Stock-Bond Correlation Shift: Is the Traditional Hedge Broken

Historically, investors used to follow a very straightforward rule: diversification of stocks and bonds in order to minimize risks. As equity markets fell, government bonds generally rose, and portfolio losses were mitigated, and returns were stabilized. Nevertheless, according to new calculations by International Monetary Fund (IMF) economists Tobias Adrian, Johannes Kramer, and Sheheryar Malik, this long-term relationship has deteriorated significantly since the COVID-19 pandemic, and this poses new concerns to investors and policymakers.

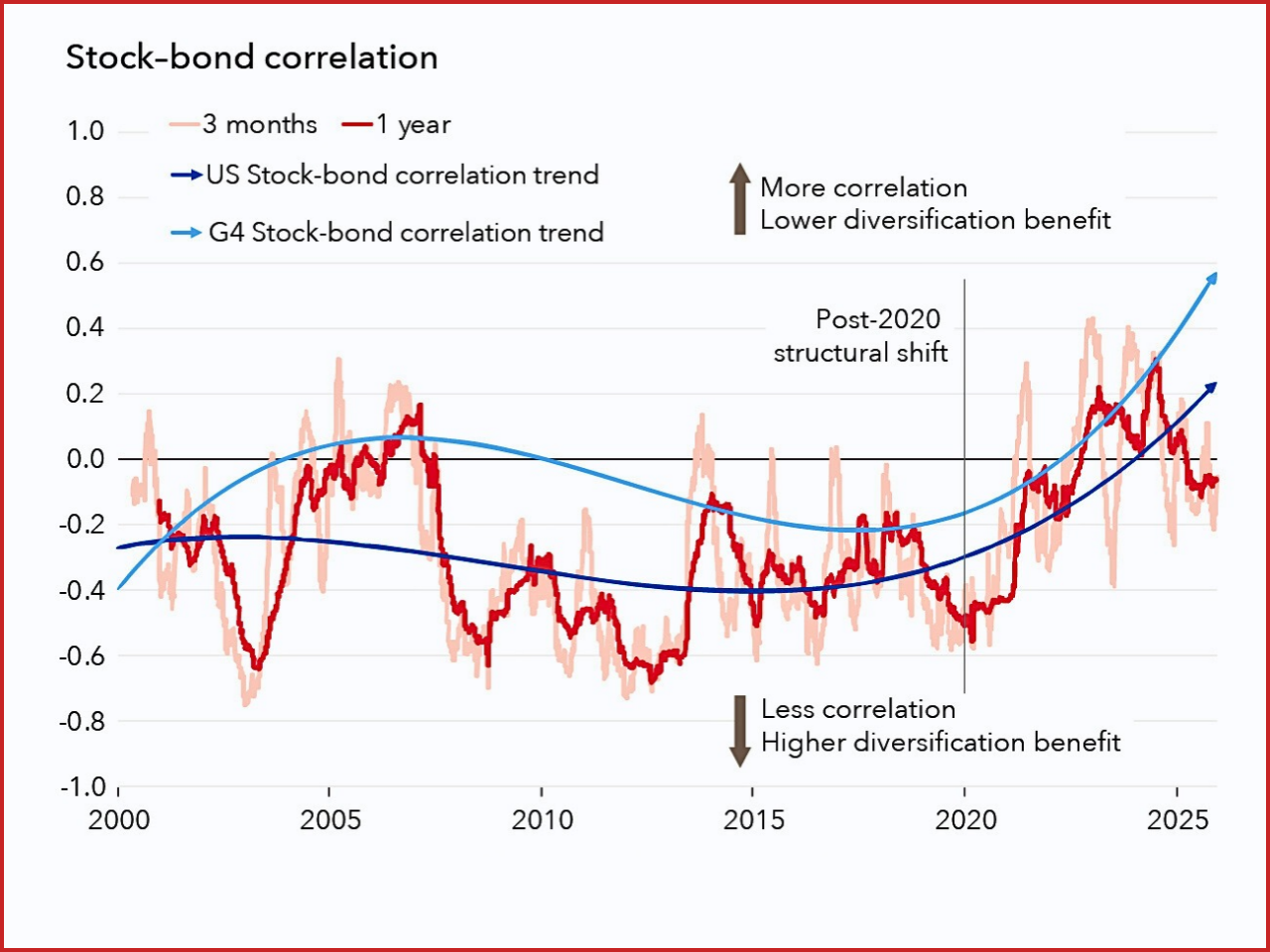

The macroeconomic behavior was the basis of the traditional stock-bond dynamic. When market stress or economic slowdown comes, investors normally run away with risky equities and turn to the safety of sovereign bonds. This flight to quality drove bond prices up and stocks down, generating the negative relationship that defined the archetypal 60/40 portfolio and the risk-parity models. This negative correlation remained steady between 2000 and 2019 to the point that it was encoded in asset-allocation models of pension funds, insurers, and hedge funds. That pattern has shifted. According to IMF analysis, the stock and bond returns have been trending in the same way, mainly on acute selloffs, since early 2020. Rather than bonds covering the losses of equity, the two asset classes have sometimes declined in tandem, eliminating the diversification advantages. It seems that the shift started towards the end of 2019 and accelerated with the supply shocks prompted by the pandemic, which created global inflation. Statistics provided by the IMF indicate the presence of a structural break. In the pre-pandemic past, the correlation between equities and government bonds rolled negatively in the majority of cases. In 2020, the trend of the correlations was positive and often had a positive value. This implies that the portfolios that previously used bonds to act as a buffer in their protection can now have an even greater tendency to be volatile during times of stress in the markets. There are far-reaching implications. Risk parity and leveraged hedge fund and other types of strategies were founded on the hope that bonds would hedge equity risk. The IMF researchers say that the strategies are more closely aligned to the Treasury returns than before. During turbulent markets, this correlation may lead to forced deleveraging when losses occur in an asset liability match-up.

Even the conventional conservative institutional investors are not spared. Pension funds and insurance companies will be more exposed to swings in portfolio values as the markets will experience more swings to stabilize portfolios through the use of sovereign bonds. The issue is not just a hypothetical one. The drawdowns in both stocks and bonds have already been simultaneous due to market stress that has taken place lately and compounded losses.

The disintegration also combines with market volatility. The correction of the equity markets is usually accompanied by volatility indicators, such as the VIX spiking. In the historical context, increasing volatility enhanced future returns to equities, whereas bonds enjoyed secure-haven demand. Analysis of the IMF between the pre-2020 and post-2020 periods indicates that this divergence has been weakened. The increased volatility in the present setting is being more and more correlated with greater expected bond returns, that is, decreasing bond prices, which diminishes their hedging capabilities. The shift seems to be shifting on several structural forces. The most prominent of them is the renewal of inflation in the post-pandemic era. With increased inflation risks, bonds will be more responsive to interest-rate expectations, and investors will require higher compensation for holding longer government debts. This raises the cost of the term premium and exposes the bond prices when the times are tough.

