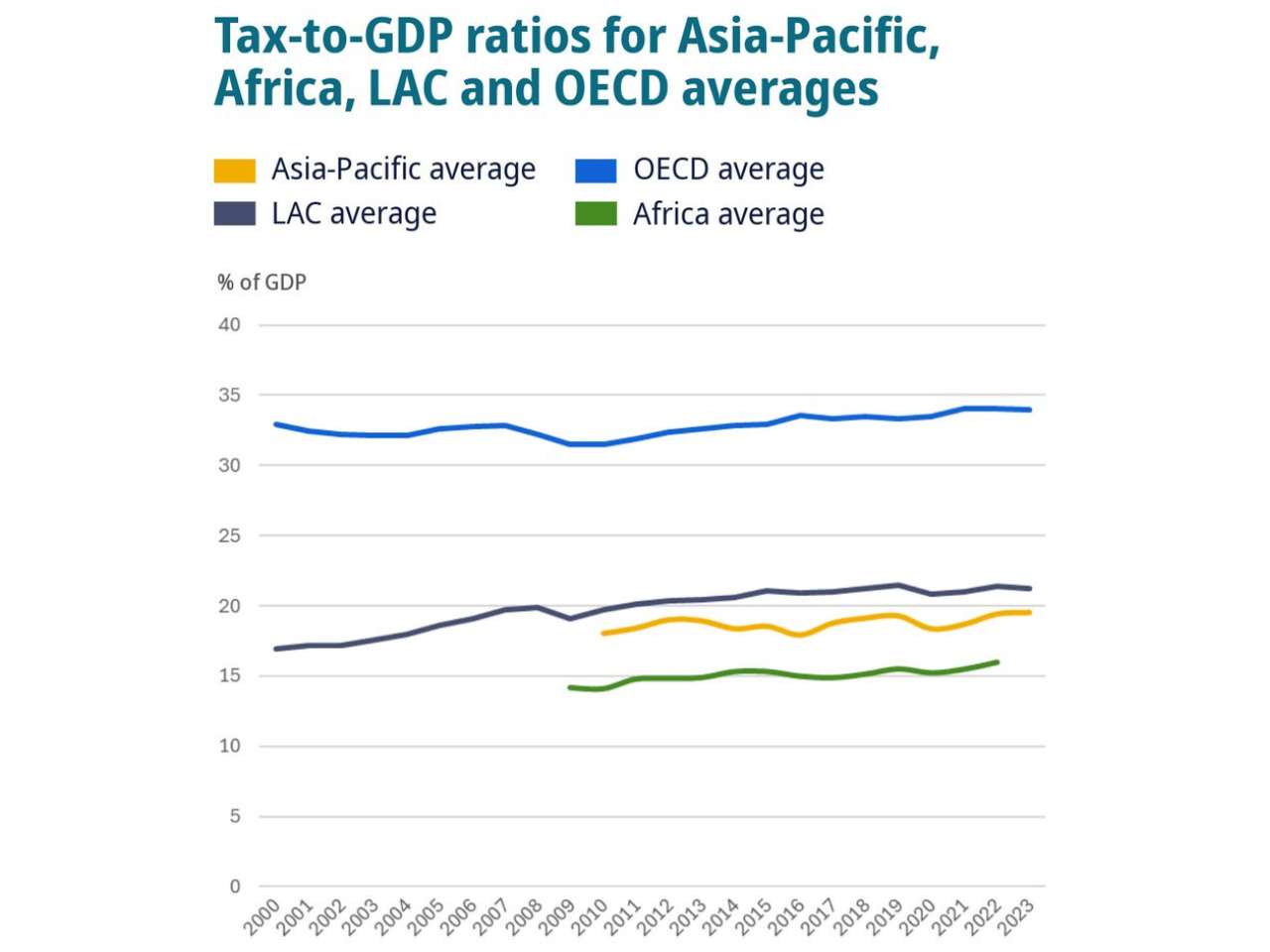

Asia-Pacific Tax Trends: Revenue Statistics 2025 Reveals Insights into Public Finances

