World Bank Unveils New Era of Debt Transparency: 3 Pillars to Boost Global Financial Stability

The blog post from the World Bank explains that real debt transparency is more than just making public data about debt; rather, it is a quality indicator that governments, markets, and people can use to gain a better understanding of their debt risks. True debt transparency is based on three different “pillars”: 1) disclosure; 2) standards; 3) timely, comprehensive coverage. The first pillar of true debt transparency is disclosure, which means providing access to data (including metadata) and describing the data collection and sharing process.

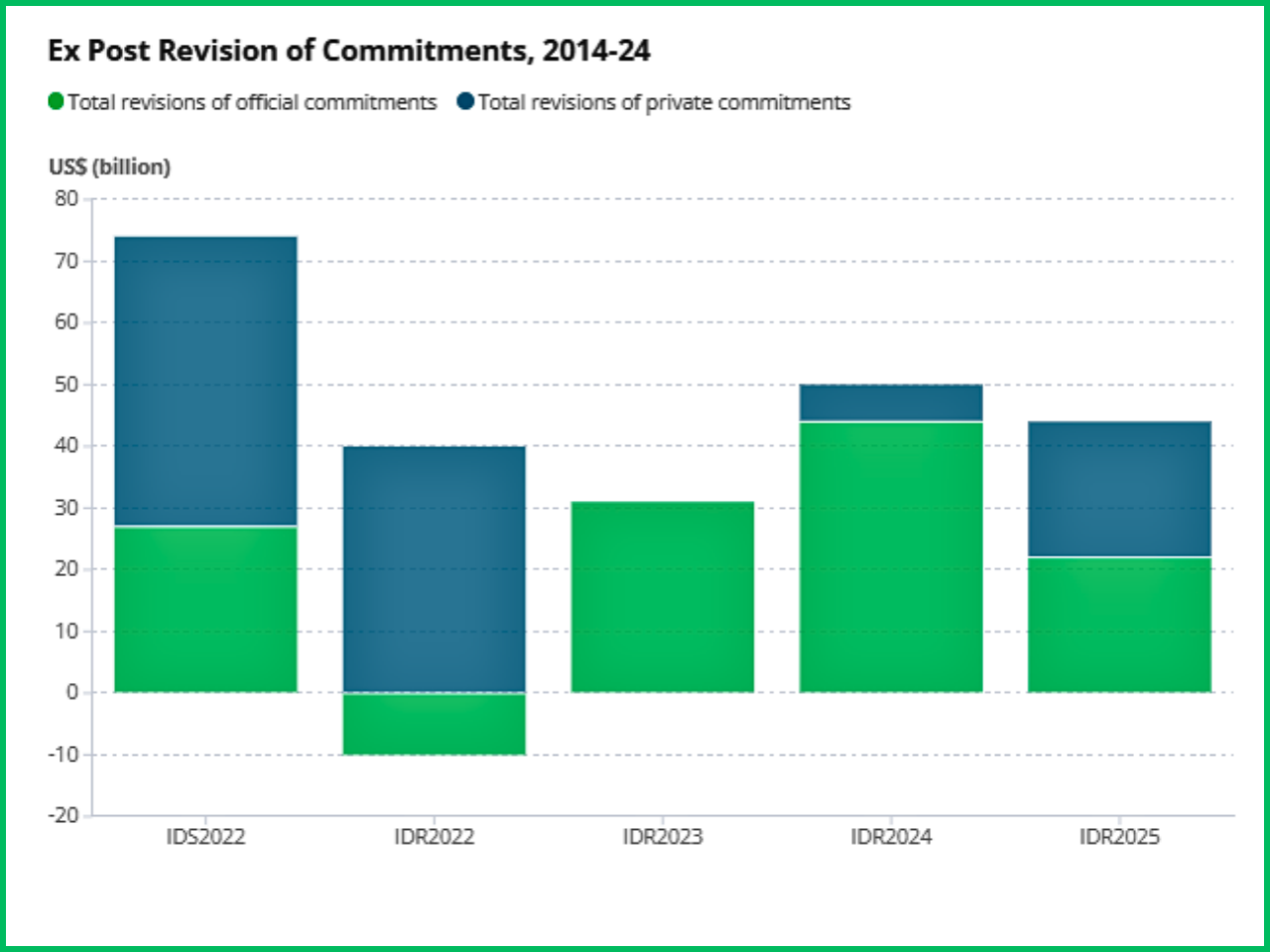

Over the last ten years, the World Bank has expanded its International Debt Statistics (IDS) program to cover a much larger portion of the world’s external debt, thereby increasing usability and comparability. However, consistent definitions and reporting practices must also be used in conjunction with disclosure in order to create real debt transparency. The second pillar of true debt transparency is providing debt statistics that are consistent with other international standards, which will provide better comparisons. The upgraded Debtor Reporting System (DRS) has been released (2026) and will be connected to UN Trade and Development’s DMFAS and the Commonwealth Secretariat’s Meridian, and will be in cooperation with the International Monetary Fund through the Working Group on Charged Debts.

Additionally, the previous reconciliations with creditors for International Development Association countries have helped improve the consistency of data. Lastly, transparency must extend across more sectors, and reporting will need to occur more quickly. The IDS will include the debt of state-owned enterprises and will now have state-owned enterprise debt that comes from Turkish and Vietnamese entities, and there has been a sharp decrease in the amount of delayed submission since the foreword of the IDS in 2019. Overall, the continuous improvement of standards, coverage, and timeliness will promote trust, reduce borrowing costs, and facilitate better debt management.

Latest News

South Asia's Climate Crisis: 90% Population at Risk of Extreme Heat by 2030

The area is already the most vulnerable to climate change among emerging and developing markets, and it is estimated that almost 90 percent of its population will be in danger of extreme heat by the year 2030. The exposure in urban context is also observed to be quite alarming: by 2030, 1.2 billion of the urban population (92 percent) is projected to be exposed to extreme heat, and 322 million (24 percent) will face flood risks.

