Asia-Pacific Tax Trends: Revenue Statistics 2025 Reveals Insights into Public Finances

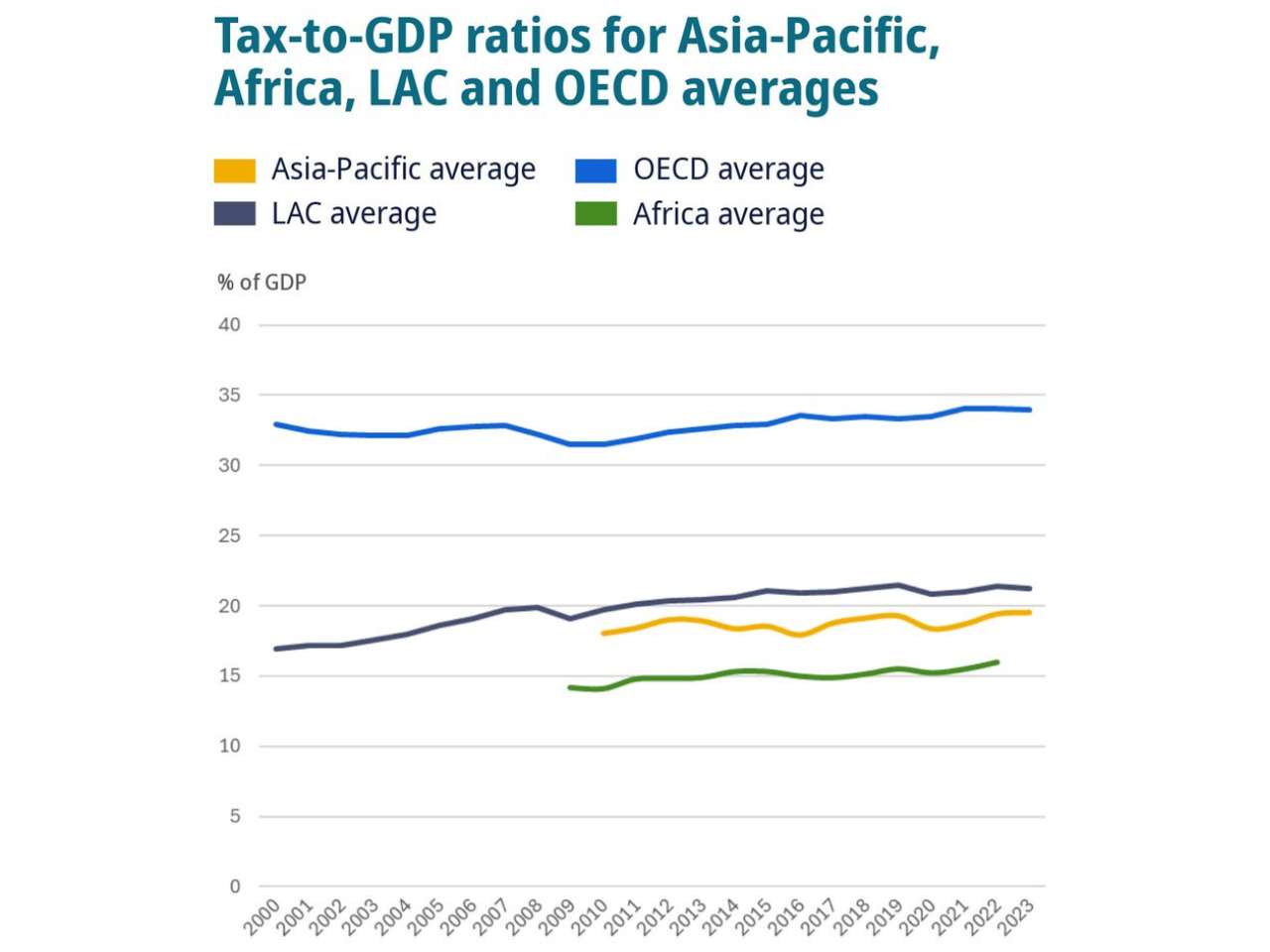

The Revenue Statistics in Asia and the Pacific 2025 publication utilizes data drawn from 2023 to provide a comprehensive analysis of the public revenues of 37 Asia-Pacific economies, comparable on a global level with widely used, internationally comparable statistics. In addition to undertaking an assessment of longer-term trends, the regional comparison of public revenues, and tax and non-tax matters associated with revenue, the report features a special section dedicated to personal income taxation (PIT). In 2023, tax revenues as a percentage of GDP increased for the third consecutive year in the Asia-Pacific region, although at a slower rate than previously, due to slower economic growth. Also, tax and non-tax revenues increased for most economies from 2022 to 2023—a sign that the fiscal position adjustments resulting from the pandemic are now primarily behind us. This publication analyzes a broad economic landscape, from large economies such as China, Japan, Korea, and India to tiny Pacific island economies such as Niue, Tokelau, and the Maldives.

However, the averages for the OECD Lite and LAC dropped by a narrow 0.1 percentage point and 0.2 percentage points, respectively, in 2023; the tax incidence for the Asia-Pacific was 0.1 percentage point higher than in 2022 and above the pre-pandemic level of 19.3% in 2019. Among the 35 economies with 2023 data available, 23 countries saw an elevation in their tax-to-GDP ratios, and, conversely, 12 economies experienced a shrink in their ratios. Niue, the Cook Islands, Azerbaijan, the Maldives, Vanuatu, Fiji, Tokelau, and Sri Lanka accomplished the largest gains in tax-to-GDP ratios as a result of tax reforms, increased business activity, and a recovery from high tourism levels. Timor-Leste, Nauru, Korea, and Vietnam saw the huge drop in tax as a percentage of GDP, resulting from lower corporate income tax (CIT) and goods and services tax (GST) realizations.