Over the long term, or between 2010 and 2023, tax-to-GDP ratios increased in 22 economies and reduced in 15 others. The Maldives, Niue, Nauru, Japan, Cambodia, and Korea saw some of the largest improvements. Some of the increases can be attributed to tax reforms and recoveries from economic crises in Japan and Korea. In the long term, the greatest decreases occurred in Timor-Leste, Kazakhstan, China, the Marshall Islands, and Vietnam; this was due to a sudden decline in global commodity prices, which reduced fiscal revenue in these commodity-dependent economies

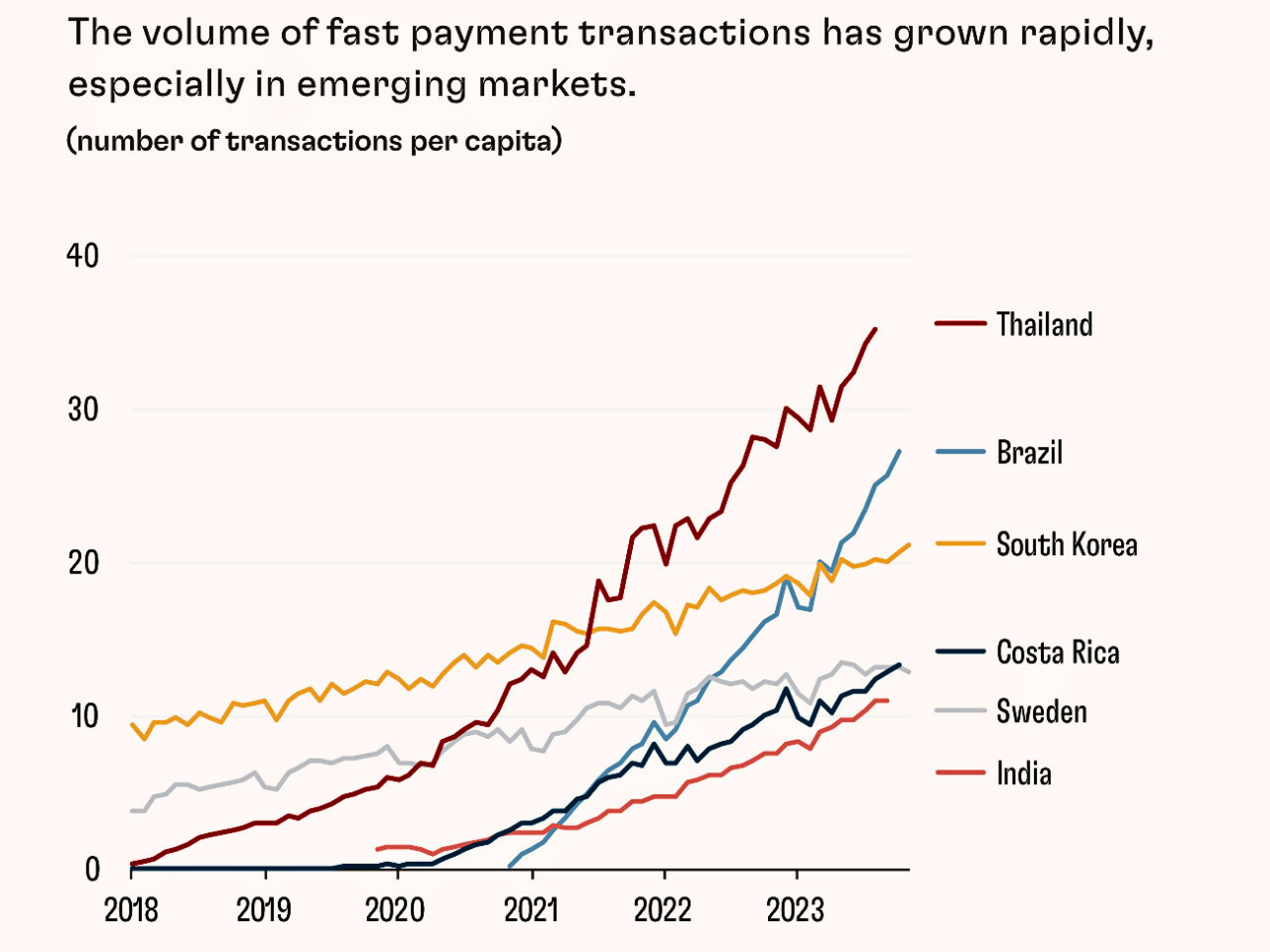

The Future of Finance: How Fintech and Public-Private Partnerships Are Revolutionizing Payments, Credit, and Investment

Brazil's Pix was launched in 2020 by the central bank and has just recently reached over 90 percent of the adult population using it regularly for their everyday purchases. India's Unified Payments Interface (UPI) is a single platform connecting banks, fintechs, and tech firms with the oversight of the central bank. In the United States, Venmo and Zelle still remain largely incompatible. In China, Alipay and WeChat Pay were initially both stand-alone platforms. In Peru, similar to China, having Yape and Plin as competing systems caused comparable challenges.

Food Safety: The Key to Unlocking Africa's Agricultural Potential and Economic Growth

which has generated $600 million in additional investment and $700 million in additional sales. This has been done with Government of Canada funding through the Facility for Resilient Food Systems (FRFS), which supports food safety as well as food loss, waste reduction, and food supply chain efficiencies

