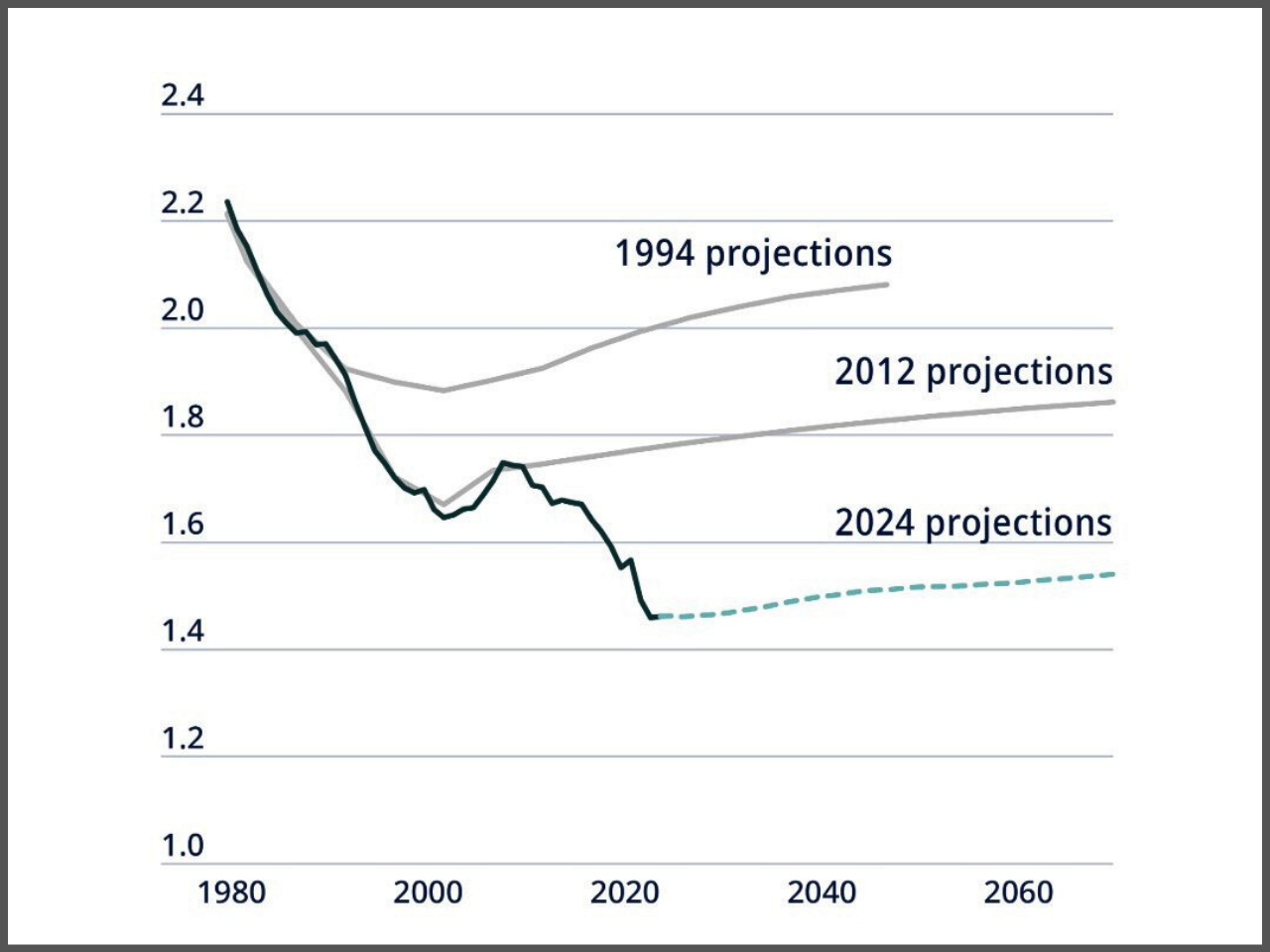

Pension Systems in Crisis: OECD Report Reveals Challenges and Opportunities for Reform

The OECD’s Pension at a Glance 2025 looks at reforming pensions in OECD Countries over the period between 2023 – 2025 and provides new indicators of pension systems and projections of pensions for retirees. It reports on rapid population ageing, where the ratio of people aged over 65 to people aged 15 to 64 is expected to rise sharply from 2023 to 2050 due to declining birth rates and increasing life expectancy, now means there is a significant challenge to the sustainability of pension systems.

There are a number of important changes to policy that countries are implementing in response to demographic shifts, including increasing retirement ages in the Czech Republic and Slovenia, as well as reforms in both Chile and Mexico aimed at achieving better pension adequacy for women. Many countries are reviewing contributions and calculating pensions so that they can ensure that the short- and long-term financial stability of their pension system will be maintained.