Over the long term, or between 2010 and 2023, tax-to-GDP ratios increased in 22 economies and reduced in 15 others. The Maldives, Niue, Nauru, Japan, Cambodia, and Korea saw some of the largest improvements. Some of the increases can be attributed to tax reforms and recoveries from economic crises in Japan and Korea. In the long term, the greatest decreases occurred in Timor-Leste, Kazakhstan, China, the Marshall Islands, and Vietnam; this was due to a sudden decline in global commodity prices, which reduced fiscal revenue in these commodity-dependent economies. The report also considers the tax structure in the region and identifies that it is characterized by a heavy reliance on consumption taxes, particularly the tax on value-added (VAT) and other general taxes on goods and services. Taxes on goods and services constituted 50.2% of total revenue in 2023, a quite significant figure compared to the OECD (31.5%) but similar to Africa (51.3%) and LAC (47.0%). Of this, VAT accounted for 25.8%, which is greater than the OECD (20.8%) but less than LAC (28.5%). Other taxes on goods and services were at 24.3 percent (again, significantly higher than the OECD (10.8%)). For the region examined, corporate income tax provided 19.5 percent of total revenue, higher than LAC (18.7%) and OECD (12.0%) and only lower than Africa (21.2%). Taxes on personal income were 16.5 percent of total revenues, lower than the OECD (23.6%), equal to Africa (16.2%), and higher than LAC (9.5%). Compared to OECD economies, the share of total revenues consisting of social security was a paltry 7.7 percent. This tax mix means that these countries rely far more on indirect taxes than income taxes and social security contributions. In spite of non-tax revenue, including grants and income from property and resource rents, being a significant component of revenue for many small Pacific Island countries, it was available for only 23 economies.