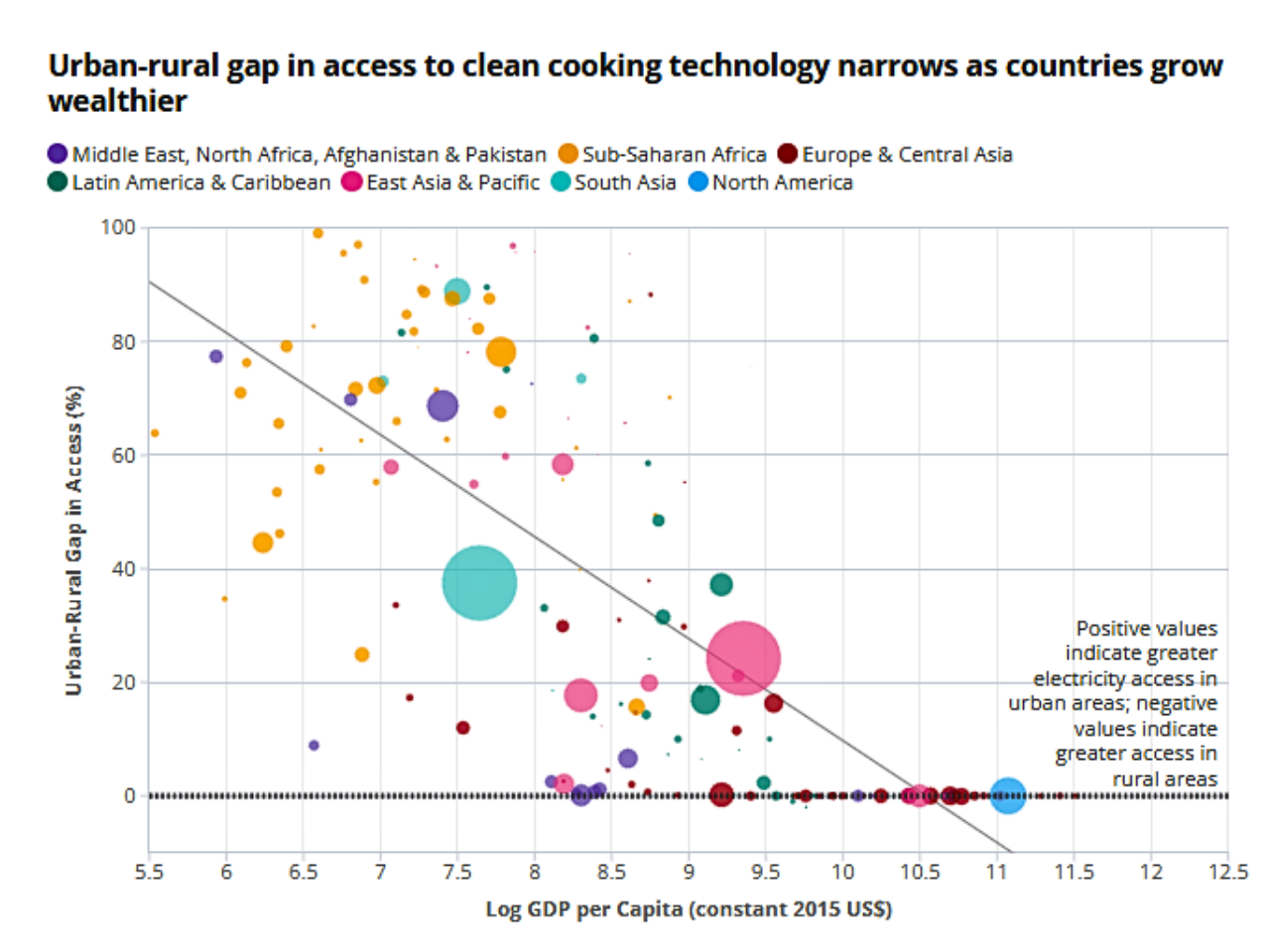

Rural Areas Left Behind: 44% of World Lives Without Access to Basic Necessities

Over the last sixty years, the world has encountered dramatic demographic change. Since 1960, the percentage of people living in rural areas has steadily declined due to the expansion of cities and the overall advance and speed of urbanization globally. In 2008, the majority of the world lived in rural areas while they maintained their lives, but without warning, worldwide populated urban areas dramatically increased their majority share

Philippines' Aging Population Set to Double by 2050: Can the Country Keep Pace?