Fiscal dynamics have been contributing as well. The advanced economies have greatly increased government borrowing to fund pandemic aid and the consequent fiscal programmes. The IMF reports that gross issuance of bonds by major economies has been exceeding the rate at which central banks are reducing their balance sheets by quantitative tightening. With the maturation of bonds, which are not reinvested, a greater portion of the new supply would have to be recaptured by the more price-sensitive private investors. This supply-demand mismatch has been more noticeable by late 2023. Despite the slowing of central bank balance-sheet runoff, sovereign issuance was high. What it brings about is an increase in the upward pressure on yields and increased volatility in the bond markets. Government debt as a haven is impaired as investors start to perceive it as being riskier based on fiscal issues or ongoing inflation. Another recent market development that can be attributed to the changing environment is the great surge in other safe-haven assets. There have been significant increases in precious metals like gold, silver, platinum, and palladium, and also currencies like the Swiss franc have received inflows. In particular, gold has risen to a steep incline as investors seek protection in non-conventional sovereign bonds. This change indicates that the demand for diversification is moving toward non-sovereign forms of values.

The stakes are high to become financially stable. The resulting losses of portfolios could be enhanced during the downward movements of both stocks and bonds, which may lead to the problem of liquidity pressure. An increase in volatility would increase the funding conditions of leveraged investors, and this would cause feedback that would increase the market stress. IMF cautions that this kind of dynamics may increase systemic vulnerability when it is not well handled. The responses in terms of policy will be decisive. The central banks still have the capacity to make an intervention when the markets are highly dysfunctional, yet the IMF warns that the recurrent emergency rescue has its own perils. The reliance on backstops may promote too much risk-taking and market laxity. Rather, the hedging functions of sovereign bonds will probably need deeper amendments. The key to that endeavor is fiscal credibility. Large ratios of the public debt and unpredictable budgetary trajectories may erode investor confidence in the government securities. The bonds will not find it easy to reclaim their traditional status of haven without believable medium-term fiscal structures. On the same note, monetary authorities should be adamantly determined to keep prices stable. A major trigger that led to the reversal of stock-bond correlation against the background of the unexpected inflation surge after 2020.

The regulators are also being called upon to change. Historically-based stress testing structures can be understated about the existing risks. Incorporating the situation where the traditional diversification does not work, supervisors might need to have enough capital and liquidity buffer in financial institutions to deal with this novel regime. To investors, it is simple to read between the lines: the same assumptions about portfolio construction that had been made before 2020 might not apply anymore. Although other options like commodities, private assets, or currency hedges may help to offer partial diversification, they have their own liquidity, valuation, and operational risk. The historical stock bond hedge cannot be easily replaced. Finally, the IMF analysis is an indication of a wider change in the financial environment. The pandemic was not just a precipitant of a short-term break; it seems to have changed the essential market relations. Bonds can no longer offer the haven they once did in a world of constant inflation risk, massive sovereign issuance, and a changing monetary policy. The new environment has now challenged investors as well as policymakers to re-strike the balance of risk management frameworks. Major asset classes may be linked in such a way that market volatility spreads faster throughout the financial system in case the correlation between them is high. Diversification might no longer be easy, and as the investment environment has become less forgiving, traditional hedges cannot be assumed.

Monthly Edition