There were increases in non-tax revenues as a proportion of GDP for 16 economies from 2022 to 2023. Seven economies showed decreases. Non-tax revenues in Niue, Tokelau, Nauru, the Marshall Islands, Vanuatu, and Bhutan exceed 10% of GDP. Grants contributed more than 30% of non-tax revenue for nine economies, and property income was the greatest source of non-tax revenue for twelve economies, further demonstrating the reliance of small states on external assistance (grants) and resource rents. The report does maintain that PIT revenues are underdeveloped in the Asia-Pacific developing economies, contributing very little to overall tax revenue, and there has not been substantial growth in PIT since 2010. The issues still remain of a sufficient level of informal economy, quite a narrow tax base, and issues with capacity at administrative levels with compliance obligations for taxpayers being relatively high. To improve the equity and revenue mobilization, there will be a need to broaden PIT bases to reduce the narrowness of their scope and concerns, the use of digitalization to undertake tax administration processes, and mechanisms that will lead to simpler compliance for taxpayers.

Key regional comparisons indicate that total tax-to-GDP ratios in the Asia-Pacific region are lower than average ratios in the OECD and LAC, with significant reliance on goods and services taxes as opposed to the heavier reliance on PIT and social security contributions in the OECD. Overall, the Asia-Pacific region performs relatively well on CIT revenue, falling just behind Africa, while in small Pacific economies with a limited tax base, non-tax revenues are very often relatively large parts of the fiscal revenue through grants and endowments or resource rents. Overall, the report finds post-pandemic recovery has increased tax ratios for the most part across the region, although a continuing uneven performance remains across economies. Reliant on indirect taxes, which the OECD has larger PIT and social security contributions, the Asia-Pacific region utilizes the PIT and social security contributions very little overall. Broadening the tax base and having stronger systems of PIT and programming the administration sector are critical areas of consideration for the long-term fiscal sustainability of the region.