Pension payments offered to future workers are estimated to be about 63% of net wage earnings on average across the world, but there are significant variations between different countries. Women continue to receive monthly pension payments that are roughly 25% lower than the amounts received by men. Imbalances in employment availability for jobs, hours worked per week, or base salary are major contributors to the lifecycle earnings differentials that create the overall pension gap. Such disparities tend to compound over time and result in lower overall pension benefits received at retirement (especially applicable to women). The report includes various policy measures to address these differences through increased participation in the workforce (labour market) and to improve equity in terms of salary. Closing these gaps will help create a more equitable pension system while ensuring the financial viability of the pension system for many years into the future.

Latest News

India's Economic Resilience: A Beacon of Hope in Turbulent Times

The Union Budget 2025-26 and the Economic Survey of India present a long-term economic plan that would enable the country to focus on internal development and make changes in the face of the unpredictable global world. The policy framework depicts a balance of fiscal discipline, structural reform, and increased involvement in international markets.

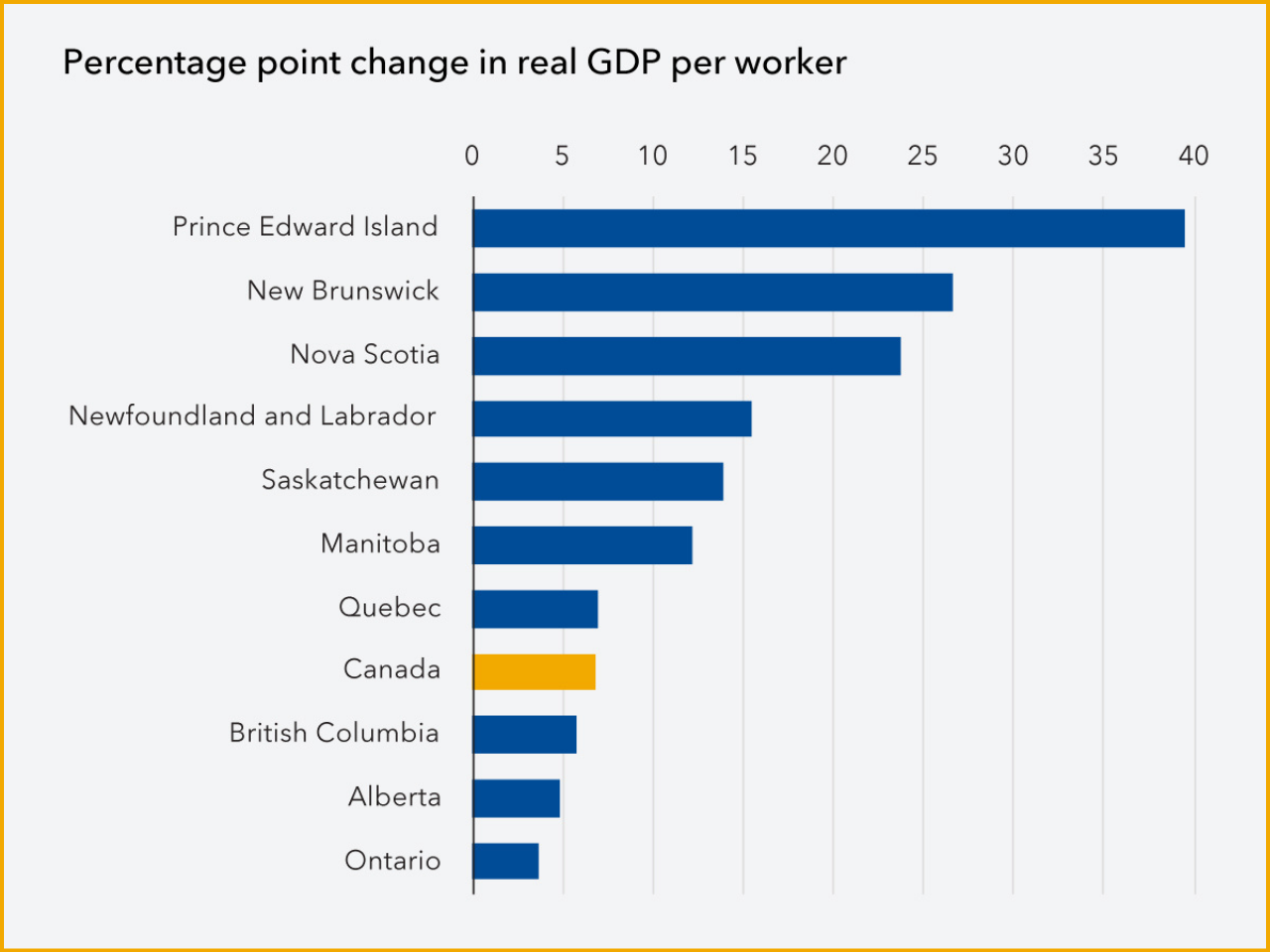

Breaking Down Barriers: How Canada Can Boost Productivity and Growth by Reducing Internal Trade Barriers

The Canada’s long-run real GDP would increase by an estimated 7%, representing an increase of approximately C$210 billion. Increasing the productivity of firms by removing these barriers would, in turn, stimulate economic development primarily through enhanced productivity, more efficient allocation of resources, increased competition among firms and improved firm growth versus demand increases in the short term.