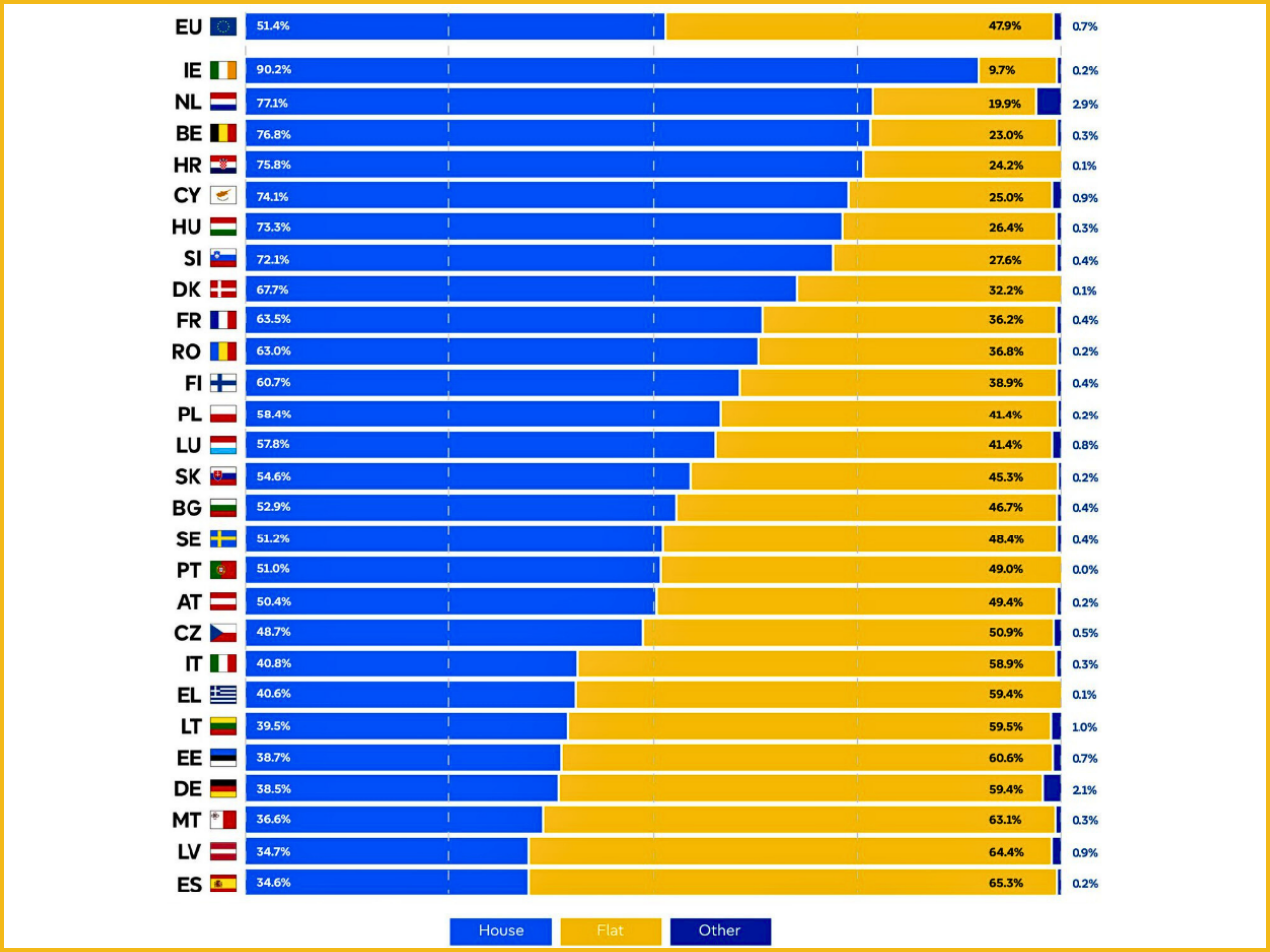

EU's HOUS Committee Takes Bold Steps to Address Housing Crisis by 2026

The European Parliament’s HOUS Committee (Housing Crisis in the EU) has a mandate to develop solutions for housing issues in the EU (affordable, sustainable, and decent) aimed at resolving these issues by 2026. The European Commission’s Joint Research Centre and Eurostat for meetings held in January 2026. These meetings have been very valuable in providing the members of the committee with an improved understanding of housing data and housing policy.

Data Centre Boom Sparks Energy Crisis: Power Companies Scramble to Meet Surging Demand

The industry that capital outlay on data centres may approach approximately 7 trillion dollars by 2030, of which approximately 1.3 trillion dollars will be used in power generation, cooling equipment, and electrical equipment. In Ireland, data centres already represent approximately 20 percent of national electricity consumption, as the example of the digital infrastructure redefining energy demand shapes up that speedily.