Latest Explained

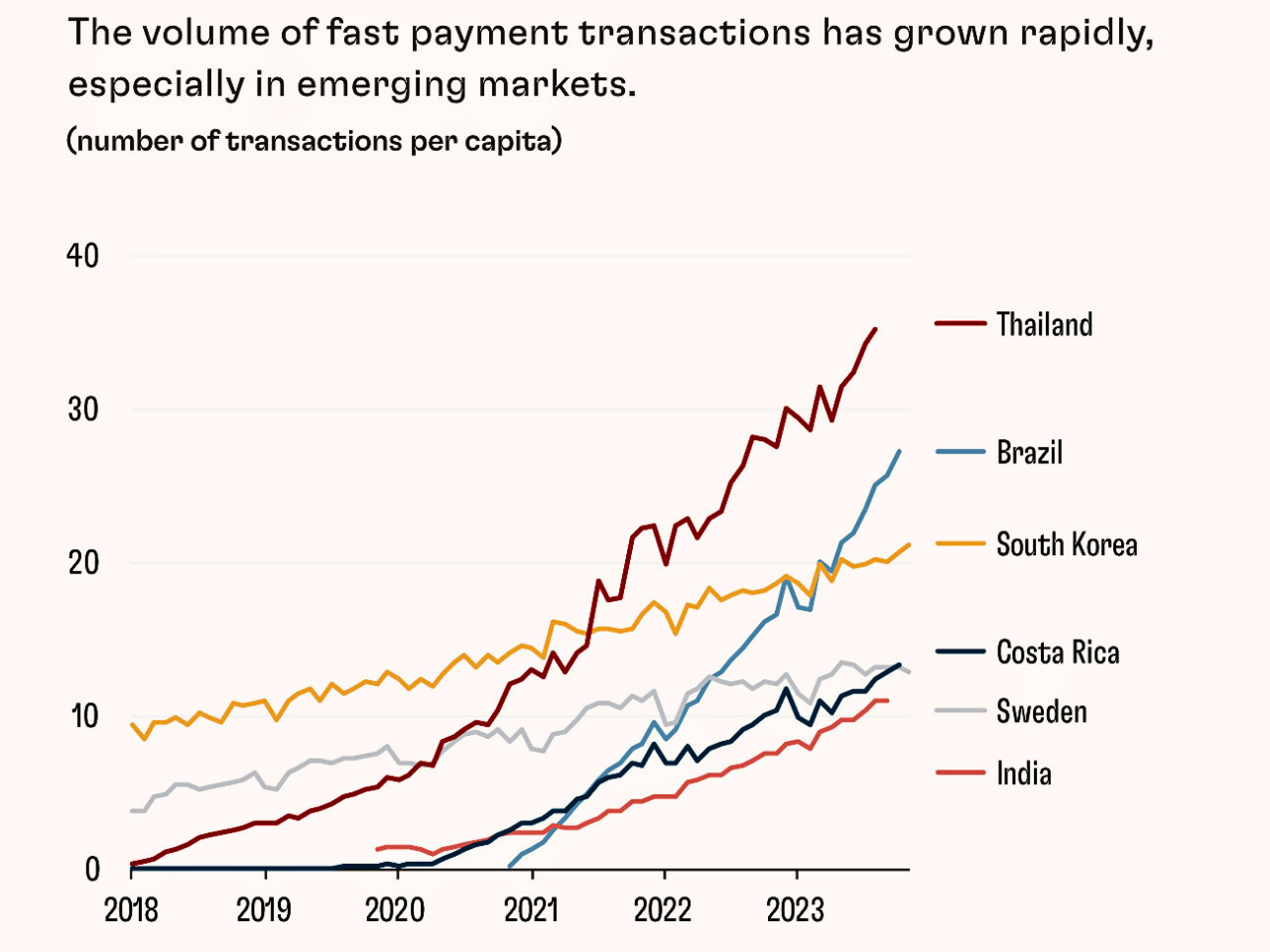

The Future of Finance: How Fintech and Public-Private Partnerships Are Revolutionizing Payments, Credit, and Investment

Brazil's Pix was launched in 2020 by the central bank and has just recently reached over 90 percent of the adult population using it regularly for their everyday purchases. India's Unified Payments Interface (UPI) is a single platform connecting banks, fintechs, and tech firms with the oversight of the central bank. In the United States, Venmo and Zelle still remain largely incompatible. In China, Alipay and WeChat Pay were initially both stand-alone platforms. In Peru, similar to China, having Yape and Plin as competing systems caused comparable challenges.

Food Safety: The Key to Unlocking Africa's Agricultural Potential and Economic Growth

which has generated $600 million in additional investment and $700 million in additional sales. This has been done with Government of Canada funding through the Facility for Resilient Food Systems (FRFS), which supports food safety as well as food loss, waste reduction, and food supply chain efficiencies