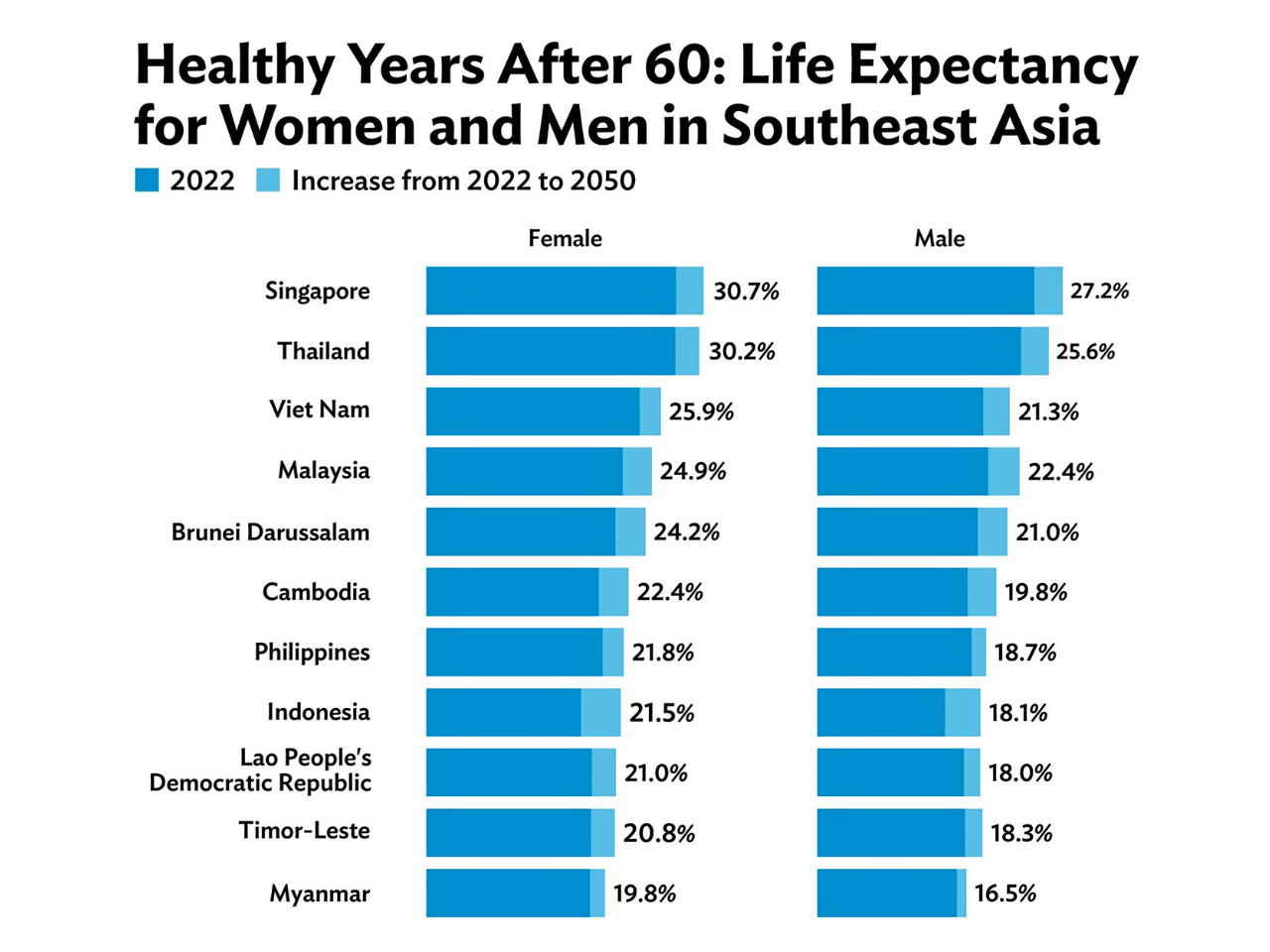

The Philippines is in demand for a demographic change that will reopen the priorities of its economy, society, and public policy. The number of old Filipinos is expected to double by the year 2050, which creates pressure on the nation’s health care systems, elderly care services, and pension schemes

