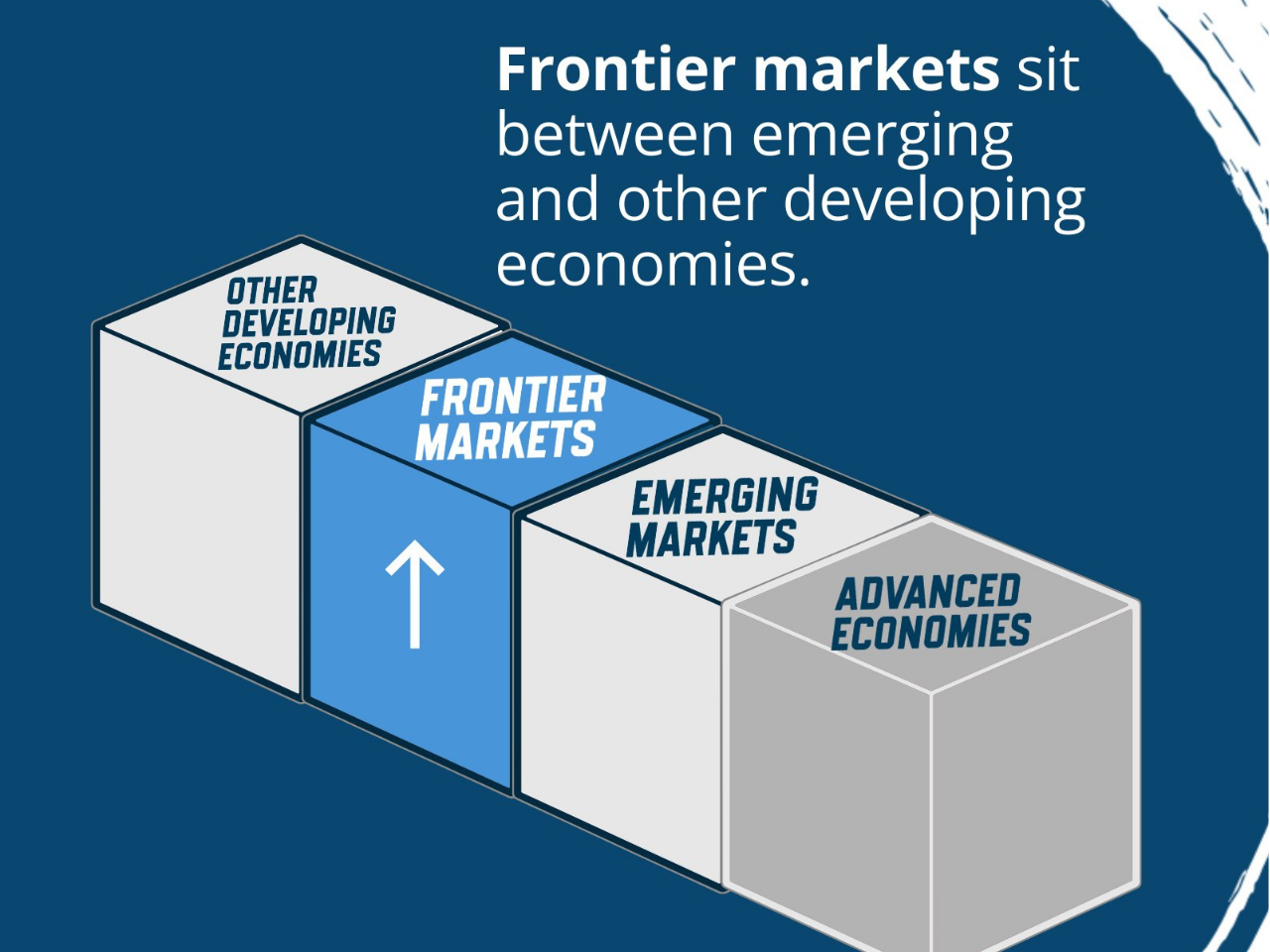

Frontier Markets: A Tipping Point for Global Development

Frontier-market economies are uniquely and more and more significant in the global economic environment. These countries are placed between the advanced emerging markets and low-income developing countries, characterized by low yet significant access to international financial markets. New analysis in the World Bank Global Economic Prospects (GEP) 2026 report shows that frontier markets present huge potential and a huge threat to the global economy. With almost 1.8 billion inhabitants, approximately a fifth of the global population, the frontier markets at present contribute approximately 5 percent of the global gross domestic product. Although this is a small percentage, their population impact is still growing fast. The greater part of the world population growth in the next quarter century is predicted to be in these economies, and therefore the development process in these economies would not only be critical in the prosperity of these economies, but also to the stability of the world and the creation of employment.

Losing Building Momentum with Big Potential-

The report points out that frontier markets have a number of structural advantages. Most of these economies are well endowed with natural resources such as minerals needed in the global energy transition. They usually have relatively better institutions, healthier populations, and better-educated workforces compared to the other developing economies. International access to capital markets offers more financing opportunities, which can be used to finance investment and growth.