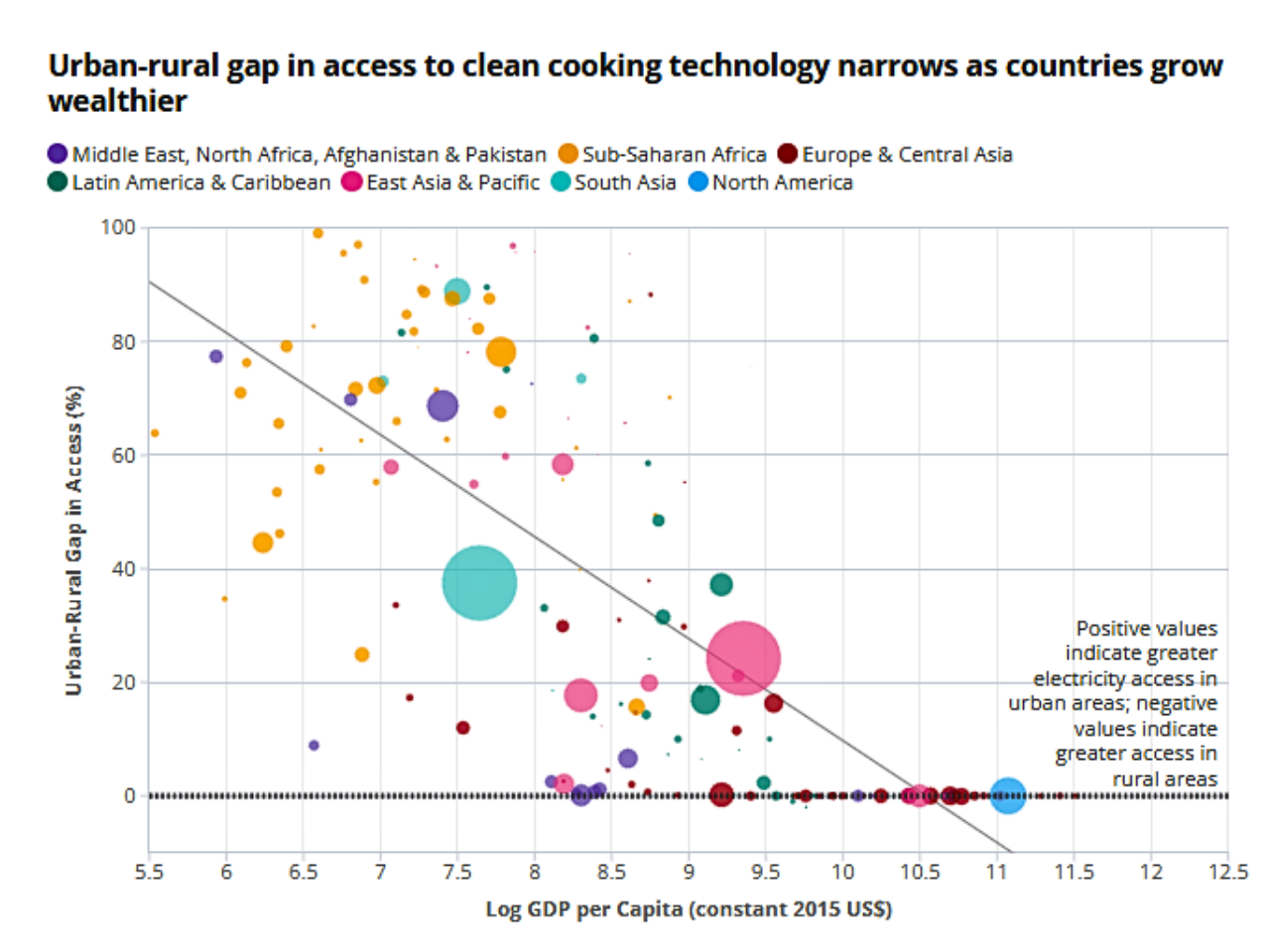

Rural Areas Left Behind: 44% of World Lives Without Access to Basic Necessities

Over the last sixty years, the world has encountered dramatic demographic change. Since 1960, the percentage of people living in rural areas has steadily declined due to the expansion of cities and the overall advance and speed of urbanization globally. In 2008, the majority of the world lived in rural areas while they maintained their lives, but without warning, worldwide populated urban areas dramatically increased their majority share