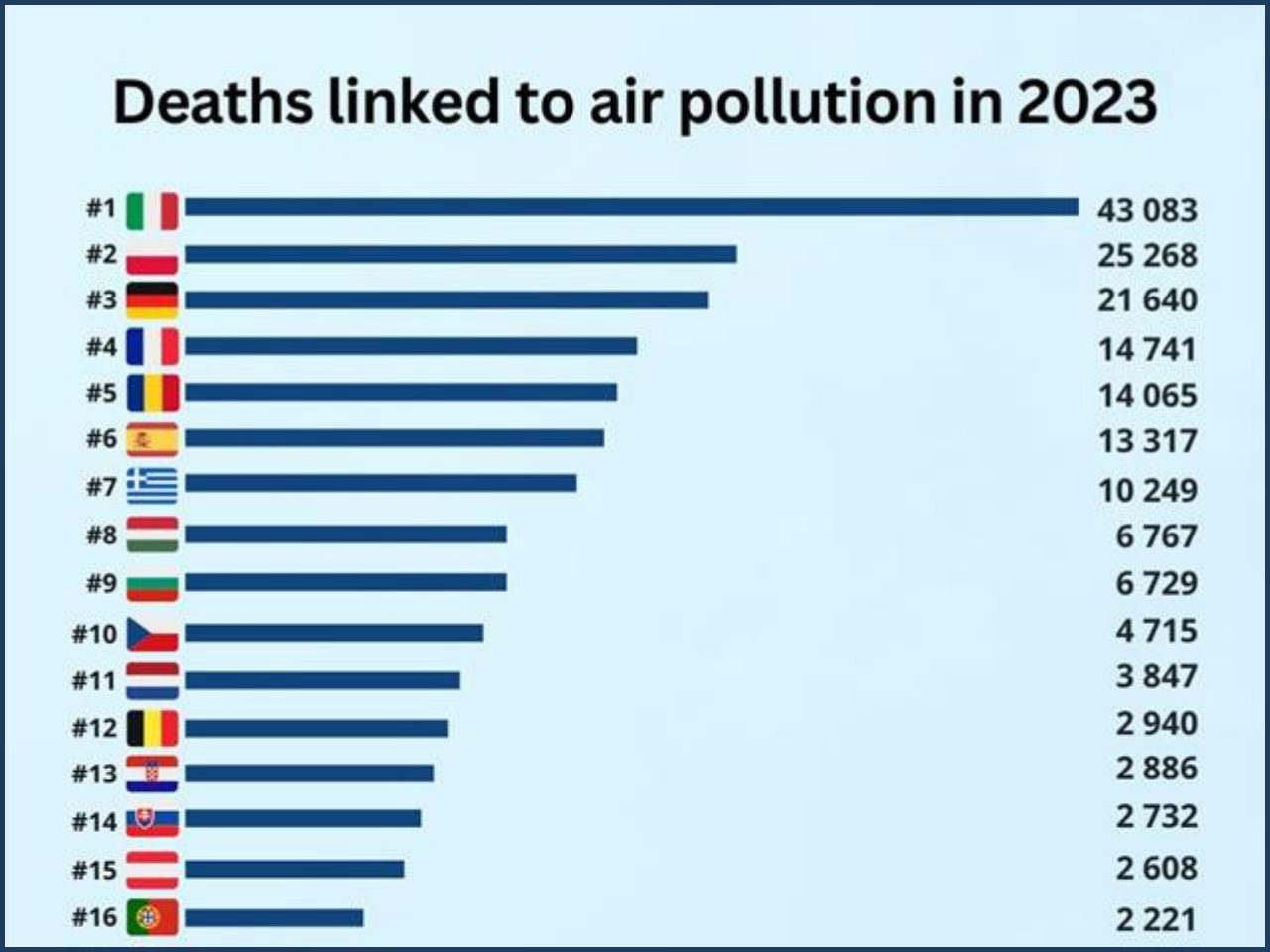

EU's Zero Pollution Action Plan: Aiming for a Toxic-Free Environment by 2050

The European Union’s “Zero Pollution Action Plan” will strive to achieve an environment without toxins by decreasing air, water, and soil pollution to levels that have no effect on human health or the ecosystems’ ability to function properly and provide vital services (e.g., storing carbon or filtering pollution). The plan includes significant targets for progress toward 2030, including a 55% decrease in premature deaths caused by air pollution.