EU Opens First Legal Gateway Office in India: A New Era for Talent Mobility and Trade

The long-awaited India-EU Free Trade Agreement (FTA) was finally signed, ending two decades of talks. European Commission President Ursula von der Leyen opined that the new office will serve as a single-stop shop to Indian students, professionals, researchers, and seasonal workers. The facility will unite visa data, mobility advice, and employer connections across Europe to streamline access to lawful migration routes and align with the labour-market needs and legal frameworks of specific EU member states.

Europe's Aging Population Meets Social Economy Solution: Care, Housing, and a New Era of Support

Europe is under the pressure of increasing ageing of its population, mounting care demand with a decreasing workforce, and escalating cost pressures. In the present day, caring is the reason behind almost one in every three Europeans, which highlights the burden on families, the labour market, and the welfare systems.

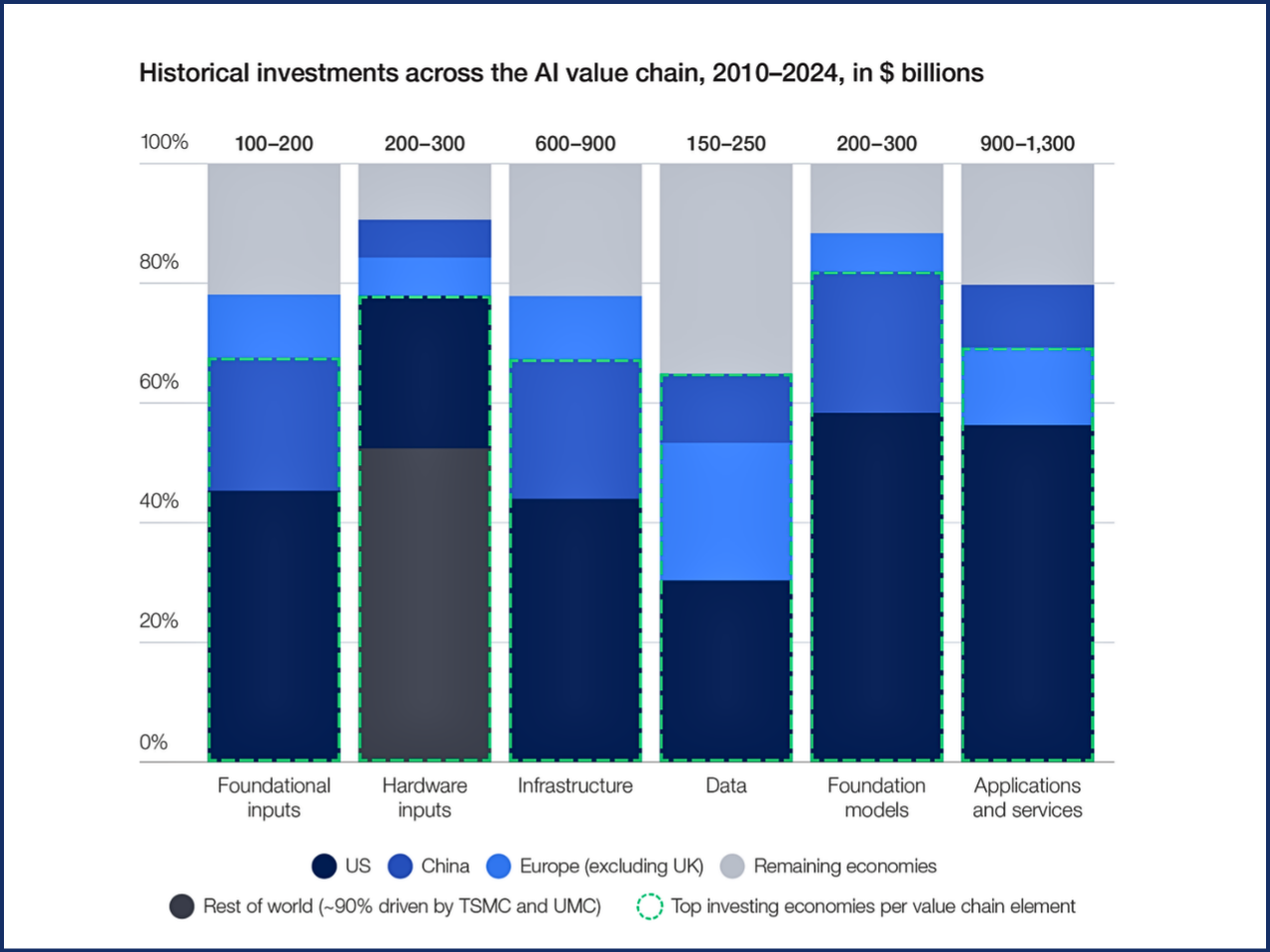

Rethinking AI Sovereignty: Why Strategic Interdependence is the Key to Global Competitiveness

The case that, rather than defining “AI Sovereignty” in terms of total self-sufficiency, a new framework based on the concept of strategic interdependence is more compatible with achieving success in an AI environment and will produce a competitive advantage for economies. Strategic interdependence focuses on encouraging collaboration based on comparative advantage (what an economy does well), interoperability between AI systems, and creating regional and global trusted partnerships.