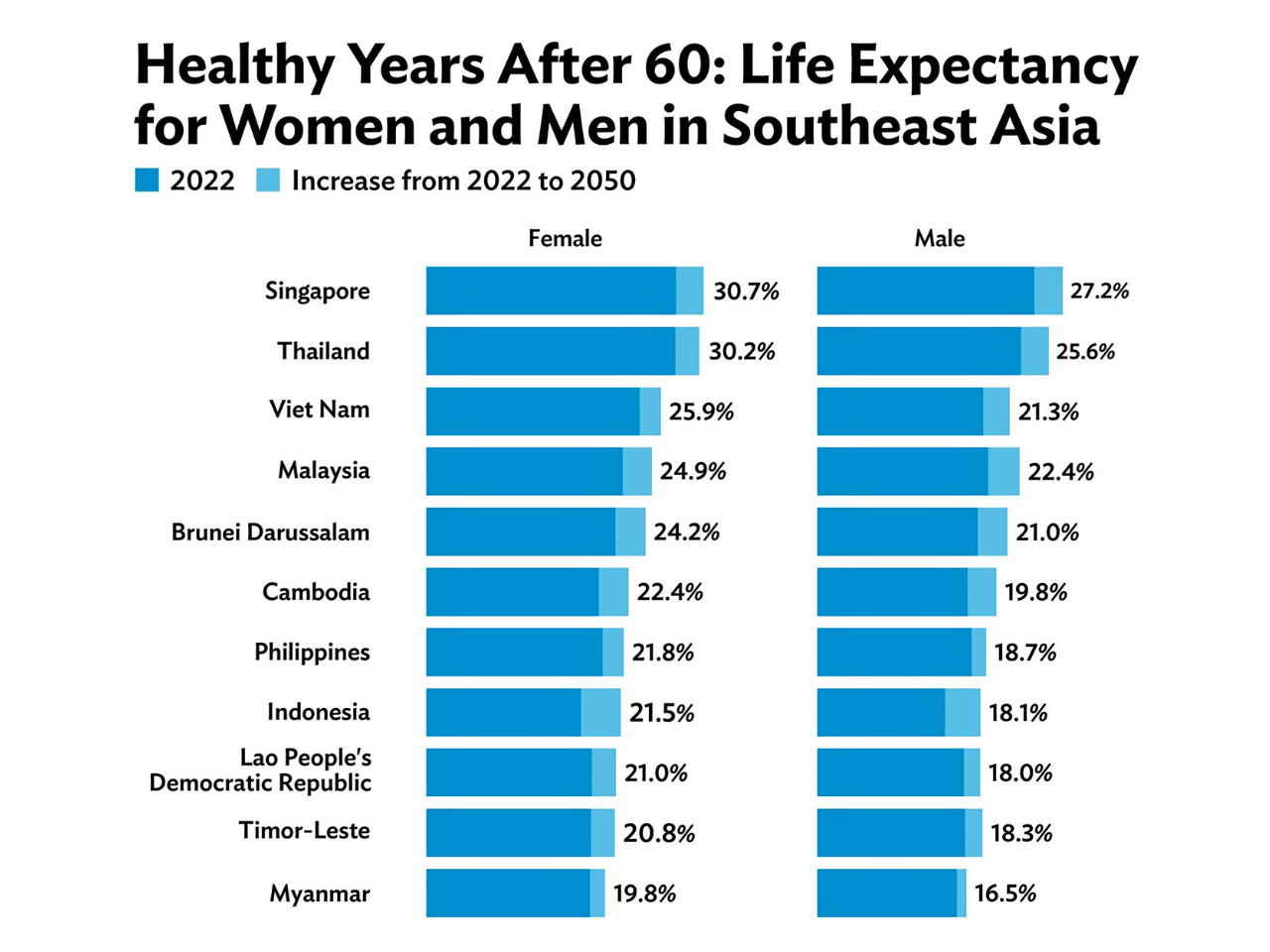

Philippines' Aging Population Set to Double by 2050: Can the Country Keep Pace?

The Philippines is in demand for a demographic change that will reopen the priorities of its economy, society, and public policy. The number of old Filipinos is expected to double by the year 2050, which creates pressure on the nation’s health care systems, elderly care services, and pension schemes

Climate Change Threatens Global Health & Poverty: Urgent Action Needed

Climate issues such as heat stress, diarrhea, malaria, and hunger can cause 250,000 deaths a year between 2030 and 2050, which challenges an important frame of adaptation. The fee, including only health systems and other areas such as agriculture and hygiene, is expected to reach USD $2 to 4 billion annually by 2030. The countries most at risk will be those that are developing countries, as they will have further weakened health systems