However, even with these positive factors, there has not been a complete economic performance. The frontier market growth has dropped sharply to approximately 2 percent/year in the 2020s, less than half of the growth in the early 2000s. Meanwhile, such economies enjoy the dividends of only 3.1 percent of world capital inflows, and this is yet another indicator of their ongoing marginalization in the global financial system.

There is also a weakened growth in per capita income. The growth in output per capita in the usual frontier market has grown at a slower rate than in the emerging markets, increasing the income disparity between the two. Though the rates of poverty have reduced since 2000, the progress has slowed down during the last few years, and living standards are fragile in most frontier economies.

The fact that frontier markets are increasingly globalizing their financial systems is one of their distinguishing features. Some of them have opened their capital accounts, issued international bonds, and allowed foreign portfolio investment during the past two decades. Its appearance in the major equity and bond indexes has helped to draw the attention of foreign investors who are seeking better returns. Nevertheless, this is yet to be fully integrated and balanced. Many frontier markets have poor domestic financial systems. The access and limited credit, poor regulatory measures, and high lending rates limit the business expansion capabilities. This means that capital inflows are not necessarily productive investments. Moreover, they have been exposed to international financial cycles, and this has been increasing, thereby making them vulnerable. Growth in the short run is normally enhanced by an inflow of capital, which is usually characterized by abrupt reversals. As the world interest rates increase or there is a shift in the sentiments of the investors, the frontier markets might experience sudden stops resulting in currency pressures, increased cost of borrowing, and reduced economic growth.

Risks associated with debts have turned into a rather acute issue-

About 40 percent of the frontier markets have defaulted on sovereign commitments at least once since 2000. These economies recorded the greatest number of defaults over the five years since the beginning of the COVID-19 pandemic, as compared to the rest of the countries. Their debts are mostly coded in foreign currencies, thus being very vulnerable to exchange rate fluctuations and external shocks.

The Question of Why Some Frontier Markets Work-

Regardless of these complications, the GEP report points out that frontier markets do not all perform in the same manner. Many nations have been able to experience sustained growth and development through proper policies as well as strategic investments. The frontier markets that have been expanding at a faster pace since 2000 are likely to have a number of common features. They have registered high levels of investment growth, specifically in the field of infrastructure and human capital. They have also significantly enhanced their governance and institutional quality, which has served to create confidence in investors. Notably, effective actors have been able to contain government debt and have had more stable macroeconomic conditions.

The report shows that there are different ways in which development can take place by citing case studies. Kazakhstan used its energy resources to attract investment and modernize its infrastructure. Vietnam had embarked on export-led industrialization, which was built on deep integration into the global supply chains. Rwanda specialised in the development of the service sector and tourism, with a significant investment in reforms in the area of public administration and business climate. These diverse experiences demonstrate that there is no exact formula of success, but that disciplined policy choices can be able to make a decisive difference.

The Road Ahead: Policy Priority-

Frontier markets will require a holistic and well-balanced policy agenda in order to realize their potential. Some priorities are identified by the World Bank. To begin with, the financial and trade integration should be accompanied by increased oversight and risk management. The evolution of richer domestic financial markets can be used to minimize reliance on unstable foreign financing sources as well as to supply domestic businesses with more stable funding. The export bases would have to be diversified in an attempt to cushion these economies against fluctuations in world prices rather than focusing on primary commodities.

Second, it is necessary to have macroeconomic stability. Plausible fiscal and monetary policies, sustainable debt management, and sufficient foreign exchange reserves can reduce borrowing costs and create shock resilience. The predictable nature of the policies, especially in areas of long-term investment, is relevant. Third, the increase in productivity and investment is a major factor in long-run growth. Various frontier markets have massive infrastructural lapses in transportation, power, and internet connectivity. Sealing such gaps would help spur activity in the private sector and reduce unemployment. The additional investment in education and skills training will be critical to make sure that growing working-age populations become a demographic dividend as opposed to an increase in unemployment. Lastly, it is essential to reform governance and institutionalize it. The business environment can be improved by having transparent regulatory systems and effective public administration, as well as the rule of law, to promote investment, both local and foreign.

Global Implications Frontier market performance is important much more than its borders. With the working-age populations in the advanced economies declining, the countries will become an even more significant source of labor in the world, consumer demand, and investment opportunities. Their success or failure will define the migration trends, commodity markets, and the overall wave of global development. There is also the role of the international partners. Frontier markets can be fostered by multilateral institutions, development banks, and private investors with concessional finance, technical advice, and investment in essential infrastructure. Co-ordinated debt relief efforts and better access to international capital markets would also enhance success in the achievement of sustainable development.

A Moment of Decision: Frontier markets are at a critical position -

They have young populations, resource endowments, and growing financial linkages with vast opportunities. However, the deceleration in investment, increased vulnerability to debts, and exposure to turbulent flows of capital will be the factors that hold them back. The policy choices that they make now will determine whether these economies will live up to their promise. Frontier markets can be growth engines and sources of opportunities in the next few decades, provided they are reformed, invested in, and supported by the global community. In their absence, they stand to lose their positions on the fringes of the world economy.

The future of global development, as the GEP 2026 analysis reveals, not only affects the 1.8 billion inhabitants of these economies but also the future of the entire world's development.

Monthly Edition