Climate Change Threatens Global Health & Poverty: Urgent Action Needed

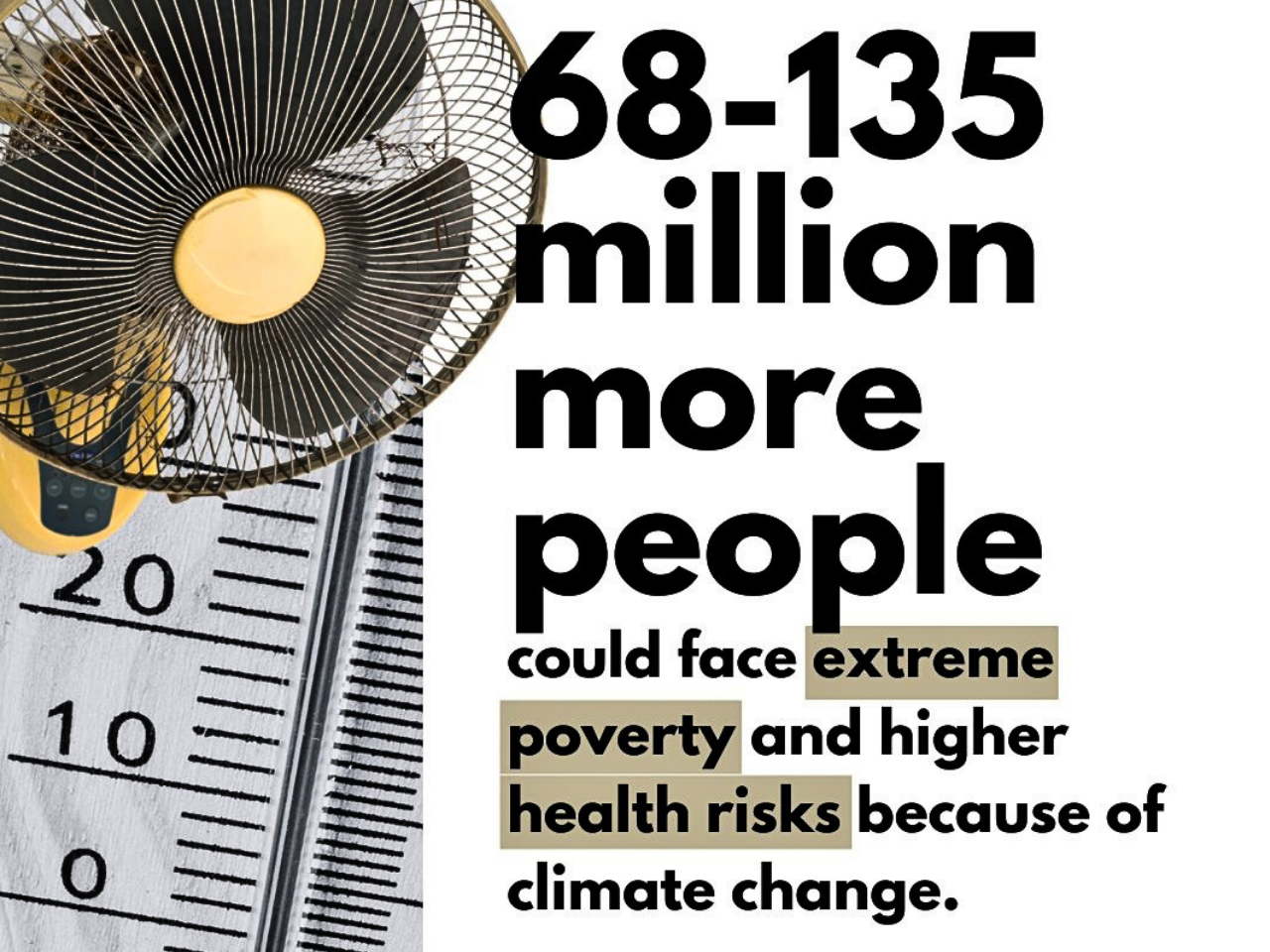

Climate issues such as heat stress, diarrhea, malaria, and hunger can cause 250,000 deaths a year between 2030 and 2050, which challenges an important frame of adaptation. The fee, including only health systems and other areas such as agriculture and hygiene, is expected to reach USD $2 to 4 billion annually by 2030. The countries most at risk will be those that are developing countries, as they will have further weakened health systems