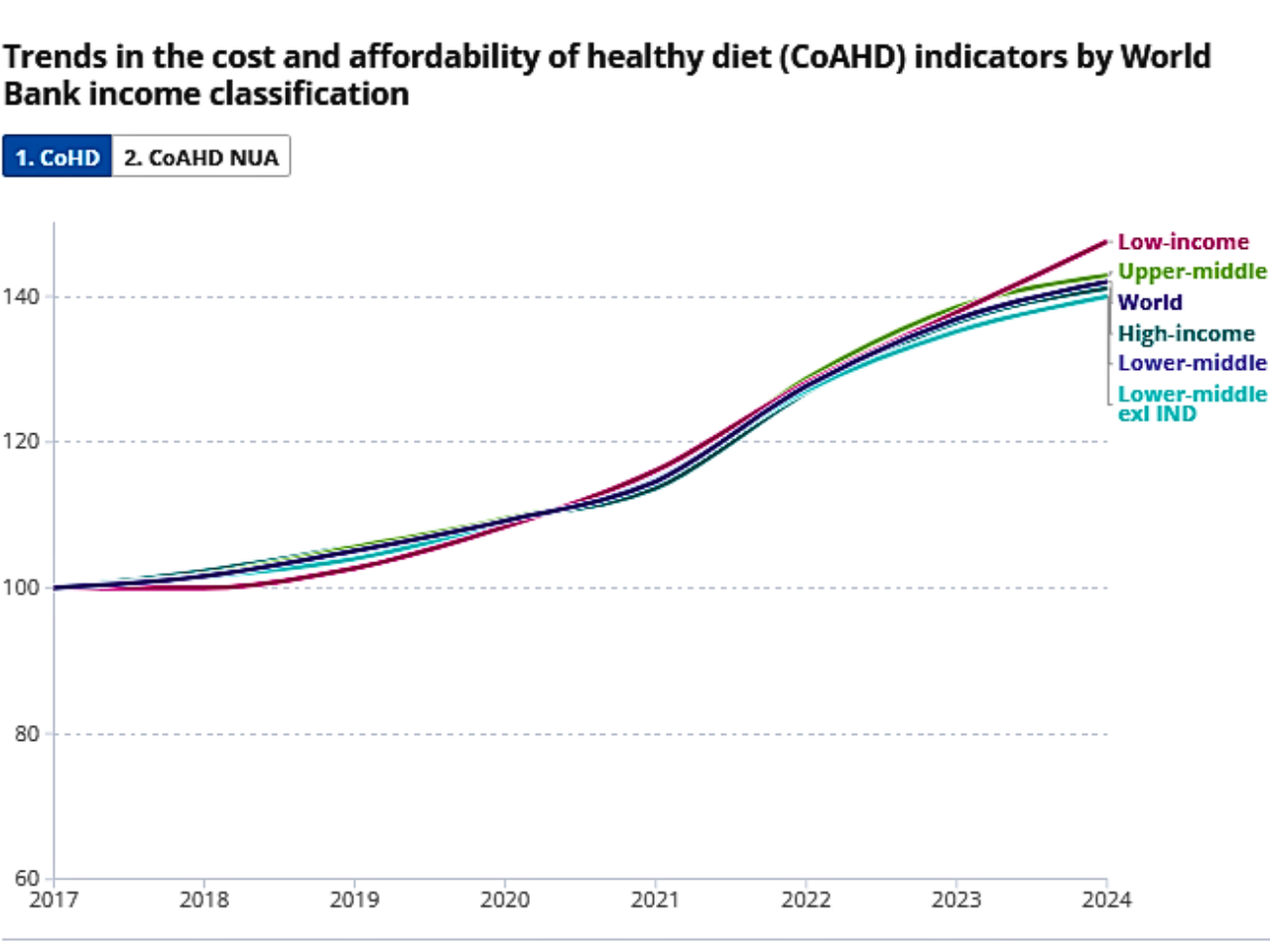

The Rising Cost of Nutrition: Can everyone afford a healthy diet?

The (SOFI) report of 2025 says that low-income nations, especially those in Sub-Saharan Africa, need to become a global movement towards more affordable, healthy diets. Based on the report, even if the global average price of a healthy meal increases to $4.46 per individual per day in 2024, only 48.8 million fewer individuals would still not be in a position to afford it, leaving close to 2.6 billion individuals in poverty