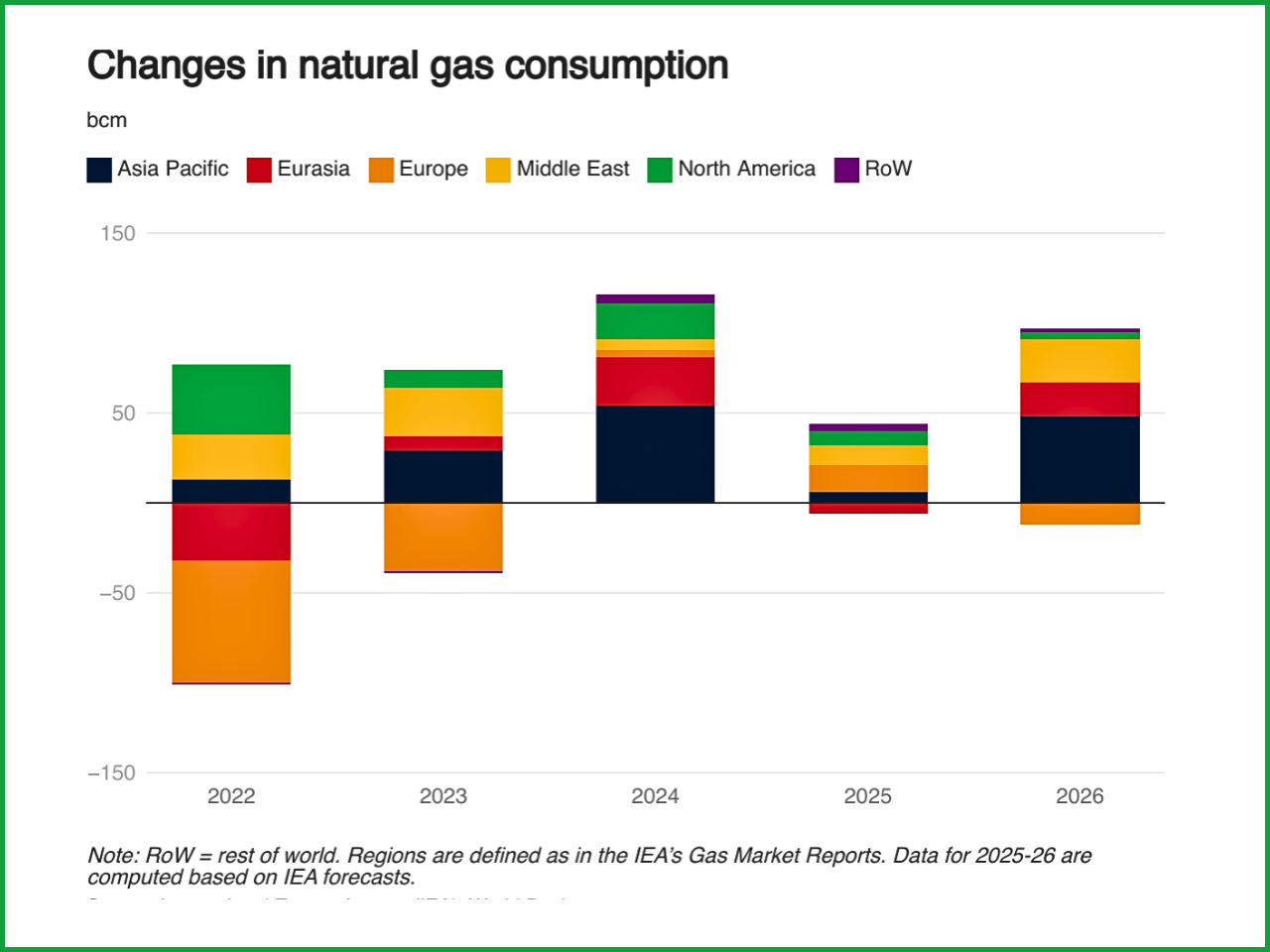

Global Gas Market in Flux: Prices Diverging as LNG Trade Shifts

The World Bank’s gas price index went up slightly, but the trend in prices looks very different depending on where you live. In the United States, natural gas prices kicked up above $5/mmbtu for the first time in three years due to cold temperatures and, on top of other things, increased LNG shipping over to Europe. Throughout Europe, prices for natural gas fell again this week, reaching an all-time low since early 2024 based on declining demand and increasing volumes of LNG imports.

Monthly Edition