World Bank Warns of Stunted Global Growth: 2.3% Forecast for 2025

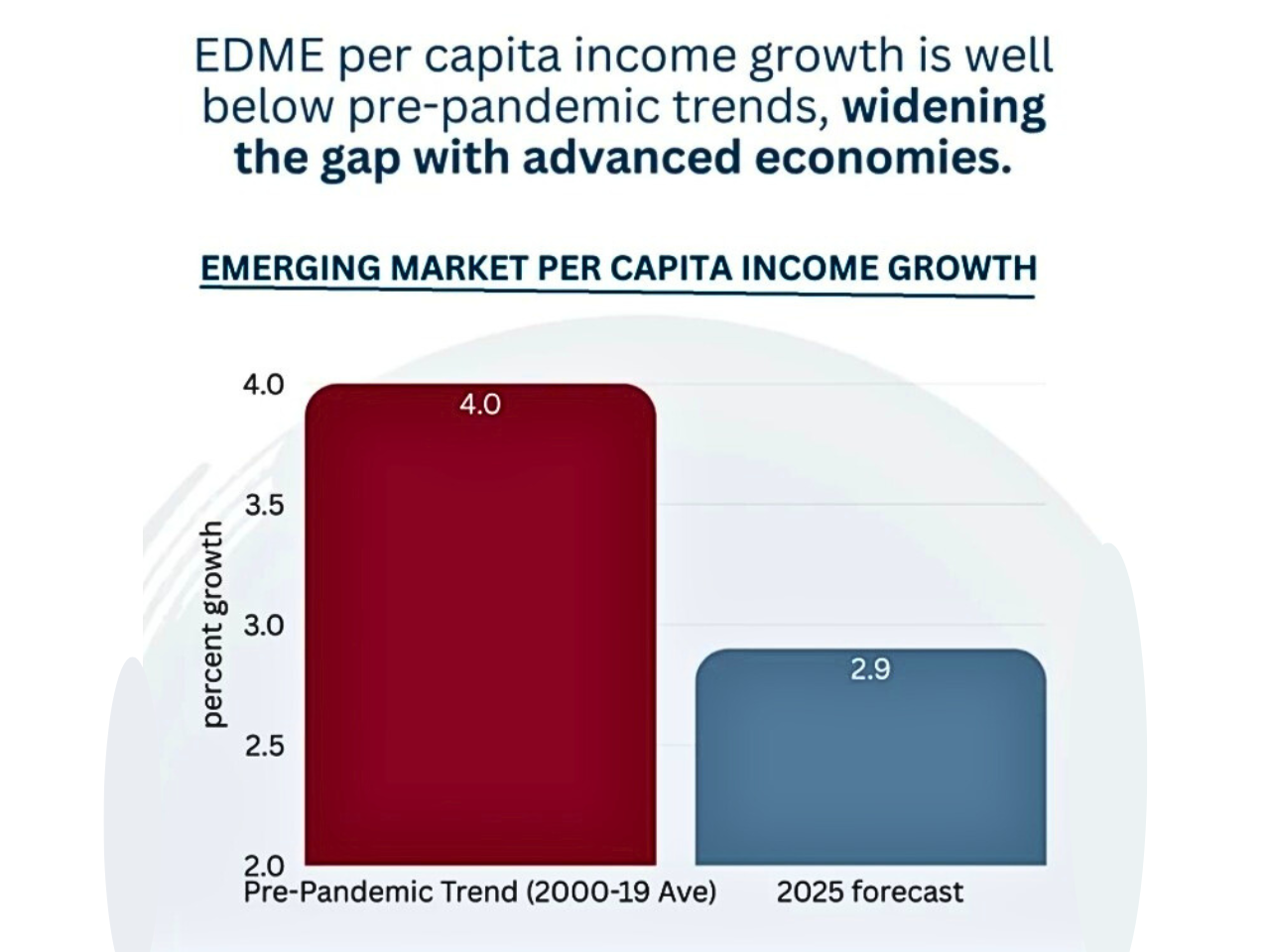

Investments in emerging markets and developing economies (EMDEs) expanded at an annual rate of 7% from 2000 to 2010; however, the annual rate has declined to less than 4% in the current decade. This weakness is a direct attack on productivity growth and development outcomes. Without stronger investments in infrastructure, clean energy technologies, education, and technology, many economies will increasingly fall behind in their progress of poverty mitigation and income convergence with the developed world.

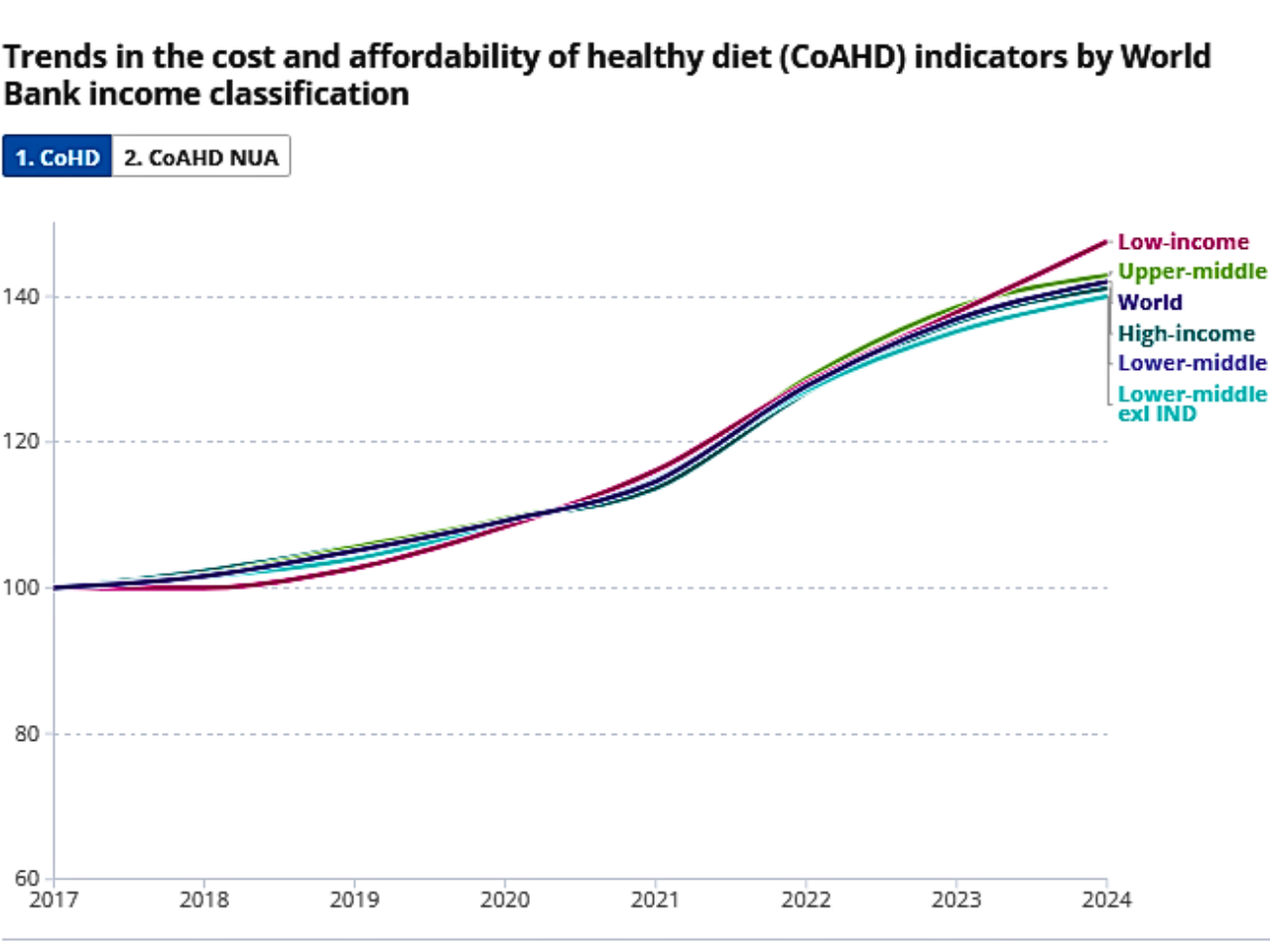

The Rising Cost of Nutrition: Can everyone afford a healthy diet?

The (SOFI) report of 2025 says that low-income nations, especially those in Sub-Saharan Africa, need to become a global movement towards more affordable, healthy diets. Based on the report, even if the global average price of a healthy meal increases to $4.46 per individual per day in 2024, only 48.8 million fewer individuals would still not be in a position to afford it, leaving close to 2.6 billion individuals in poverty